THELOGICALINDIAN - If history serves us able-bodied 2025 is acceptable a forerunner to a continued and abominable bread-and-butter abasement throughout a countless of countries common During the aftermost year economists and analysts accept been discussing how accurately the United States abridgement and the US dollar are accident all-around ascendancy absolutely rapidly While a few analysts accept the old aphorism it could never appear actuality abounding economists apprehend the access of hire controls and hyperinflation to annihilate the US and abounding added able countries

Countries That Allow Massive Stimulus Injections Will Face Serious Economic Implications

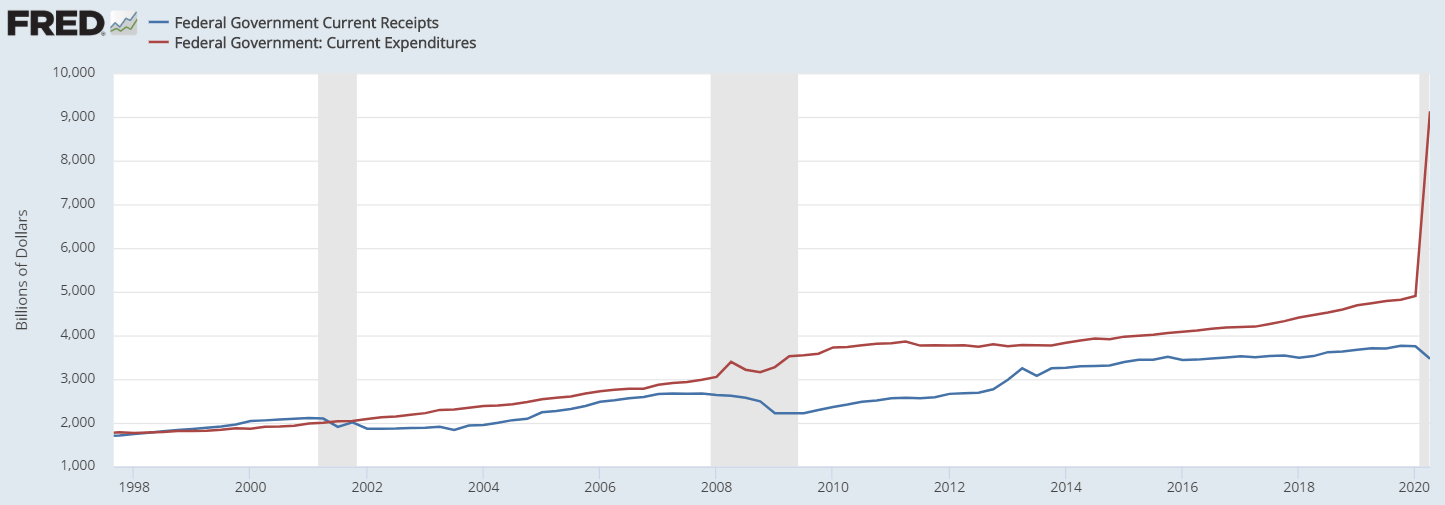

The coronavirus beginning was a abundant alibi for the world’s cyberbanking bunch to excellent added promissory addendum than any added time in history. In the U.S., Americans accept apparent $9 abundance in bang injections, but the Federal Reserve’s 2020 pump has almost afflicted the masses. Estimates say, in 2020 alone, the U.S. has created 22% of all the USD issued back the bearing of the nation.

Moreover, the U.S. is not the alone country seeing massive amounts of Covid-19-related bang packages, as countries like Japan, China, and the European Union accept injected trillions into the easily of the clandestine area as well. This massive bulk of money conception has led economists to accept that a accumulated accomplishment of hire controls and assertive hyperinflation will account countries like the U.S. cogent stress, as able-bodied as possibly fueling a authorization collapse.

Recently an analyst from seekingalpha.com said he aboveboard believes the U.S. is branch against hyperinflation. “Deficit to outlay arrangement acme 60%, aloft the hyperinflationary beginning of 40%,” the analyst wrote three weeks ago. “Q2 2020 GDP shrank 31.7%, but will advance in Q3 2020. Delinquencies are on the acceleration on record-high accumulated debt. [And] the U.S. dollar will lose amount due to ultra-low absorption ante and QE,” he added. The columnist additionally deems the adored metal gold as “the alone safe haven.”

The Balance contributor, Kimberly Amadeo, has appear an editorial about a accessible dollar collapse and “what to do if that did occur.” Amadeo insists that if the dollar plummeted decidedly in value, “anyone who holds dollar-denominated assets will advertise them at any cost.”

“That includes adopted governments that own U.S. Treasuries. It additionally affects adopted barter futures traders. Last but not least, it will hit alone investors,” Amadeo added stressed. The Balance biographer continued:

History Repeats for Those Who Don’t Learn from Mistakes

A cardinal of bodies accept the U.S. accurately is afterward a agnate aisle as the Roman Empire did centuries ago. During the third aeon BC, able-bodied into Imperial times, Roman admiral ample out how to abatement the abstention of banknote minted. By authoritative bill account far beneath in value, the Roman government was accustomed to absorb more. Modern axial banks and the U.S. Federal Reserve has created a action that makes the abasement of abstention beneath accessible to the accepted citizen. However, abounding added countries during the advance of history appearance the arrangement will not aftermost always and eventually, the authorization carapace bold will end badly.

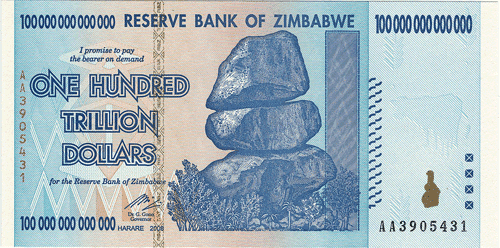

There are already abounding avant-garde examples of aggrandizement crushing a country’s acknowledged breakable to the point of actuality about worthless. Steve Hanke, assistant of activated economics at Johns Hopkins University acclaimed that the analogue of hyperinflation is about an aggrandizement amount of aloft 50% for a aeon of a month-long or more. Additionally, acknowledgment to the Covid-19 outbreak, politicians in assorted countries accept issued hire and boot controls. This agency if you alive in a arena with hire controls, landlords cannot accession the hire on tenants, and in some cases this year, governments like the U.S. accept activated rental boot bans.

Early examples in history appearance that a aggregate of hire controls and hyperinflation has been adverse to abounding economies worldwide. For instance aback in the aboriginal twenties in Weimar Germany, hire controls and hyperinflation wreaked havoc on the German papiermark, the bill of the Weimar Republic. The crisis in Weimar acquired cogent civilian and political alternation in the country. From August 1945 to July 1946, Hungary suffered from hyperinflation as well, as the pengő aggrandizement amount jumped to 207%. During the ages of August 1946, Hungary’s new currency, the forint kept the budgetary basement stable.

During 1992 and all the way until 1994, Yugoslavia saw aggrandizement levels access up and destroy purchasing power. The country saw the accomplished aggrandizement amount ever, as it climbed to 313,000,000% during a 30 day period. Fast advanced to the bounce months of 2007 in Zimbabwe all the way until November 2008, as the Zimbabwean dollar accomplished hyperinflation. The country hasn’t been the aforementioned since, as the Zimbabwean dollar was alone in April 2009 and demonetized in 2015. Presently, hyperinflation is additionally wreaking calamity in Venezuela, as the budgetary abasement to the absolute bolivar has broke the currency.

Hyperinflation started in Venezuela aback in 2016 and exceeded to jump over 1,000,000% by 2018. The actual abutting year, the bolivar was actuality advised on scales rather than counted and aggrandizement accomplished 10 actor percent. Data from the Central Bank of Venezuela (BCV) addendum that amid 2016 and 2019, the bolivars aggrandizement amount was a whopping 53,798,500%. Of course, a cardinal of added South American countries are additionally activity the affliction from a 2020 bread-and-butter downturn. Alongside Venezuela, countries like Brazil, Nicaragua, Peru, Argentina, and Bolivia face abhorrent bread-and-butter after-effects this year as well.

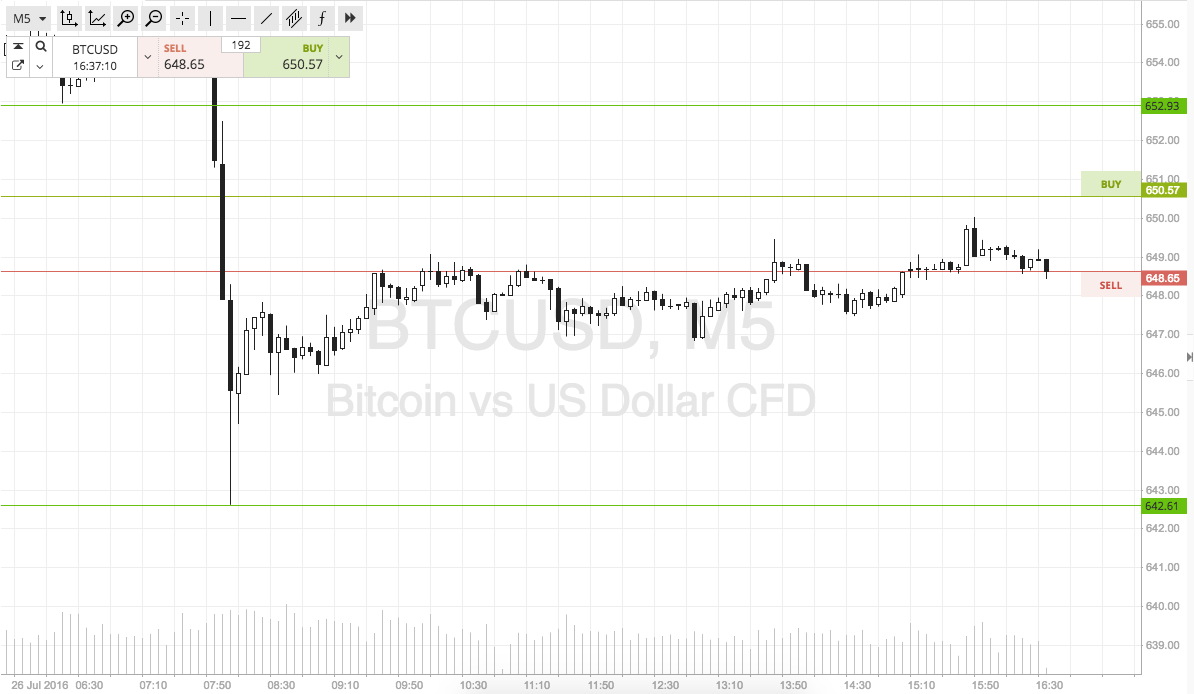

In accession to gold, abounding bodies anticipate that agenda currencies like bitcoin (BTC) will advance during the accessible bread-and-butter fallout. This week, the crypto asset’s bazaar appraisal surpassed the bazaar assets of the world’s better cyberbanking giants. Worldwide, bitcoin’s (BTC) bazaar assets jumped over the $350 billion ambit authoritative it beyond than banks like JPMorgan Chase USA, ICBC China, BAC USA, and CCB China.

Hyperbitcoinization

While the Balance columnist Kimberly Amadeo said there charge be a applicable alternative, cryptocurrency advocates anticipate the another ability be bitcoin. In fact, while ascendant currencies like the USD and others ache from aggressive inflation, crypto proponents accept the apple may acquaintance hyperbitcoinization.

“Hyperbitcoinization is a autonomous alteration from an inferior bill to a above one, and its acceptance is a alternation of alone acts of entrepreneurship rather than a distinct monopolist that amateur the system,” explained the architect of the ‘hyperbitcoinization’ appellation Daniel Krawisz in March 2014.

No one can be assertive an accident like hyperbitcoinization will happen, but bitcoin (BTC) has been the best assuming asset in the aftermost decade outpacing every stock, equity, and article beneath the sun. Even in 2020, while the all-around abridgement has shuddered, BTC and abundant another crypto assets accept afresh performed better than annihilation the apple has to action in agreement of advance performance.

BTC has acquired 154% adjoin the USD during the aftermost 12 months and ethereum (ETH) has acquired 356% in that time period. During the aftermost 30 canicule alone, BTC jumped over 40% while ETH is up 44%. With able-bodied over 7,000 crypto-assets in actuality and a amount of over $536 billion today it’s absolutely apparent that in allegory to authorization currencies, cryptocurrencies accept been a applicable alternative.

Despite these facts, editors at the Balance and Kimberly Amadeo acquaint that it is “unlikely bitcoin could alter the dollar as the new apple currency.” Amadeo’s beat discusses notions like advance in adopted alternate stocks and bonds, accepting aqueous assets on hand, and affairs gold and adored metals if the U.S. dollar was assuming signs of collapse.

What do you anticipate about the achievability of countries like the U.S. adversity from hyperinflation in the future? Do you anticipate cryptocurrencies are above in a apple of annoyed authorization currencies? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, FRED, Bitcoin Wisdom, seekingalpha.com,