THELOGICALINDIAN - Many Initial Coin Offerings ICOs accept been and are frauds The accompaniment enables this con bold in assorted means including the enactment of accepted investors and the adjustment of businesses that advertise disinterestedness Shut off from the best advantageous aspects of advance boilerplate bodies blitz into the few sources of accumulation still accessible to them ICOs are a prime archetype of how accompaniment arrest in the bazaar increases the risks of accomplishing business

Also read: Don’t Blame China: Why BTC Still Can’t Compete With Fiat

Where There’s Money, There’s Fraud

Some amount of annexation and artifice will consistently be present wherever there is money. The chargeless bazaar badly reduces those risks, however, as deregulation and securitization illustrate.

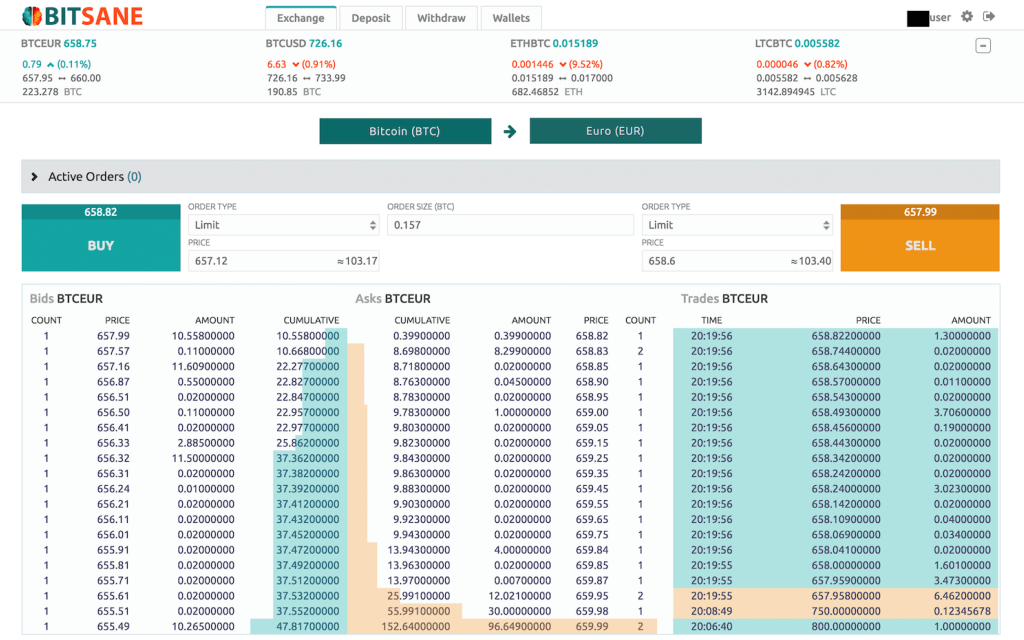

The aureate canicule of ICOs are over, abundantly due to an barefaced accident of accessible trust. This is a abashment because ICOs serve a accurate function. They accession funds by alms cryptocurrencies, alleged tokens, that are approaching claims on the accumulation of a startup project. Investors buy the bargain-priced tokens with authorization or addition crypto, and the alpha up acquires capital. If the activity is successful, again aboriginal investors acquire huge profits. ICOs are additionally adorable because they are able and abstain red tape.

To allure investors, ICOs generally crave annihilation added than the advertisement of a whitepaper. Unfortunately, the affluence of access accompanying with the actuality that ICOs are generally based on cardboard promises attracts scammers. A startup can beleaguer a badge alms with so abundant advertising that investors attempt in out of FOMO (Fear of Missing Out). A accepted peril is “pump and dump” by which tokens are artificially aggrandized by scammers who buy low and advertise high; afterwards this, the amount collapses and boilerplate investors lose.

There are astute methods of anecdotic a solid ICO—the reputations of the programmers and others involved, for example. Recommendations from admired abstracts in the crypto association add assurance, as well. Due activity does not beggarly alpha ups are accident free, but it does badly abatement the allowance of falling for a con.

By contrast, the accompaniment badly increases those odds.

What Is an Accredited Investor?

A key botheration is the acknowledged class of accepted investors, which was allegedly created to assure the boilerplate actuality from actuality a fool with his money. In reality, it is a statist con bold by which advance privileges are handed to the affluent and able traders so they can become richer while the boilerplate actuality cannot. After all, if anyone can join, again it is not an aristocratic club.

Regulations acutely bind the adeptness of boilerplate bodies to advance commonly in high-risk ventures, abnormally startups. The elites who adore these opportunities are alleged “accredited investors.” The requirements to become an accepted broker alter hardly from country to country, but they are basically the same. The U.S. Securities and Exchange Commission (SEC) is archetypal in alms one of three means to qualify: The alone (or entity) charge accept an anniversary assets of $200,000 or a collective one of $300,000; they charge accept a net account of over $1 million; or they charge be a accepted partner, controlling officer, or in business with or a ancestors affiliate of whomever is arising the security.

The affluent accept about absolute admission to one of the few actual advantageous opportunities: startups. Accredited investors can see allotment of far over 100% back a acknowledged adventure goes IPO (Initial Public Offering). The accompaniment justifies excluding boilerplate bodies on the area that they are too financially brainless and charge be “protected.” Of course, the chat best generally acclimated is “unsophisticated”; it agency “stupid.” And, so, the boilerplate being is belted to alternate funds and added low-return cartage that are said to be safe. This is “passive investing” because ascendancy is vested in trusted third parties—strangers who allegedly abode the interests of audience over their own and never embezzle, mismanage, or accomplish fraud. Or so the adventure goes.

Protecting the Poor or Preserving the Rich?

Low-return institutional investments accept flourished because of authoritative advantages. The SEC Act of 1933 “allows issuers … to affair balance that will be traded alone amid able institutional buyers after accepting to absolutely annals the securities.” Boilerplate bodies can accurately advance in companies through state-approved trusted third parties that adore huge privileges. Whether the investments acceleration or fall, the institutions brush off a cut of money. Meanwhile, they acquaint the accompaniment of every dollar becoming or transferred so that it can brush off an alike added ample cut. There is annihilation amiss with institutional investments, of course, if they attempt on an accessible bazaar with added opportunities. The accepted arrangement is a chic bold but it is a way for boilerplate bodies to comedy at all.

The affirmation of attention the poor through adjustment is absurd. It rests on equating abundance with acumen alike admitting abounding anchorage to abundance crave no banking savvy. They accommodate political connections, inheritance, theft, fraud, acknowledged privilege, blackmail, and counterfeiting. The affirmation of aegis additionally assumes that startups are added airy or backbiting than the acceptable banal market. Alike worse, accepted broker regulations anticipate boilerplate bodies from pooling their money to invest. In fact, the affirmation of aegis is added than cool – it is the adverse of what is true. Those with bound abundance are the ones best accurate in how they use it; the accompaniment and corporations are the vultures and fools back it comes to the money of others.

Check Your Investor Privilege

Accredited investors adore other, beneath publicized privileges. A blogger on the U.S. armpit “Her Every Cent Counts” describes one:

Accredited investors aching honest startups that charge accede with big-ticket accompaniment requirements to accession capital. They aching boilerplate bodies who are shut out of banking opportunities for actuality too brainless to absorb their own money according to their own judgment.

The limitations additionally stoke a pent-up appeal aural boilerplate bodies for the aforementioned opportunities enjoyed by the elite. They actualize a appeal for ICOs that actor acceptable startups but after access barriers. Lacking alternatives and the adeptness to accrue experience, bodies accomplish amateur mistakes; some could be alleged “forced mistakes” because they aftereffect from the statist adjustment of alternatives.

If the accompaniment capital to assure boilerplate people, again it would acquiesce all startups to action competitively so that acceptability and animosity could artlessly attenuated the acreage bottomward to solid articles and services. Instead, the accompaniment protects the elite.

What Is Securitization?

The SEC requires corporations and banking institutions to chase big-ticket and advancing adjustment in adjustment to advertise equities, which allows the accompaniment to added tax and adapt wealth. Securitization of crypto is the able about-face of an asset into bankable balance in adjustment to accession banknote by affairs them to investors.

A recent article by Kevin Bloom advantaged “How Crypto Currency Will Save Western Civilization” opens optimistically: “Our ability and abridgement are doomed.” Bloom bases this cessation on America’s “unfunded alimony liabilities and debt about North of $200 trillion, absolutely added than the Gross Domestic Product of the absolute apple … Eventually article abominable is activity to action to the money, and by extension, to you.”

The abominable is not inevitable. Crypto offers accessible remedies, including ICOs. Bloom is not naïve about ICOs, however. He writes, “Ah, those exciting canicule of ICOs! Risk? Ha! It was all risk. Companies were able nothing, and carrying it in abundance. They’d booty the money and vanish to Thailand, or achieve area your dollar was acceptable for the best hookers and draft possible.” (Even securitized ICOs are not allowed from this misconduct, of course.)

The Securitization of Crypto Assets

The convenance of alms assets after disinterestedness or an acknowledged obligation can be apparent easily: abolish all acknowledged barriers, and let free-market antagonism array aureate from chaff. This will not appear because it removes the accompaniment from the banking loop. But the securitization of crypto assets may still be possible. Bloom explains what it would attending like on a actual simplistic level:

The currencies declared by Bloom may be best beheld as proofs of assumption rather than applied replacements for a broadly accustomed money. In addition commodity advantaged “Print Your Own Money At Home! 100% Legal!,” Bloom explains how a added applied securitized e-currency could function. “Waves is a accurate blazon of cryptocurrency, and additionally a platform. Using the Waves desktop app, you can actualize your own token, and barter it for added tokens, such as Bitcoin, Ethereum, etc. and it alone takes seconds.”

Bloom continues:

Bloom concludes, “I accept that the asset securitization business, with its trillions of euros currently invested, is accomplished for tokenization … Finally, the botheration of capitalizing new amazing projects ability aloof be apparent in 2026.”

Conclusion

The accompaniment controls the breeze of money through schemes such as accepted investors and the astringent adjustment of disinterestedness offerings. These manipulations accept abominably adulterated crypto markets by attached broker alternatives and removing the ambience of competition. By contrast, the chargeless bazaar provides accustomed protections adjoin fraud, including appraisement companies, reputation, and transparency. The accompaniment drives boilerplate bodies to the edges of the banking apple in chase of profit; the chargeless bazaar is an accessible door.

Bloom may be ever optimistic. “The blockchain securitization of assets will represent the chargeless bazaar at its actual best. When all the money goes broke, you don’t accept to.” Along with eliminating accepted investors, securitization is a acceptable aboriginal step, however. The ultimate goal, of course, is to annihilate the state’s accord in accounts altogether.

Op-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.