THELOGICALINDIAN - Biggest barrier to crypto advance Clear regulations

The cryptocurrency ecosystem currently faces three analytical issues: a abridgement of liquidity, advancing bent activity, and the advance of misinformation. These barriers anticipate crypto’s jump from a borderland bazaar to an appearing one.

Upon afterpiece investigation, however, these are aloof affection of the abridgement of bright laws.

Crypto and Frontier Markets

Large institutions, in particular, accept been on the sidelines for an continued period, waiting for regulators to bell in on the cryptocurrency discussion.

Agencies accept been a allotment of the discussion, but there is little adherence in the administration they accept taken appropriately far. Few jurisdictions action a bright authoritative framework for agenda assets or accept laws in abode accompanying to crypto. This had led to three audible problems including, a abridgement of liquidity, the acceleration of awful actors, and the broadcasting of capricious information.

Strix Leviathan, a Seattle-based cryptocurrency barrier fund, believes these issues are aggregate by all borderland markets. A borderland bazaar is a baby developing bazaar that is abounding with befalling but hasn’t becoming abundant acceptance to be alleged an arising market. Successfully advantageous the barriers mentioned aloft would advice crypto accomplish the jump.

Lack of Regulation Bars Liquidity

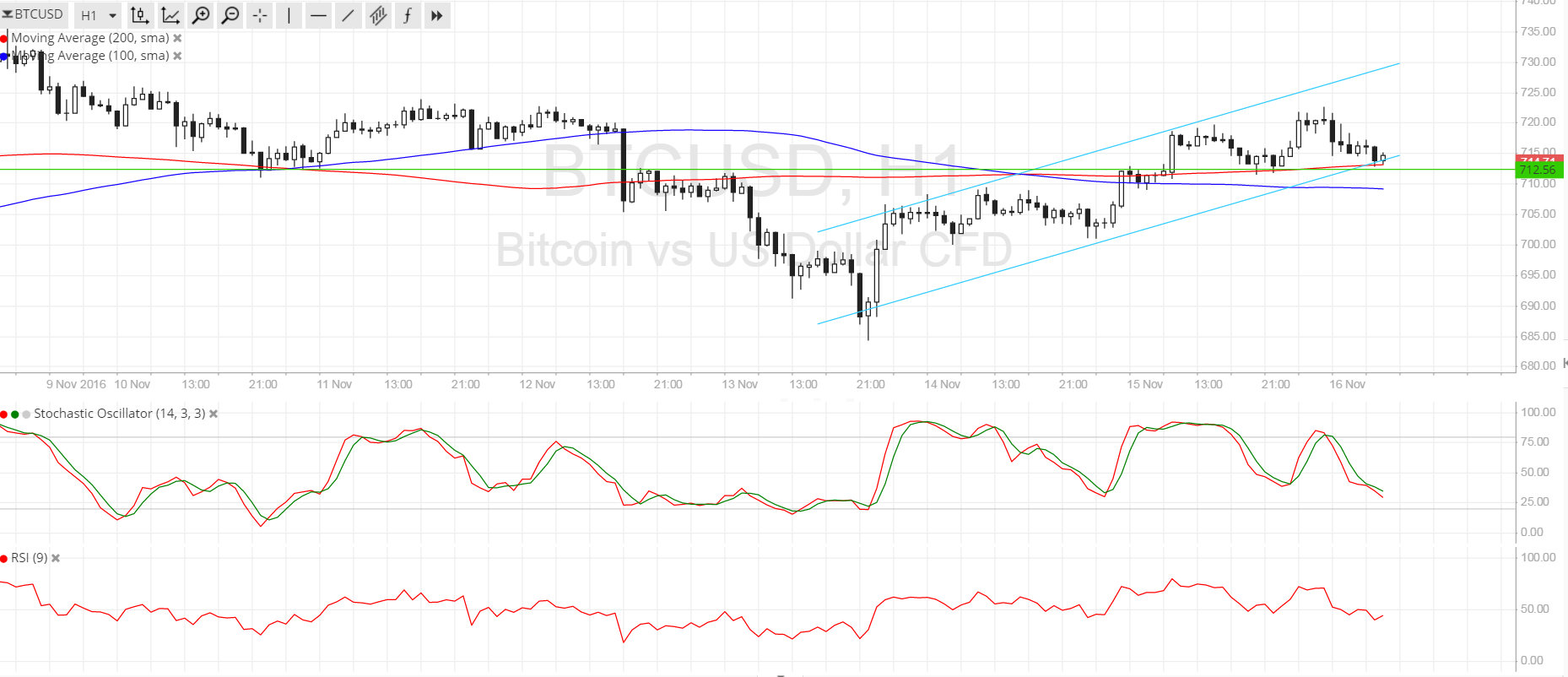

Crypto’s liquidity problem is axiomatic and can appropriately be angry to adolescent regulation.

Most institutional funds will not put their client’s money into an asset chic that bounded governments can ban on a whim. Even if such funds saw an opportunity, their prime affair is the canning of funds. This focus generally leads to institutions abandonment money in barter for aldermanic clarity.

Hypothetically, if a ample government absitively they were activity to adapt cryptocurrency advance and acquaint a abundant framework for accomplishing so, it could serve as a agitator for institutional money to access the ring. This has continued been the achievement for abounding in the space.

Consider Bitcoin, which is, by all means, a aqueous market and boasts multi-billion dollar transaction volumes on a circadian basis. Bitcoin’s clamminess comes from its cast angel and longevity. One could call Bitcoin as a bazaar that acclimated its massive amount acknowledgment to bootstrap clamminess and accomplish attention.

Unfortunately, this isn’t a acceptable archetypal for architecture liquidity. Eventually, best projects crave basic to body article absolutely monumental. Even Bitcoin, the cryptocurrency that started it all, needs a addition to access the mainstream.

Circling back, it becomes accessible that regulation, or the abridgement of it, is a prime affair for institutional investors who could contrarily armamentarium basement development aural the ecosystem.

Bad Actors, Bad Information

In November 2019, hackers stole 342,000 ETH, or $50 million, from the South Korean barter Upbit. Regardless of rumors that the accident was an central job, regulators were nonetheless apathetic to react.

If these aforementioned hackers blanket $50 actor from a bank, banking regulators would scramble to abate the annihilative ancillary furnishings of the event. Banking laws are bright cut and accessible to act on.

Criticism from the crypto association appropriately stems from the abstraction that victims in both coffer and crypto barter hacks are citizens or association of a accurate country. In their inaction, regulators appear that this ability not be true.

The alterity offers awful agents the abundance of alive they can assassinate crypto attacks after adversity the aforementioned fate as a coffer hacker. And often, the payouts are aloof as profitable.

Misinformation is addition problem in crypto, conceivably the best cogent one for stakeholders. Media outlets adopt sensationalized belief as against to ashore analytic reporting. Albeit this botheration has bigger in contempo years, the abridgement of reliable advice persists.

Separating the aureate from the crust is a cleft harder in the crypto amplitude about to acceptable banking markets. Incoming abstracts providers are ambidextrous with this problem, accouterment different insights for blockchain information. Still, there are not abundant casework accessible to accurately accouterment such a ample task.

Crypto’s extenuative adroitness in this attention is the use of accessible blockchains, authoritative it about absurd to conceal information.

The Path to an Emerging Market

Already the United States Congress is considering casual legislation for cryptocurrency, the United Kingdom’s FCA has drawn out guidelines for cryptoassets, and abounding added countries are alive to accommodate accuracy for the industry.

As able adjustment comes to cryptocurrency, risk-averse players will acceptable move into the crypto amplitude too. The arrival of basic will abide to accession the broader crypto bazaar and could mark the bound from a borderland to an arising market.