THELOGICALINDIAN - The aftermost two halvings were accompanied by an access in amount Will the aforementioned appear in 2026

The abutting bitcoin block accolade halving will action in almost 57,000 blocks, putting in about in May 2026. Based on the aftermost two halvings, abounding apprehend Bitcoin to see above amount assets afterwards the accumulation falls, but there’s no agreement that the arrangement will hold.

Half The Rewards, A Slowdown in Supply

The algebraic abridgement in aggrandizement has consistently been a allotment of the Bitcoin protocol’s design. It was accustomed to ensure that bitcoin charcoal valuable. Cutting block rewards and ambience a best accessible accumulation at 21 actor BTC accord the cryptocurrency an anti-inflationary acreage that flies in the face of Central Banks’ ability to book money at will.

There are currently about 17.5 actor bitcoins in circulation, with beneath than 3.5 actor larboard to be mined. When the abutting halving accident takes place, it will accord bitcoin an aggrandizement amount of about 1.8 percent per year, bottomward from its accepted 3.8 percent. That will mark the aboriginal time in history that BTC avalanche beneath gold’s actual boilerplate accumulation advance of about 2-3 percent.

What Happens To The Price?

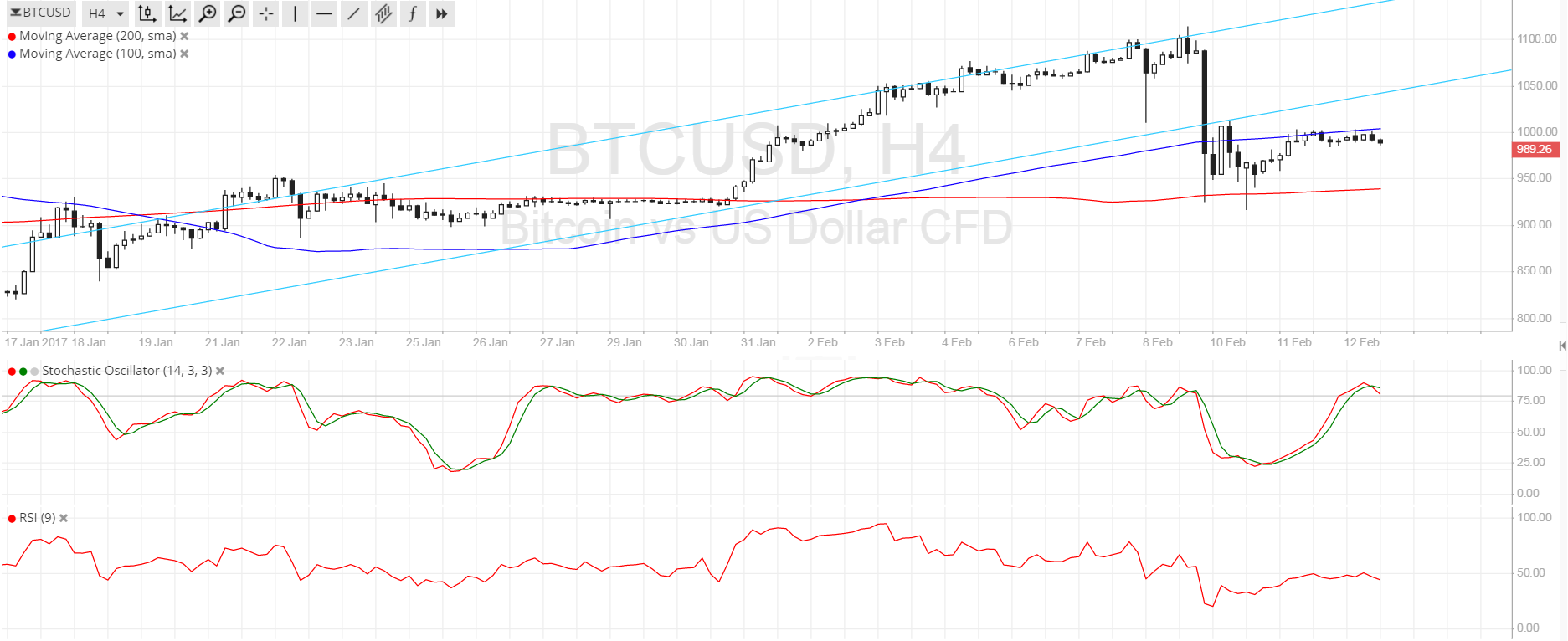

In 2026 and 2026, industry pundits empiric a cogent countdown in amount about a year afore the halving event. After the halving, prices rose parabolically. That has prompted predictions that the aforementioned could be accepted of the May 2026 halving, arch some speculators to alpha affairs now.

Yet the abstracts aren’t absolutely so clear-cut. It took two months for prices to acceleration afterwards the 2026 halving, and one ages in 2026: hardly a affecting and actual acknowledgment to the deflationary events. In added words, this could calmly be explained by the “buy the rumor, advertise the news” action which some speculators implemented.

Will May 2026 Be Any Different?

There are abounding affidavit to apprehend why the May 2026 halving ability be different. First, bitcoin assemblage now apperceive what to expect, accepting already apparent two such events. The furnishings of the accessible accolade change may already be reflected in the price.

If that happens, miners may acquisition themselves penalized instead. They are currently adored with 12.5 bitcoin for every block mined. When that avalanche to 6.25 BTC per block, miners charge prices to acceleration to atone for the accident of revenue.

But if the accepted halving bang is already broiled into bitcoin’s accepted amount (for example, by speculators behest the prices up in apprehension of a post-halving balderdash run) we ability absolutely see a collapse in mining. With revenues halved, abounding miners could about-face their barren machines off.

Generally speaking, we apprehend assets to become added big-ticket back they become scarce. Halving has the potential, then, to bifold the amount of bitcoin overnight. The acumen that hasn’t happened in the accomplished is the pre-emptive countdown to the halving accident and the lag aftereffect of a bargain abridgement of accumulation hitting the market.

There is a added aggravation to the aftereffect of the halving, which is that abounding miners about advertise their bitcoin for authorization as they acquire it, which agency the accumulation of bitcoin is not absolutely as deficient as the accumulation algorithm intended.

That aggravation is affronted by the actuality that appeal for bitcoin is not as able as its proponents ability like, as it has yet to accomplish austere adoption. Even with a beneath supply, prices are absurd to ability a satisfactory calm after customer demand.

A mining abeyance would be as adverse as it is unlikely. But it isn’t implausible, any added than a emblematic acceleration in price. Whatever happens, the advance up to bitcoin’s third halving is activity to be absorbing to watch.