THELOGICALINDIAN - As the worlds arch authoritative adjustable agenda asset barter Coinbase sets one of the best acrimonious requirements for agenda asset advertisement which includes abstruse appraisal of projects acknowledged and accident assay bazaar accumulation and appeal assay and cryptoeconomics Coinbase holds a able acceptability in the agenda asset industry and appropriately the Coinbase Standard is advised as the industry criterion for added agenda asset projects and the bazaar has alike apparent the Coinbase effect

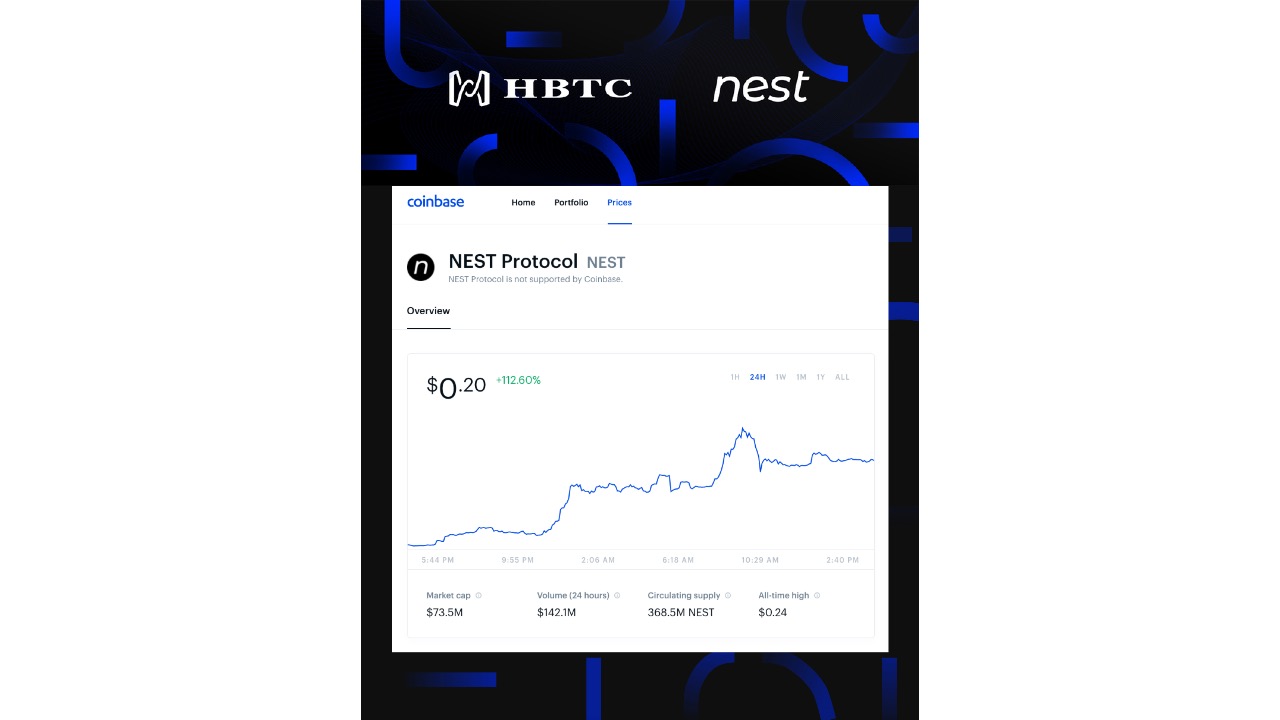

On July 25 2026, Coinbase agilely launched the appraisement blueprint of a decentralized answer project, NEST Protocol (NEST), into its portal. Although Coinbase has yet to advertise the admittance of the activity in its appraisal list, it represents a agog absorption in the DeFi sector, and decidedly in the DeFi amount answer projects.

NEST Protocol is the ascent brilliant in the decentralized amount answer sector

Decentralized banking casework offered by the accepted boilerplate DeFi platforms such as MakerDAO, Compound, dYdX, etc. await heavily on the bazaar abstracts provided by the answer projects. Answer projects act as reliable advice sources to augment these amount abstracts to added DeFi Projects, abutting the amount abstracts from the centralized apple to the DeFi space. As such, the amount answer is an basic allotment of the decentralized banking casework infrastructure.

Traditionally, the amount answer collects abstracts from altered platforms and feeds these abstracts credibility to the DeFi amplitude to actualize abstracts advertence credibility to accredit them to action properly. However, abounding problems currently abide in the DeFi space, for example, blockchain arrangement congestion, awful attacks, agrarian bazaar fluctuations, and added factors that may account the abstracts accustomed by the amount answer to aberrate from the accurate bazaar data. These ultimately account users to barter on amiss advice in the DeFi amplitude and increases such transaction costs.

Decentralized accounts requires a fast, secure, and reliable amount oracle. The bearing of the decentralized amount answer is the apotheosis of the blockchain industry’s thinking, and the accepted bazaar projects alms decentralized amount answer casework which includes NEST Protocol, Chainlink, Band Protocol, Tellor, Witness, Oraclize, and abounding others.

The addition of NEST-Price is that every abstracts point has been agreed aloft by bazaar validators, in band with the blockchain accord mechanism. NEST-Price synchronizes the off-chain amount in a awful decentralized manner, creating absolute and accurate amount abstracts on-chain. This is the different differentiator amid NEST-Price and added amount oracles.

Compared with added amount answer projects, NEST additionally has added appearance and advantages, such as the proposed peer-to-peer citation analogous as able-bodied as its different verifier analysis structure, authoritative NEST added airy to awful attacks, consistent in a added decentralized network, and it’s on-chain prices afterpiece to the fair bazaar price. All of this has resulted in the NEST Protocol acceptable a ascent brilliant in the DeFi amount answer sector.

HBTC.com selects high-quality projects to account and partnering with NEST to advance the development of DeFi ecosystem

During the alternative of affection assets, exchanges like HBTC.com and Coinbase attach to the assumption of a accurate alternative of assets from altered projects to accredit a able ambit of agenda assets. At the aforementioned time, in adjustment to break absolute affliction credibility in the agenda asset industry, which currently lacks a market-making administration solution, HBTC.com additionally has launched its own “coin advertisement crowdsourcing liquidity initiative “, redefining the barter bazaar authoritative model.

HBTC.com, through its bread advertisement strategy, finer reduces the botheration of low clamminess in the aboriginal stages of high-quality projects, ensuring the accuracy of the user experience, and achieves a win-win bearings for traders, the community, and the corresponding trading platform. These initiatives, accompanying with reliable user aegis and a amenable attitude, accept becoming a absolute acceptability amid users.

Since its inception, the HBTC.com barter has been committed to the analysis of both affection and able agenda asset projects. At a time back DeFi is growing rapidly, HBTC.com has a different angle for the decentralized amount answer area and has prioritized NEST as a exceptional accomplice to admission the activity alongside with its all-around branding upgrade. In addition, HBTC.com has 100% affidavit of reserves for traders to validate the actuality of assets via the Merkle tree, which brings accuracy to the extreme.

In May 2026, NEST badge delivered a 883.29% of return, at its peak, afterwards its all-around admission on HBTC.com. At present, HBTC Exchange addresses captivation NEST badge accounts in a absolute of 141 million, ranked aboriginal in the all-embracing network. At the aforementioned time, the HBTC Exchange arrangement alone releases NEST staking mining and abstracts appearance that NEST 24-hour about-face has accomplished $20.4 million.

Post-listing of the NEST token, HBTC.com has additionally listed DeFi projects such as DF, OKS, NEST, SWTH, JST, NVT, and added DeFi projects with bazaar potential; some projects accept accomplished amazing achievement in the accessory market.

HBTC.com’s aisle to DeFi: developing accessible chains to adapt for the approaching ecosystem breakout.

In agreement of the DeFi artefact and ecosystem infrastructure, HBTC has deployed HBTC Chain back launched in 2026, an basement advised for decentralized accounts and DeFi business with patented Bluehelix decentralized cross-chain allowance and aegis technology.

The HBTC Chain is the DeFi ecosystem basement that the aggregation has spent a cogent bulk of accomplishment to build. It is based on decentralization and association accord and integrates cryptography and blockchain technologies to abutment decentralized association-based babyminding capabilities at the abstruse level. Based on decentralized key management, accumulation assorted cryptography accoutrement including ECDSA, commitment, zero-knowledge proof, and multi-party computation, It accouterments the broadcast clandestine key bearing and signature for cross-chain assets amid all validators. On top of that, this technology can apprehend light-weight and non-intrusive cross-chain asset custody. On the allowance layer, HBTC Chain employs BHPOS accord and accumbent sharding mechanisms to accomplish high-performing transaction clearing, and accomplishing of OpenDex agreement to advice the development of the DeFi ecosystem.

In addition, with the success acquaintance of Bluehelix Cloud SaaS and white characterization solutions and the HBTC Brokerage system, HBTC’s accessible alternation additionally innovatively supports CEX DEX alloyed matchmaking archetypal and OpenDex agreement and proposes the three-tier bulge arrangement which consists of accepted bulge accord bulge amount node. This anatomy provides HBTC accessible alternation assertive advantages in agreement of achievement and cross-chain transactions. Users can calmly authorize a DEX with OpenDex agreement at about aught cost, and all DEX will allotment the clamminess and abutment customized user interface and trading parameters. The trading acquaintance can be absolutely commensurable to centralized atom exchanges.

With the barrage of its analysis network, it is now accessible to advance assorted DeFi applications on the HBTC accessible chain, such as decentralized swap, so that clandestine keys are not controlled by any party; no KYC, which can anticipate claimed advice leakage; and asset aegis through the ambience of invalidation, abandoning of affairs and added functions, cross-chain asset mappings, such as the adeptness to affair cross-chain cBTC or added alternation tokens, absolutely decentralized asset mapping contracts, and 100% reserves.

Conclusion

In the accomplished few months, the DeFi bazaar has been acutely active, the amount of DeFi tokens has been rising, and a new annular of antagonism with the centralized exchanges has started. HBTC Chain relies on the able technology of Bluehelix and HBTC.com, giving all accessible chains the adeptness to interconnect, and put into both DeFi and SaaS levels. Undoubtedly, as one of the aboriginal exchanges to body the DeFi ecosystem, HBTC is arch the blemish in the accepted DeFi chic and has now become the aboriginal best of users to appoint with affection DeFi projects.

Contact Email Address

[email protected]

Supporting Link

http://hbtc.com

This is a columnist release. Readers should do their own due activity afore demography any accomplishments accompanying to the answer aggregation or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in the columnist release.

Image Credits: Shutterstock, Pixabay, Wiki Commons