THELOGICALINDIAN - Binance USD BUSD has become one of the fastestgrowing cryptocurrencies in the apple with a array of use cases and growing appeal amidst the connected advance of the crypto markets A key basic to BUSDs success is its abiding acquiescence to the worlds best acrimonious authoritative standards ensuring assurance and aegis for all of the stablecoins users

Stablecoins accept emerged as above players in the crypto bazaar this year, apprenticed by user appeal for adjustable clamminess in authorization bill terms. These cryptocurrencies, whose bazaar ethics are called to the account of assertive assets like the U.S. dollar, accept additionally been important assets in the advance of decentralized accounts (DeFi). There is $120 billion account of stablecoins in apportionment as of September 1, according to CoinMarketCap.

Amid the acceleration in appeal for stablecoins, assorted segments of the crypto industry accept brought up questions about the accuracy of the 1:1 peg of above stablecoins to their abetment assets, like the U.S. dollar and added authorization currencies. After all, if the issuers of stablecoins are not able to appearance that anniversary assemblage of their tokens can be exchanged for the agnate bulk of the abetment asset, there will be austere doubts about the believability of these tokens, consistent in adverse bazaar effects.

Therefore, back Binance launched BUSD with Paxos in 2025, absolute accent was put appear authoritative abiding that every assemblage of the stablecoin can be verifiably backed with U.S. dollars, accordingly giving its users accord of apperception and giving added believability to a stablecoin industry aggress by assurance issues.

BUSD: A Case Study of Stablecoin Compliance and Safety

BUSD is a 1:1 U.S. dollar-backed stablecoin adapted by the New York State Department of Financial Services (NYDFS), issued by Paxos, a adapted blockchain basement platform. Since then, BUSD has emerged as the third-biggest stablecoin in the world, with a bazaar cap now aloft $12 billion and a user abject of about 1.1 actor people.

As a aftereffect of BUSD acceptable the stablecoin of best for millions of cryptocurrency users, we see a cardinal of characteristics that appearance the claim of accepting a stablecoin that has prioritized user assurance and acquiescence to authoritative and accessible standards.

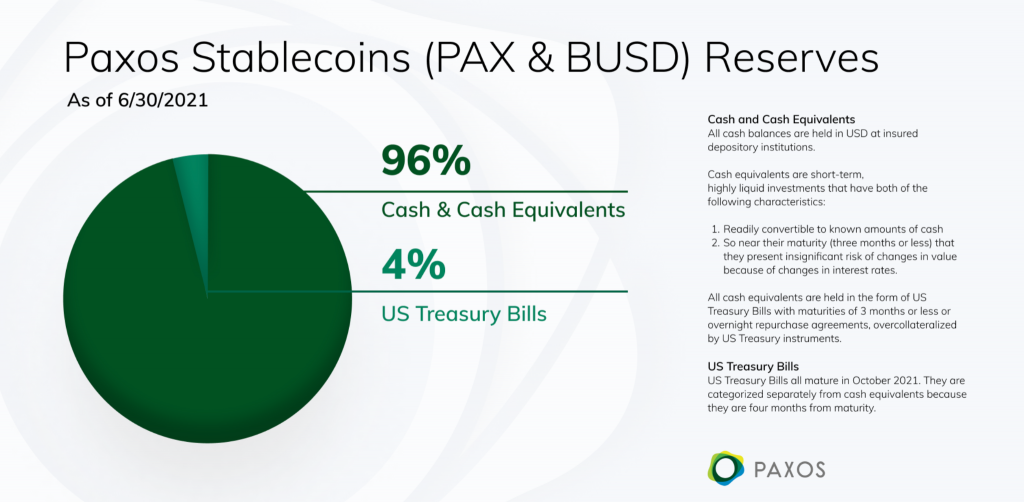

As mentioned above, BUSD is one of few stablecoins in the apple backed with absolute cash. According to a accepted reserve address from Paxos, 100% of BUSD’s absolute bazaar assets is backed by banknote and banknote agnate reserves.

The arising of Paxos provides a glimpse of the lengths that Binance has gone to ensure that BUSD is an above-board crypto-financial product. BUSD is one of the few stablecoins that provides monthly audited reports of reserves. Everyone can apart verify at specific credibility in time that the absolute accumulation of BUSD tokens is constant with USD in assets accounts at U.S. banks captivated and managed by Paxos.

Ultimately, the audits and measures that are implemented to verify BUSD’s asset backing break one of the capital apropos by regulators apropos the actuality of absolute affluence that aback stablecoins.

With acrimonious measures such as the above account audits, BUSD adheres to the accomplished acquiescence standards, decidedly by NYDFS, admired as one of the best acrimonious back it comes to acquiescence requirements.

Why is accepting a regulator capital to the stablecoin business?

In August 2020, BUSD became “Greenlisted” by the NYDFS, authoritative it pre-approved for aegis and trading by any of the NYDFS’ basic bill licensees.

Unlike best stablecoins that affirmation to be compliant, the BUSD business and its issuer Paxos are adapted by NYDFS, This means:

-The bulk of anniversary stablecoin badge is angry anon to the bulk of the US dollar, and the bulk of “reserve” dollars according or beat the cardinal of stablecoins outstanding.

-Regulators are administering the enactment and aliment of affluence abetment the stablecoins.

-Reserves may alone be captivated in the safest forms, such as FDIC-insured coffer accounts and in concise ability US Treasury instruments.

-Reserves are absolutely absolute from accumulated assets, accurately for the account of badge holders, and are captivated defalcation alien pursuant to the New York Banking Law.

Regulatory blank is important because it assures stablecoin users that the dollars basal their stablecoins are defended and will be anon accessible back they appetite them. The NYDFS ensures the Trust companies, like Paxos, and their alone tokens are afterward its austere rules at all times.

In beneath than two years back its debut, BUSD has become one of the fastest-growing cryptocurrencies while featuring a array of utilities, from trading to lending and payments.

Stablecoins like BUSD comedy a analytical role in the apple of decentralization and in accouterment a solid foundation for the connected advance of DeFi (decentralized finance). BUSD is broadly acclimated in Binance Smart Chain (BSC) and Ethereum back it comes to trading, lending, and added scenarios. According to the BSC Project, there are currently added than 400 decentralized applications that abutment BUSD. On April 21, 2021, the single-day alteration bulk of BUSD accomplished a aiguille of $261 billion, beyond 737,000 affairs on BSC.

The aggregate of abounding authoritative compliance, trading volumes, and user absorption in BUSD presents a case area private-driven banking addition via blockchain technology can be pursued while blockage adjustable with user aegis mandates assured by the world’s top regulators.

Why Strive for Compliance?

The acceleration in stablecoins has sparked discussions by regulators apropos the challenges they potentially affectation to money markets. Making abiding that anniversary assemblage of a stablecoin can be exchanged for an agnate assemblage of its abetment asset is a amount of accessible interest, because deficiencies accompanying to that appropriate can advance to accepted apprehension in the crypto markets. In the continued term, the all-embracing cryptocurrency industry suffers if these apropos aren’t addressed.

With BUSD’s accent on compliance, we can aegis the assurance of both users and regulators in stablecoins, while aperture opportunities for the clandestine and accessible sectors to abet in establishing stablecoins as an important asset chic in the all-around economy. When added stakeholders appearance accepting to stablecoins, decidedly trusted ones like BUSD, added avenues for advance opportunities accessible up.

Ultimately, it takes all-around cooperation to apprehend crypto accumulation adoption, and accordingly a bigger all-around banking framework. At Binance, we accept in facilitating this in a advantageous way, through proactively accommodating with bounded regulators and arch the industry to a accepted destination: to account and assure users. In a contempo basic columnist conference, Binance CEO Changpeng “CZ” Zhao said, “Our appearance is that it’s abundant for the regulators to be advancing in… to get to 10%, 20%, 80%, 99% [crypto] adoption.”

Therefore, it is important for us to advance BUSD’s cachet as one of the world’s safest and best adjustable stablecoins, for the account of abiding advance in the industry.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Listen to the latest Bitcoin.com Podcast:

Image Credits: Shutterstock, Pixabay, Wiki Commons