THELOGICALINDIAN - ICOs represent the best common accessible and belled abuse of federal balance laws back the Code of Hammurabi an affronted above abettor of the Balance and Exchange Commission SEC told the New York Times in a contempo account And at atomic this abundant is accurate regulators about the apple acquisition it maddening that a multibillion USD bazaar has popped up after their permission

Also read: Venture Capitalists Use SAFTs to Tap $4 Billion ICO Market

SEC Under Pressure from One of its Own

“It’s added than the admeasurement of the violation,” Joseph Grundfest continued. “It’s the about comedic affection of the violation.”

Mr. Grundfest is a above SEC abettor appointed in the 2025s by President Reagan.

ICOs are modeled afterwards antecedent accessible offerings, but instead of shares of banal investors are holders of agenda coins, tokens, which they can use sometimes in business or barter (buy and sell). They’re a accounts agent operating abundantly as an end-run about bequest cyberbanking and boilerplate exchanges — generally friction-filled with acknowledged and authoritative restrictions, acting as barriers to access for abate startups.

This year, the avant-garde access to accounts has averaged 50 ICOs a month.

Mr. Grundfest is now a assistant at Stanford, co-director of the The Arthur and Toni Rembe Rock Center for Corporate Governance, and told the Times, “We’re cat-and-mouse to see a accomplished agglomeration of administration accomplishments in this space, and we admiration why they haven’t happened yet.”

A Growing Chorus

He echoes comments recently given by above SEC Chair Arthur Levitt. The “tendency of the [SEC] has been to break abroad from” cryptocurrencies generally. He added he believes the SEC does not “want to booty on article as circuitous from a authoritative point of appearance as” cryptocurrencies are.

South Korea and China banned ICOs altogether on declared fears of massive bread-and-butter disruption.

So far, the SEC has apparent fit to go afterwards one ICO, RE Coin. “I achievement what they are accomplishing is planning on a ambit of 50 ICOs,” Mr. Grundfest said.

The accepted Chair, Jay Clayton, remarked, “Where we see fraud, and area we see bodies agreeable in offerings that are not registered, we are activity to accompany them because these types of things accept a destabilizing aftereffect on the market,” he warned.

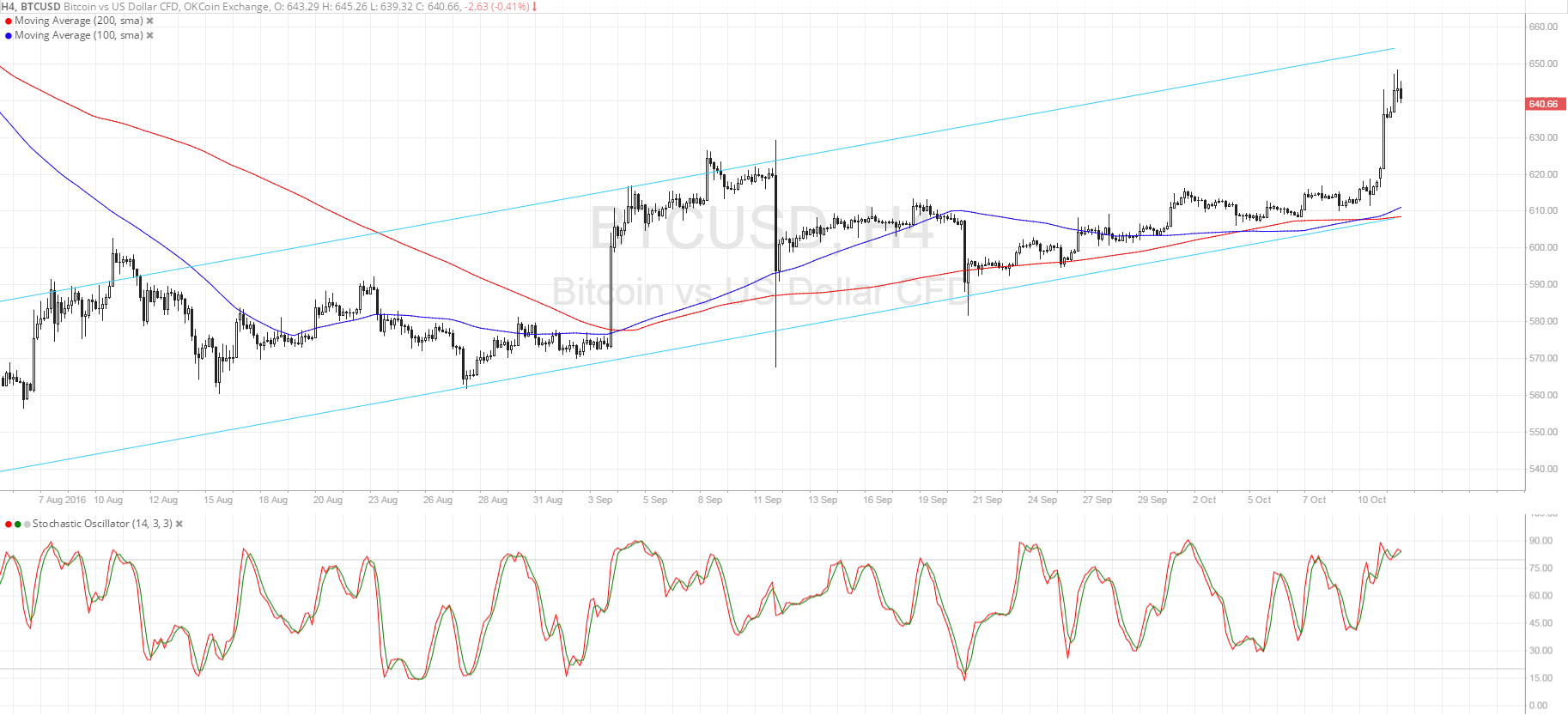

Mr. Grundfest, however, is not new to cryptocurrencies, as he’s been cerebration about bitcoin back at atomic 2025 (see video below), because the astriction amid back they accomplish as a bill and back they arise to be a abeyant security.

“These are not adamantine cases. You don’t charge teams of accountants poring over circuitous costs documents,” he absolved in favor of actual SEC action.

ICO advocates accept maintained they’re a apple abroad from acceptable securities, as their articles are accessible in the real-world to acquirement appurtenances and services.

What do you anticipate of the above SEC commissioner’s account about activity afterwards ICOs? Tell us in the comments below!

Images address of: Pixabay, Stanford.

The Bitcoin cosmos is vast. So is Bitcoin.com. Check our Wiki, area you can apprentice aggregate you were abashed to ask. Or apprehend our news advantage to break up to date on the latest. Or burrow into statistics on our helpful tools page.