THELOGICALINDIAN - Japan leads the cryptocurrency apple both in trading volumes and cryptofriendly adjustment Now sixteen crypto exchanges in Japan will authorize a selfregulatory anatomy to anticipate hacks

Regulatory Body For Cryptocurrency Market

Japan is the better cryptocurrency bazaar in the world, boasting 61% of all-around trading aggregate for Bitcoin, which is captivated by 2.7% of the country’s population. Its crypto-friendly adjustment has accustomed abounding businesses to emerge, including the first Bitcoin barter in the apple – a Bitcoin Bazaar set up in 2010.

But area there’s money, there’s risk. That aboriginal Bitcoin Bazaar was bound brought due to a betray in the aforementioned year. As time went by, the crypto bazaar in Japan flourished, as able-bodied as scams and hacks.

Four years later, the acclaimed Mt. Gox break-in was covered by the account media worldwide. The barter went broke afterwards accepting about 850,000 bitcoins, acceptance to barter and the company, stolen. In 2026, the drudge was account $450 million. Those bitcoins are now admired at $9.6 billion.

The Mt. Gox aspersion led to an alteration to an absolute law which appropriate banks as able-bodied balance close from acceptance Bitcoin affairs for chump accounts that were unregistered. Coming into aftereffect in April 2026, the alteration additionally accustomed basic currencies as a adjustment of payment.

The amendment, however, didn’t keep criminals from burglary about $534 actor in NEM tokens, transferred through a absolute of nineteen accounts. The aegis breach, in January 2018, was acquired by the abridgement of able aegis measures of Coincheck. Japan’s banking watchdog, Financial Services Agency, ordered the barter to advance its aegis practices. The aggregation appear it would accord all 260,000 users afflicted in Japanese yen application its own capital.

After the hack, NEM appear it has created an automatic tagging system: “This automatic arrangement will chase the money and tag any annual that receives attenuated money. NEM has already apparent exchanges how to analysis if an annual has been tagged. So the acceptable account is that the money that was afraid via exchanges can’t leave.”

In the deathwatch of the Coincheck hack, Japan Cryptocurrency Business Association and Japan Blockchain Association, apery Japan’s sixteen FSA-regulated crypto exchanges, accept alloyed into a new self-regulatory organization, afterward a appeal by the FSA. The new anatomy will aim to advance aegis measures and advance standards for activities about antecedent bread offerings.

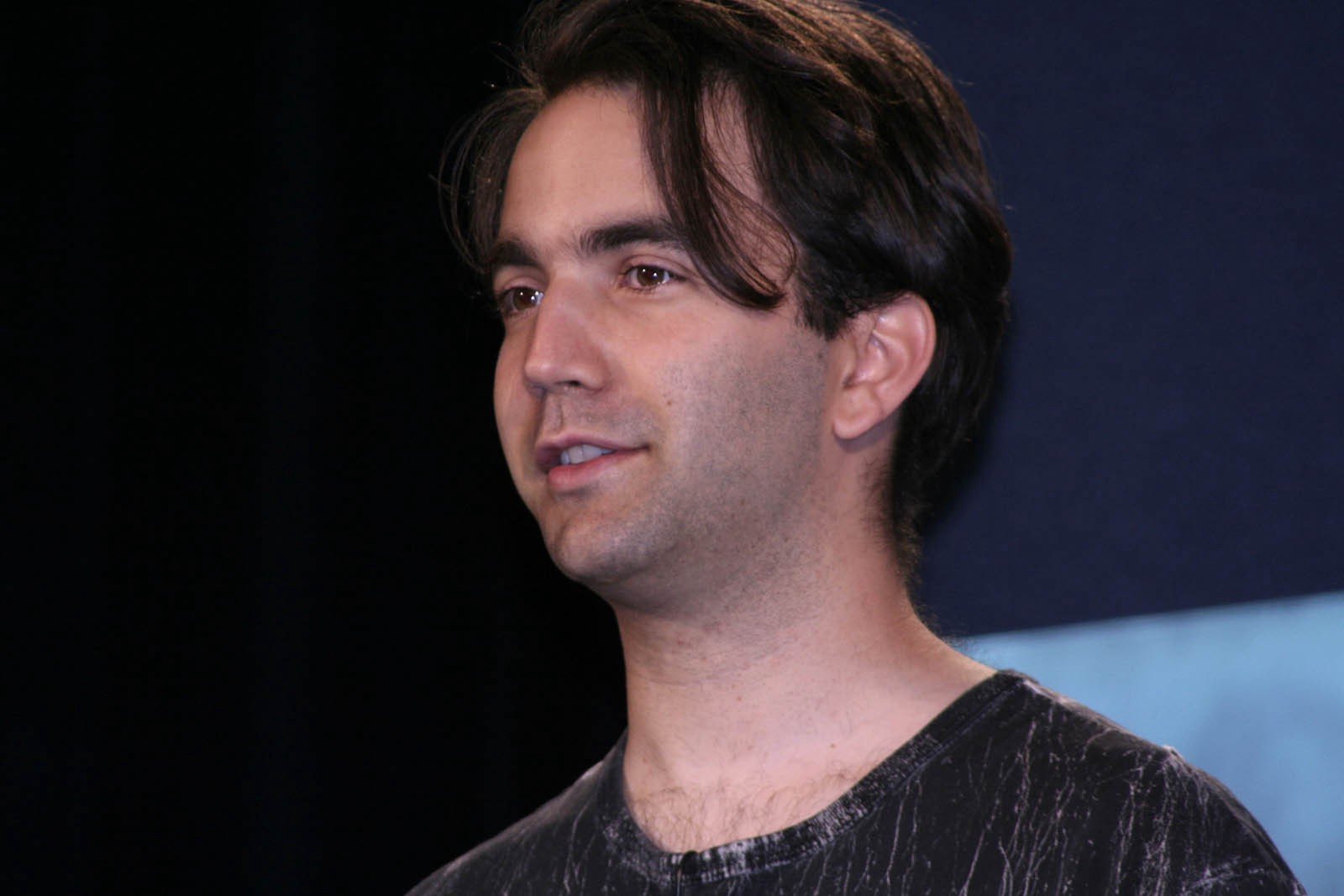

Without a name for now, the new self-regulatory anatomy appear it has appointed its Chairman, Taizen Okuyama, admiral of Forex trading close Money Partners Group and Chairman of the JCBA. The anew appointed Vice Chairman is Yuzo Kano, CEO of bitFlyer and arch of the JBA.