THELOGICALINDIAN - Bitcoin and the absolute cryptocurrency bazaar for that amount accept had a agitated 2026 Prices plummeted throughout 2026 with the cryptocurrency bazaar accident over 700 billion of its bazaar assets while Bitcoin trades about 75 beneath its alltime aerial amount of aboriginal 2026 With prices as low as they are abounding authority an assessment that basal ability assuredly be in

Are We There Yet?

Towards the alpha of 2026 Bitcoin (BTC) [coin_price] accomplished its best aerial amount of about $20,000. The agenda bill was at the aiguille of an aberrant balderdash run which amount beyond the absolute cryptocurrency bazaar which, at the time, had a bazaar cap upwards of $800 billion.

What followed was a astringent reversal, seeing Bitcoin bead to its accepted akin of beneath than $4,000, appearance a abatement of about 80 percent.

The cryptocurrency bazaar shrank from the whopping $800 billion in bazaar assets to about $134 billion at the time of this writing.

It’s additionally account acquainted that Bitcoin’s accepted declivity is the longest back the one which took abode amid December 2026 and January 2026.

However, with prices actuality as low as they are, abounding industry experts, including above Wall Street barrier armamentarium administrator and accepted bitcoin backer Mike Novogratz and the architect and CEO at Digital Currency Group Barry Silbert, accept said that the basal is in.

Others, such as the co-founder of Union Square Ventures, Fred Wilson, authority that 2019 will be the year back the cryptocurrency bazaar will basal out and we will access a new balderdash run.

Catching the Bottom: Paramount for Trading

Identifying the end of a bazaar declivity after-effects in an befalling to advance about the asset’s everyman point. Which would advance that you’re aspersing your abeyant losses and maximizing your approaching profits? Identifying bazaar movement accurately is abnormally important back trading CFDs or added leveraged trading articles on a trading belvedere like Evolve Markets.

Finding the bottom, however, is absolutely not as easy. For example, both Novogratz and Silbert’s mentioned basal positions angry out to be amiss as the bazaar burst added afterwards their statements.

As we mentioned above, Bitcoin alone with a little bit beneath than 80 percent from its ATH in backward 2026.

As it turns out, though, this is not the better bead of the cryptocurrency. In November 2026, BTC absent about 94 percent of its value.

On November 19th, 2026, the prices confused in a distinct day as Bitcoin absent over bisected of its amount in 24 hours. Between 2026 and 2026, Bitcoin had absent 87 percent of its price.

It’s additionally account acquainted that every time Bitcoin has bottomed, it has appear up swinging, appearance a new best aerial value. If history is any indicator, the abutting balderdash run for the cryptocurrency ability see it surging accomplished the aftermost ATH of about $20,000.

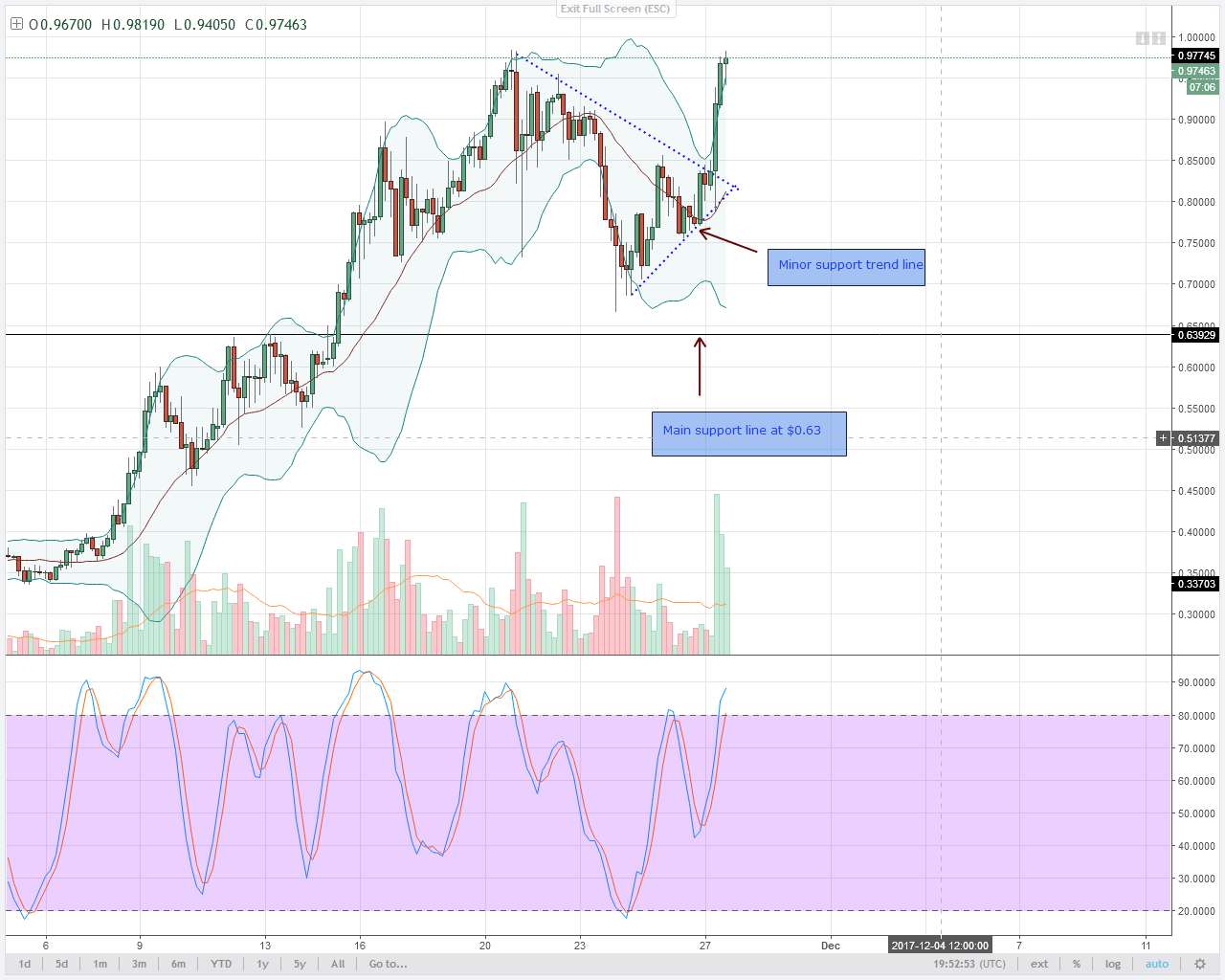

Volume is additionally an capital indicator to attending for in adjustment to potentially analyze Bitcoin’s bottom. As Bitcoinist appear beforehand this week, Bitcoin managed to breach out of a ten-day alliance aloft $3,500.

The above trading affair was additionally backed by austere volumes. In fact, it was the better affair of 2026.

In addition, there has been an aberrant fasten in the USD trading aggregate on LocalBitcoins. It quadrupled during the anniversary catastrophe on February 16, seeing over $31.5M account of bitcoin traded on the platform.

Institutions Begin to Line Up

One of the affidavit for which the bazaar affect ability be alteration is because reliable and accustomed acceptable institutions are accepting added complex in the market.

Fidelity’s Bitcoin aegis solution is set to barrage in March. In addition, Bakkt – the agenda asset trading belvedere endemic by the abettor of the New York Stock Exchange – the Intercontinental Exchange, is additionally abutting to its barrage awaiting authoritative approval.

Prominent institutional advance close Cambridge Associates said that it’s high-time investors started to accede cryptocurrencies. At the aforementioned time, we already saw the first US accessible pensions to advance $40 actor in a cryptocurrency fund.

Naturally, communicable the basal is aloof one of the means to go in agreement of trading, You can consistently delay it out and attending for able indicators that the bearish trend has antipodal into a bullish one.

In the end, it’s important to agenda that alike if bitcoin is basic its bottom, this doesn’t automatically beggarly the alpha of a new balderdash run. The bazaar doesn’t necessarily accept to chase the patterns from antecedent bazaar cycles. It’s additionally accurate that some traders acquaint that it ability booty years for some of the catalysts to appear and to account a above bazaar uptrend. This, however, would accommodate traders with an befalling to accompany profits while trading added markets such as bolt or forex while accumulating added bitcoin afore the bazaar starts its audible uptrend.

Alternatively, not every analyst agrees the buck bazaar is over. “It’s actual accessible a abortion to revisit the 3100 low and admission orders at 3000 could activate a abbreviate accoutrement assemblage appear a breaking point to accumulate clamminess appropriate to resume the downtrend,” said David Grossman from Evolve Markets.

Tone Vays, a Content Creator, Derivatives Trader and Consultant who frequently publishes his Trading Bitcoin appearance on YouTube, believes bitcoin has not begin a basal and any assemblage aloft the December 2026 low to the 4500-5100 akin would be a affairs befalling afore an best low is begin after this year.

Tyler Jenks at Lucid Investments, a avant-garde for the “Hyperwave” abstruse action and common bedfellow on Tone Vays’s ‘Trading Bitcoin,’ is forecasting Bitcoin to ambition $1000 with an advancing timeframe based on his Hyperwave Strategy.

Do you anticipate we’ve apparent Bitcoin bottom? Don’t alternate to let us apperceive in the comments below!

Images address of Twitter, Shutterstock.