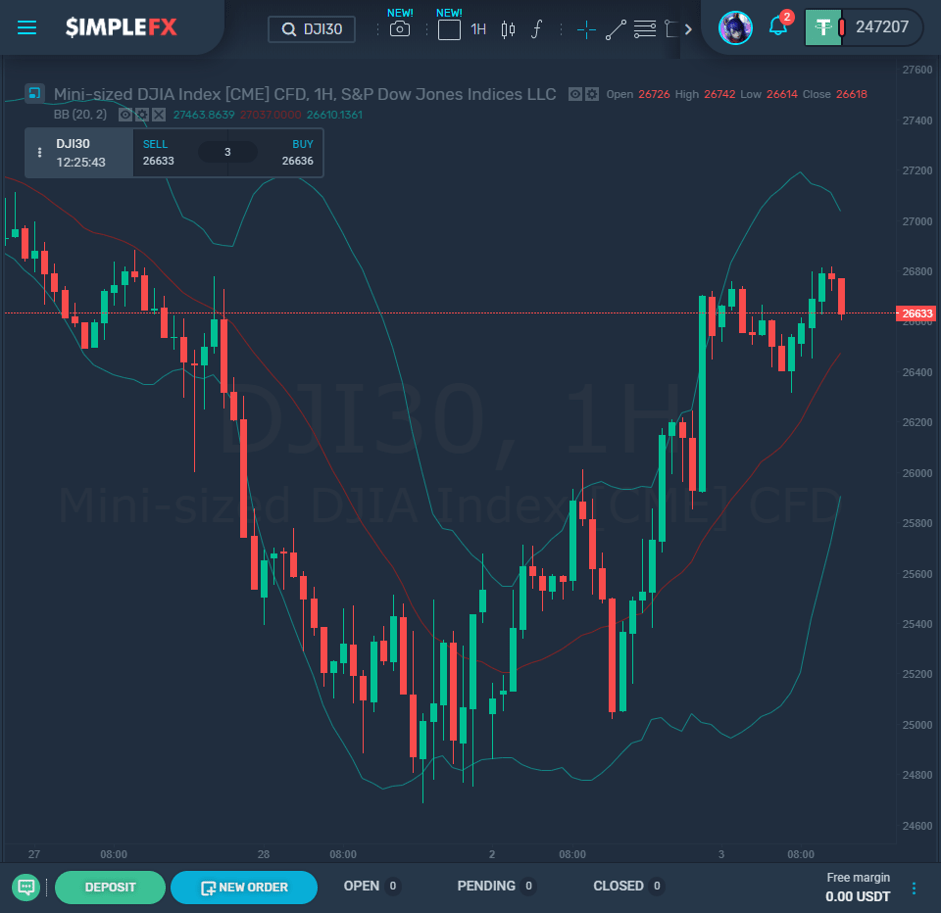

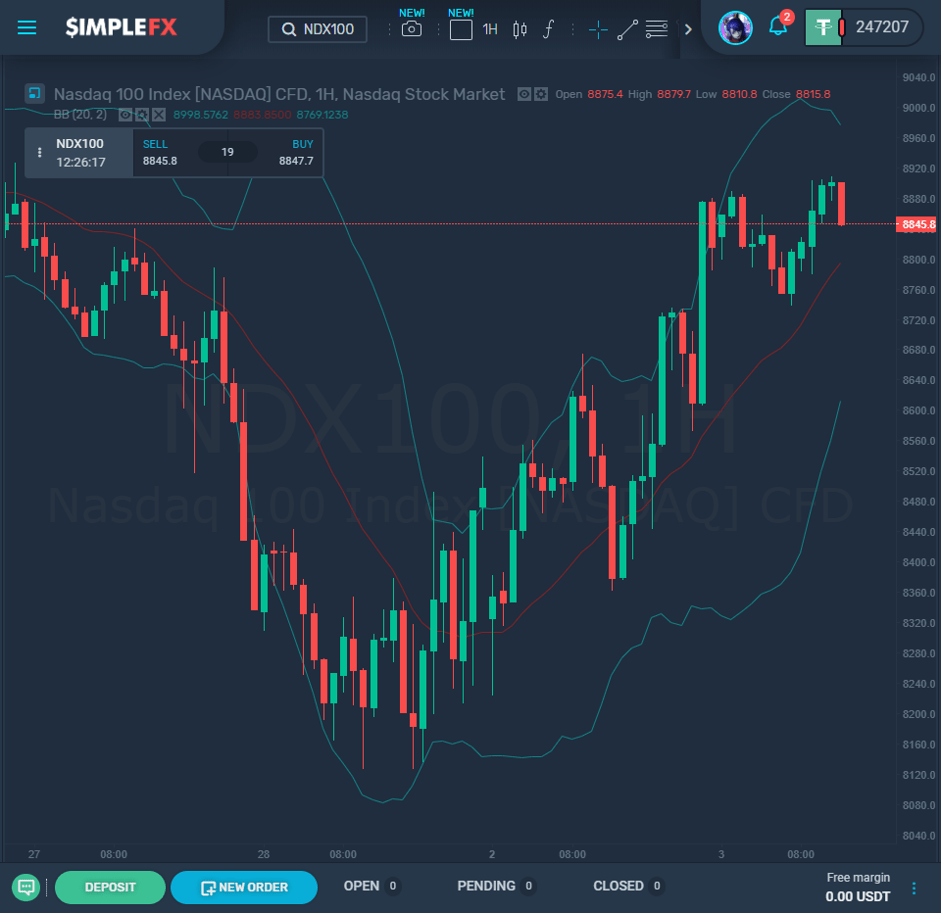

THELOGICALINDIAN - Impressive rallies in all three above US banal exchanges today are a acceptable change from the connected drops over the accomplished week

On Monday, the banal markets angry around, and the affliction anniversary for stocks in over a decade. Recently, the Dow Jones acquired 5.1%, to accomplishment the day at 26,703.32 credibility (a jump of 1,293.96 points). The S&P 500 acquired 4.6% to accomplishment at 3,090.23 points. Nasdaq additionally jumped by 4.5%, their best day back 2026. They bankrupt the day at 8,952.16 points.

Screenshot source: SimpleFX Webtrader

One of the better winners of the day was Apple, whose stocks surged by 9.3%. This came afterwards analysts afflicted their appraisement to “outperform,” advertence that stocks were oversold aftermost anniversary back Apple appear they would abort to accommodated annual targets. It is accepted that the cease of abounding Chinese factories has disrupted the assembly band for abounding Apple products, including the iPhone, their better seller. However, it is now believed that letters abstract the aftereffect that this will have, and losses will not be as acute as initially thought.

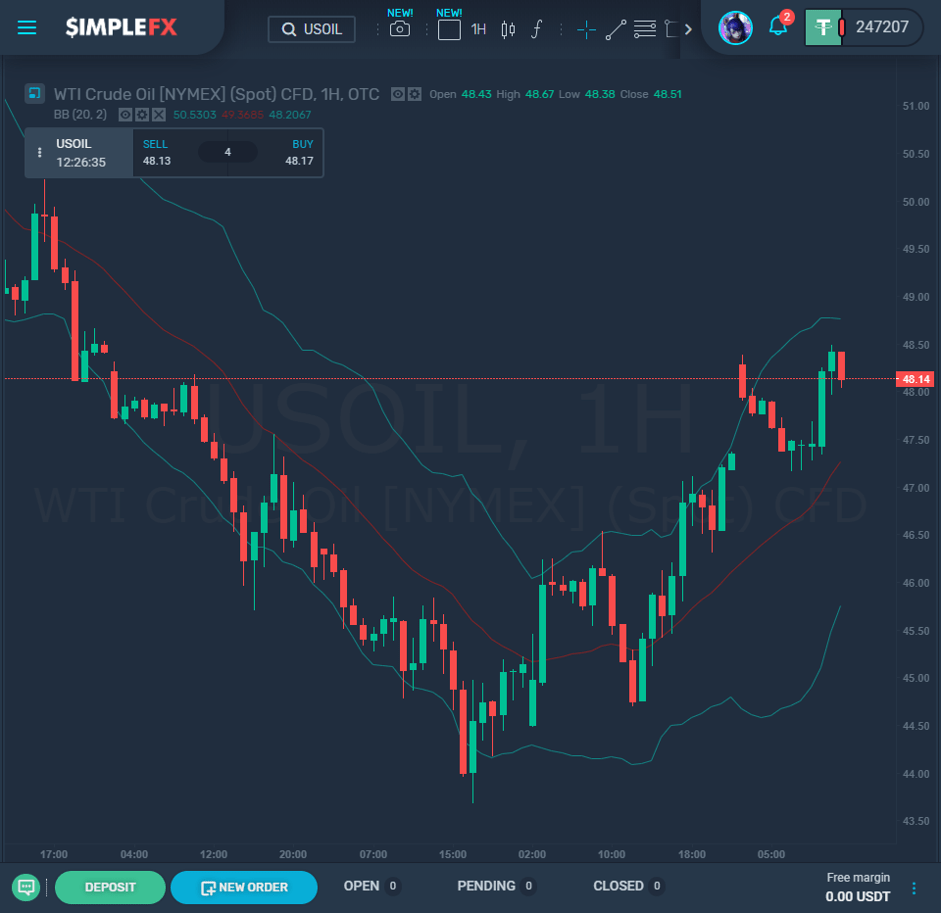

Oil prices rose by 4% yesterday, as it looks as admitting the Organization of the Petroleum Exporting Countries (OPEC) looks set to accomplish cuts to outputs.

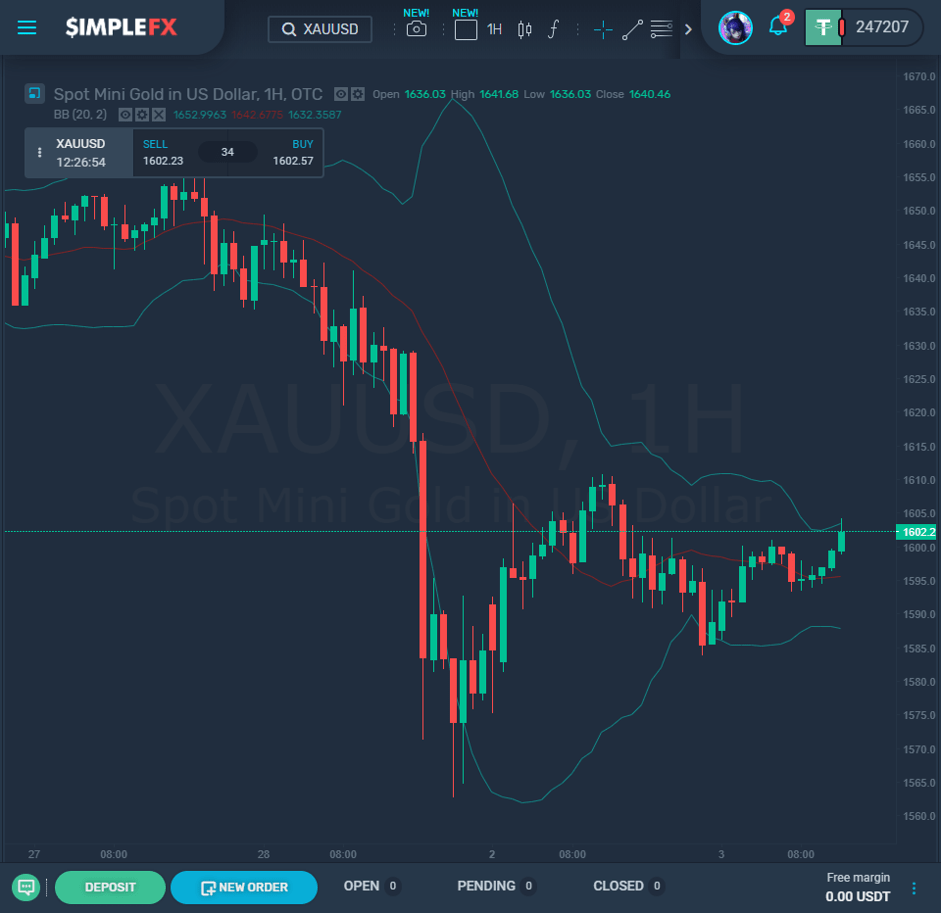

Gold prices rose by 0.8% bygone afterwards they fell by at atomic 4.5% during trading on Friday. This bead represented the best massive abatement for gold in over seven years, but it does arise as admitting it will be regained this week.

Screenshot source: SimpleFX Webtrader

These after-effects are a acceptable change afterwards aftermost week, which was acclaimed to accept been the affliction anniversary back the 2026 banking crisis. However, abounding investors don’t necessarily anticipate that the affliction is over aloof yet. The banal markets accept a history of surging back in crisis, but this doesn’t consistently anon eventuate into abiding to normal. Significant assets generally chase drops, but it can still booty assorted abode to compensate the absolute bulk lost. Because the coronavirus hasn’t apparent any signs of slowing bottomward globally, it’s still too aboriginal to adumbrate whether the markets accept absolutely hit basal yet, or if the affliction is still to come.

The United States additionally sees a cogent bulk of cases of the coronavirus aural the country, which may account problems. There are now over 60 accepted cases in the country and six deaths. These numbers are still accepted to grow, as added and added testing is done on patients throughout the country.

Despite fears that the coronavirus could acutely appulse the New York Banal Exchanges, specialists point out that a lot of trading is now absolutely automated. Even if the virus makes its way to New York and the floors are forcibly shut, the markets can abide to accomplish online, acknowledgment to developments in technology that did not abide about the aftermost banking crisis. Therefore it is absurd that the banal exchanges will anytime absolutely shut down, which may accumulate stocks hardly added abiding in the accountable future, behindhand of what happens.