THELOGICALINDIAN - Cake DeFi a belvedere that allows users to accomplish banknote breeze through affiliated masternode staking and options lending has created a belvedere with a apple-pie user interface that allows anyone from the amateur to the timestarved broker to alpha earning absorption on their cryptocurrency with a brace of simple clicks of a button

Cake was founded in aboriginal 2019 by Dr. Julian Hosp and U-Zyn Chua as a way to accompany the allowances of acquiescent assets into the boilerplate through a simple user interface. Dr. Hosp is CEO and Co-Founder and a consecutive entrepreneur, all-embracing blockchain expert, medical doctor, and ex-professional athlete. U-Zyn Chua is CTO and Co-Founder and has served as one of the aboriginal contributors to Bitcoin, Ethereum, and Dash, and a accepted blockchain adviser to the Singapore Ministry of Defense. The aggregation is broadcast beyond Europe and Asia and has Mandarin and German localization options.

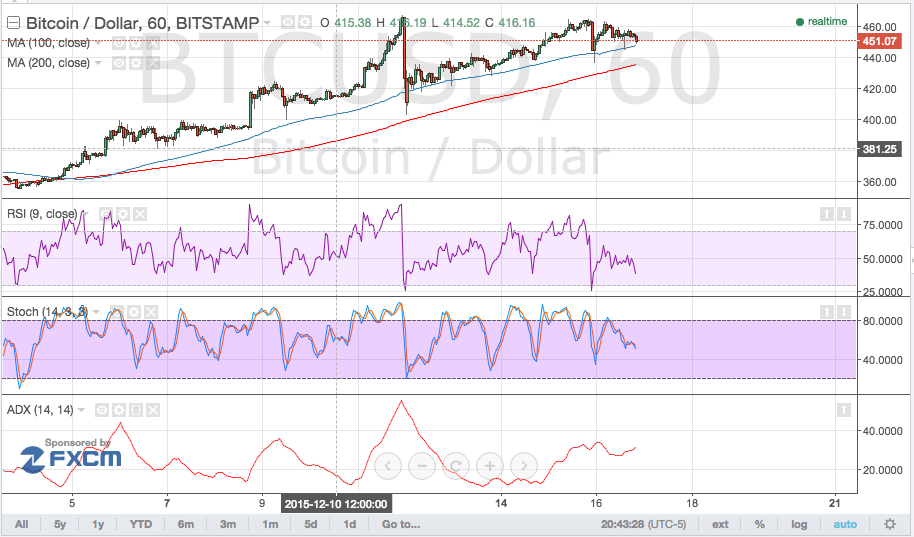

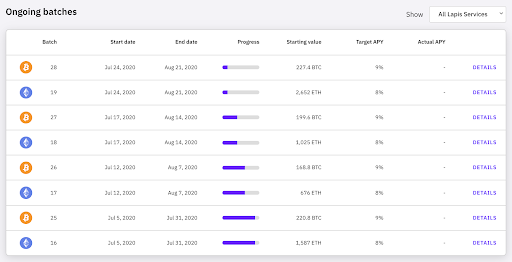

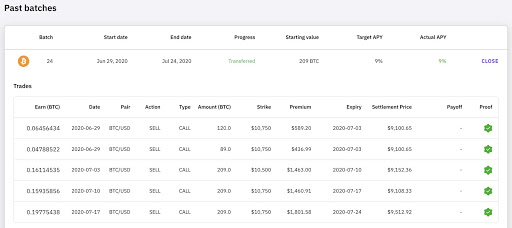

The company’s Lapis Service makes it accessible for users to accomplish aerial allotment on assets that are not currently affidavit of pale such as Bitcoin and Ethereum. The aggregation anon achieves 8-9% absorption for its users via account batches that lock for four weeks.

Interestingly, Cake does not booty “DeFi” to beggarly abridgement of acquiescence oversight. The aggregation leverages the best aspects of blockchain technology by accouterment abounding accuracy on both its Pool and Lapis Service.

To antithesis amid aegis and transparency, the trades aural anniversary Lapis Service accumulation are hashed and after about appear at the end of the batch. This allows accumulation participants and alike the accessible to analysis the specific capacity of anniversary barter – including the bang price, premium, and adjustment price.

Cake affairs on accession up its artefact portfolio by ablution USD lending in Q3 2026 as able-bodied as added authorization integrations. Cake’s authorization abutment will arresting the company’s about-face in action against alms a alloy of CeFi and DeFi solutions all in one platform.

One of the company’s different offerings is actuality the aboriginal staking provider for DeFiChain (DFI) – a absolutely decentralized blockchain advised accurately for aerial acceleration DeFi transactions. Users acquire 25% APR on Cake’s DFI Pool, with block rewards paid every 26 seconds.

The actuality that Cake offers a way for users to acquire absorption not alone through staking with DASH, PIVX, Zcoin, DeFiChain (DFI) but additionally through Bitcoin and Ethereum options presents addition different use case of CeFi affair DeFi. For this acumen the aggregation afresh surpassed ten percent week-on-week advance for new users and deposits.

Cake presents users the accessibility and adaptability of pooling tokens with no lower limit. The aggregation additionally offers account account reports, and processes for real-time compounding – acceptance users to booty advantage of the wonders of compounding absorption in a distinct click.

Overall, Cake DeFi’s name may mislead those who anticipate that DeFi consistently translates into articles that are adamantine to use. Cake combines the best elements of DeFi and CeFi for users to booty advantage of some of the accomplished ante that staking and centralized accounts can offer, all in a simple way through a Singapore registered and accountant entity.

This is a sponsored post. Learn added on how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons