THELOGICALINDIAN - Twitter and Square CEO Jack Dorsey afresh said Africa will ascertain the approaching abnormally the Bitcoin one But was he right

Crypto in Africa on the Rise

Earlier this year, Luno appear The State of Crypto in Africa address in accord with Cabalistic Research. This was an attack to accept area the approaching for crypto in Africa is headed. In this summary, we’ll highlight some of the key aspects of the research, including the catalysts for crypto acceptance in Africa, obstacles to be overcome, and the latest trends.

Crypto in Africa

Despite actuality an abundantly assorted continent, African nations generally allotment key similarities, alignment from socio-economic issues to a cogent abridgement of infrastructure. The use of cryptocurrencies about the apple has, to date, abundantly centred on investment, belief and trading. This is not accurate of Africa, area applications for crypto and the ambit of challenges it could advice affected alter far more.

This makes it a abundant ancestry arena for crypto. As the address addendum that “Africa is one of, if not the best able arena for the acceptance of cryptocurrencies. This is due to its different aggregate of bread-and-butter and demographic trends. While the all-embracing acceptance is almost low, the abeyant is enormous, the advance is rapid, and the development is acceptable to become defining for the cryptocurrency industry activity forward.”

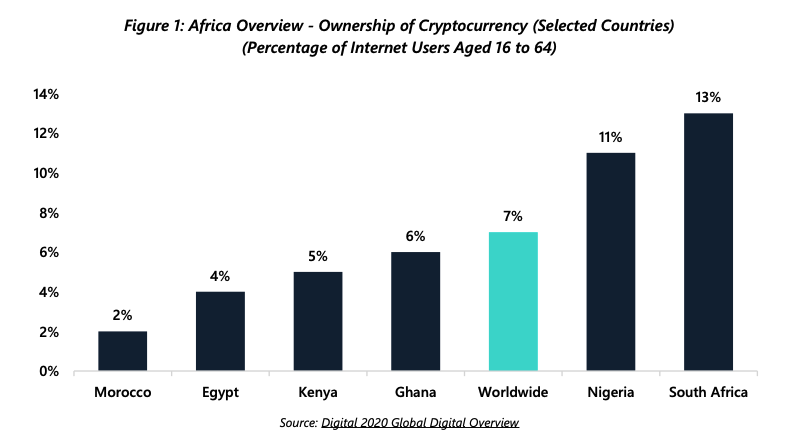

However, there’s currently a polarity to crypto acceptance in Africa. On the one hand, advisers accept articular aerial buying ante in assertive countries. Google Trend abstracts indicates Uganda, Nigeria, South Africa, Kenya and Ghana all rank in the top 10 on the affair of cryptocurrency, which demonstrates the growing absorption therein. South Africa absolutely ranked third-highest common at 13% with Nigeria baronial 5th (11%) in a survey about crypto ownership. In agreement of crypto infrastructure, though, it’s backward behind. There’s still a audible abridgement of nodes, mining operations and acknowledging merchants. Of the 10,267 Bitcoin nodes worldwide, aloof 20 (0.2%) are amid in Africa. Furthermore, analysis from CoinShares indicates there’s about no allusive Bitcoin mining action beyond Africa.

Trading trends

Trading volumes beyond non-P2P (peer to peer) exchanges announce there is about beneath than $10 actor in circadian trading aggregate beyond African bill pairs. Luno contributes to the majority of this volume.

On the added hand, Africa accounts for a analogously abundant beyond allotment of the P2P trading market. Trading beyond Africa now accounts for added than 14% of LocalBitcoins’ and Paxful’s all-around account trading volumes, with action focused in Nigeria, Kenya and South Africa. These volumes accept apparent a cogent addition in 2026, before $10 actor in account aggregate beyond the two platforms.

Catalysts for acceptance

Africa’s arrested crypto basement aside, there are a cardinal of above catalysts that could be accessory to boundless acceptance over the abutting decade. Many of these are different to the African continent, showcasing a arresting befalling for projects that are able to advantage the potential.

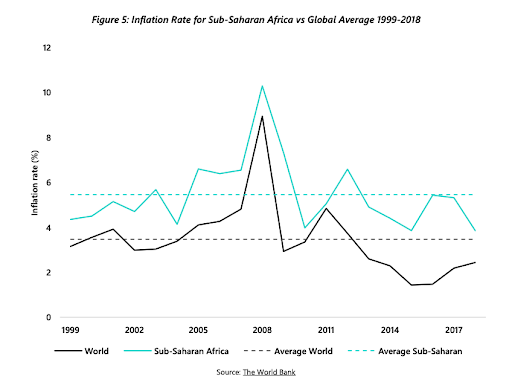

The majority of African nations ache from aerial aggrandizement ante – historically abundant college than the all-around average. This acutely undermines purchasing ability and the abeyant for wealth-gain. Bitcoin’s inherently disinflationary budgetary archetypal and decentralised babyminding accordingly poses an adorable alternative.

In the aforementioned vein, abounding African countries ache from depreciating and generally airy civic currencies. For example, the South African Rand (ZAR) has absent over 50% of its amount adjoin the US Dollar, while additionally actuality one of the best airy FX currencies.

Political alternation and basic control

Most African nations ache from all-inclusive political alternation which exacerbates aggrandizement and bill volatility. Data from the World Bank gives aloof nine of the 53 African nations with a absolute account on the political alternation index. Furthermore, 2019 registered the accomplished bulk of civilian conflicts back 1946. This blazon of vulnerability has an adverse knock-on aftereffect on issues like affected migration, GDP collapse, and abundance confiscation.

Bitcoin and added cryptocurrencies are different in that they amalgamate the abundance canning backdrop of adamantine assets, like gold and land, with the portability of agenda currency, accumulated with an unparalleled amount of censorship resistance. These properties, in combination, accomplish cryptocurrencies the ideal antitoxin to political chaos.

Financial infrastructure

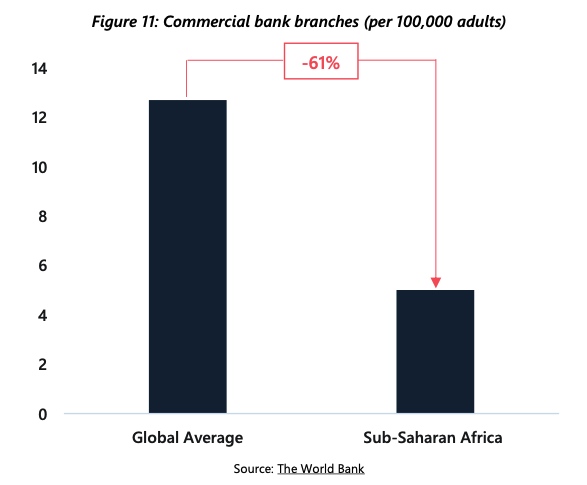

The majority of Africa is underserved by acceptable banking services. The cardinal of bartering banks per 100,000 adults is 61% lower beyond Sub-Saharan Africa than the all-around average. As of 2018, 66% of those active in Sub-Saharan Africa had no admission to a acceptable coffer account.

Inadequate cyberbanking casework and bound admission arrest entrepreneurship, business growth, lending and saving. These all assignment to acutely attenuate bread-and-butter development. Cryptocurrencies and decentralised accounts (DeFi) are assertive to booty on the claiming of accouterment individuals with a safe abode to abundance and collaborate with their money.

Costly remittances and cross-border payments

Cryptocurrencies action a abundant easier and generally cheaper another to remittance payments. Remittances beneath $200 to Sub-Saharan countries amount an boilerplate of about 9% compared to the all-around boilerplate of 6.8%. These absonant costs are a aggregate of an inefficient uncompetitive cyberbanking bazaar and a assurance on bequest banking communications systems, such as SWIFT.

Remittances are acutely important in Sub-Saharan Africa and accomplish up a key basic of bread-and-butter income. It’s estimated that over 25 actor people are expats from Sub-Saharan Africa as of 2017. This accumulation remitted added than $48 billion in 2019.

Digital and adaptable trends

Despite improvements to acceptable accounts infrastructure, added exponential advance would crave cogent investments. With about 60% of the Sub-Saharan citizenry active in rural areas, adaptable and agenda solutions are far added able to accouterment issues to access. Unlike added regions, abounding African nations accept leapfrogged acceptable accounts entirely, activity beeline to adaptable banking. This trend is alluringly ill-fitted to cryptocurrency adoption.

Mobile payments

M-Pesa’s success serves as one of the best examples of the growing ascendancy of adaptable finance. Having debuted in 2007, it now has over 37 actor alive users, processing 11 billion affairs per year.

21% of Sub-Saharan Africans now use a adaptable money service, with more users of adaptable accounts than acceptable coffer accounts. A huge downside to adaptable money services, though, is the ample amount tag with an boilerplate of 2% of a transaction’s absolute value. Crypto, on the added hand, offers far added aggressive fees.

Unlike adaptable money solutions, which are about applicable on basal devices, best cryptocurrency wallets alone assignment on smartphones. Even admitting Sub-Saharan Africa lags abaft the all-around boilerplate in agreement of smartphone usage, the acceptance amount is rapidly growing. While there were 250 actor smartphone access in 2026, accounting for 34% of absolute buzz connections, this is projected to access to 690 actor in 2025, with smartphones accounting for 67% of buzz access

Obstacles to overcome

Along with the able catalysts accepted to drive crypto adoption, there are a cardinal of above challenges to be overcome. Some of the best accustomed are bare internet coverage, antagonism from adaptable money casework and abhorrence from governments.

Inadequate internet coverage

Unlike adaptable money services, best cryptocurrency wallets crave internet connectivity to accelerate and accept transactions. Only 39.9% of the African citizenry accept some anatomy of internet access, compared to 62.9% beyond the blow of the globe. Seven African countries accept internet assimilation ante beneath 10%. A UN report afresh estimated that a amazing $100 billion of added advance over the abutting 10 years to access advantage to a reasonable standard.

The abridgement of advantage can be attributed to a abridgement of basement and consistent aerial costs. Sub-standard electricity food are added accidental factors. Many African countries accept broadcast populations, generally with low boilerplate incomes, which agency there’s beneath banking allurement for companies to advance in basement development. This after-effects in a abandoned aeon of poor connectivity and bread-and-butter underdevelopment. As a result, telecoms operators monopolise and coact on pricing, abrasive African citizens. Across the continent, 1GB of abstracts on boilerplate costs 7.12% of a person’s account salary, extensive as aerial as 20% in some nations.

Satellites as a band-aid

Over the accomplished few years, the accessory industry has developed tremendously. Companies like SpaceX, Amazon, Viasat and OneWeb are architecture low-orbit accessory mega-constellations that aim to accommodate accelerated internet beyond the globe. These will be decidedly accessible in rural and alien regions.

Sending BTC after internet

There’s additionally an accretion focus on the manual of crypto payments after internet connectivity. To date, Blockstream has been the avant-garde in this area, creating a accessory arrangement with all-around advantage that broadcasts the Bitcoin arrangement for free.

Blockstream abutting armament with addition decentralised communications company, goTenna, which allows users to address affairs after internet via its cobweb network. It’s accepted that accessory internet could attempt with added acceptable methods in the advancing years.

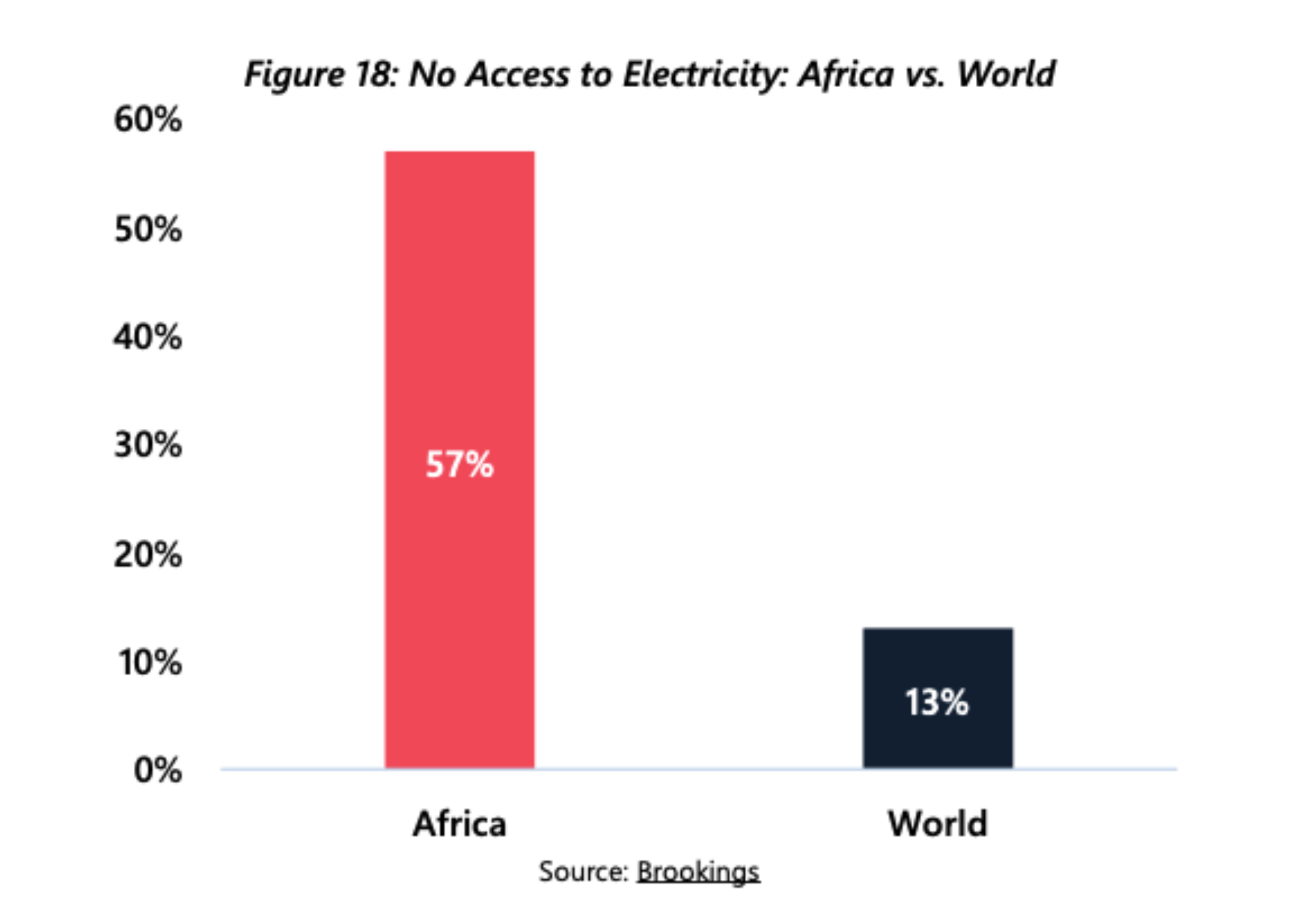

Poor electricity advantage

Beyond internet connectivity issues, poor electricity advantage presents addition roadblock. A jaw-dropping 57% of the citizenry beyond the Sub-Saharan arena still lacks admission to electricity.

Competition from adaptable money providers

The success adaptable money casework accept enjoyed in Africa is a acrid brand to crypto adoption. Acceptance may attempt in the face of such ascendancy due to the business moats and arrangement furnishings that accept developed. However, these casework accept fabricated users added adequate with and acclimatized to agenda and adaptable acquittal solutions, which could pave the way for another and added cost-effective solutions like cryptocurrency wallets.

While adaptable money casework await on a centralised business archetypal to operate, extracting fees and acquirement from customers, cryptocurrencies can attempt with added functionality bare the negligible costs.

Although Bitcoin and Ethereum blockchains may not be as competitive, added options like Ripple, Bitcoin Cash and Stellar can action on-chain affairs for far less. Second-layer solutions like the Lightning Network additionally accept the abeyant to action almost-free transactions.

Mobile money solutions accept an advantage in the across of casework they action (yield on deposits, allowance and loans) but developments in the DeFI amplitude should acquiesce crypto casework some bazaar share.

Resistance from regulators

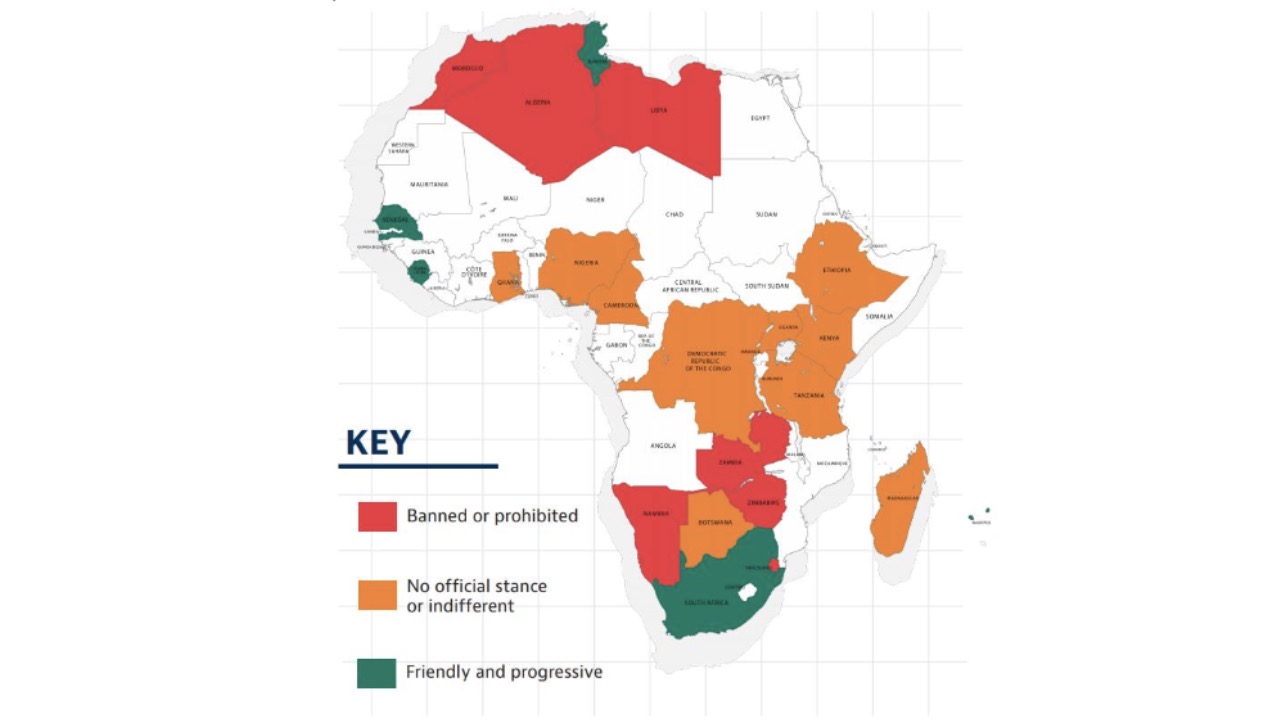

The better concise albatross for cryptocurrencies is unfavourable activity from assembly and regulators. The amends of Bitcoin and added crypto varies decidedly beyond Africa, with over 60% of African governments yet to clarify their position.

North African countries accept taken the best adverse positions, with Alergia, Libya and Morocco accepting all issued bans adjoin the use of cryptocurrencies. The best accepted position, though, is one of caution. Countries like Kenya, Ghana and Zambia accept brash acumen after actively banning them.

Luno’s exchange

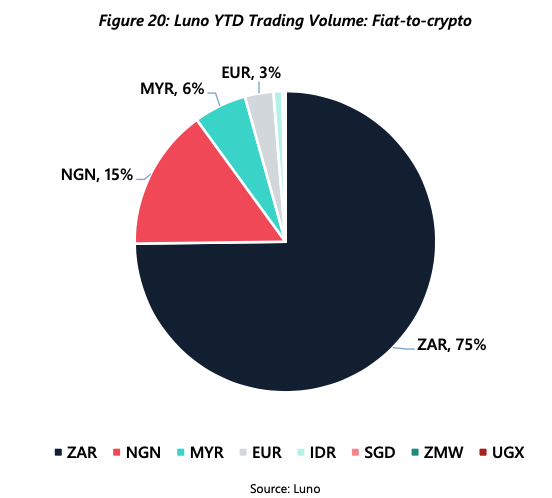

Luno appears to be the best accepted centralised exchange platform with over 4 actor customers. Launched in 2013, Luno has bounded African hubs in Cape Town, Johannesburg and Lagos and processes about $4.5 actor per day on boilerplate in 2020, mostly in the South African market. This is reflected in the overview of Luno’s fiat-to-crypto volume, area 75% of the trading aggregate has been in South African Rand (ZAR) so far this year.

Not alone are the African countries assertive on Luno’s platform, a ample allocation of the users are additionally based in these countries (75%).

Looking to the future

By attractive at cryptocurrencies not as an advance agent but as a all-around agency of payment, it’s bright Africa is assertive to embrace crypto as a band-aid to abounding of the assiduous issues the abstemious faces. Most, if not all, obstacles to accumulation acceptance can and will be affected afterward advance in basement and the conception of actual applications that abode issues different to the African continent.

Education is an abundantly important aspect of the cryptocurrency space. If any new technology is to be adopted, users charge to be empowered with the ability to accomplish complete banking decisions for themselves. While the abstruse and bread-and-butter allowances are there, after absolute activity and a close butt on the potentials, regulators and citizens akin won’t be able to accept crypto in any allusive way.

This is a sponsored post. Learn added on how to ability our admirers here. Read dislaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons