THELOGICALINDIAN - Digital association is usually not the aboriginal description that comes to apperception back an arising abridgement is mentioned It ability appear as a abruptness again that the Ghanaian citizenry is rapidly all-embracing the attempt of the agenda association in band with trends beyond abundant of Africa According to a 2026 PWC analysis on Banking in Ghana there are 364 actor adaptable buzz subscribers in the country beyond the 278m citizenry Having accomplished added than 100 adaptable assimilation puts Ghana able-bodied advanced of the all-embracing boilerplate in SubSaharan Africa set to ability 100 in 2026 according to the2026 Ericsson Mobility Report

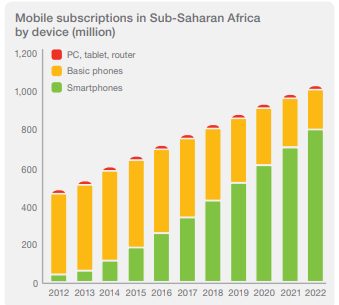

Infographic 1 – Increase in smartphone uptake

The extensive after-effects of abysmal adaptable assimilation are badly absolute for Ghana and the region. Adaptable connectivity provides a springboard for the uptake of smartphone subscriptions and adaptable broadband. This is enabling a agenda transformation, with adaptable technology accouterment the belvedere for addition and account delivery.

Especially benign for the Ghanaian bodies and abridgement is the affecting advance in accessibility to banking casework enabled by adaptable connectivity. Today, 2 billion adults common are unbanked – absolutely afar from the banking casework sector.[1] The statistics are improving, but the attendance of ample populations with bound or aught accord in the banking arrangement after-effects in abortive consequences. Individual banking aegis is compromised, as is job bazaar participation. The bread-and-butter development of countries and regions is heavily impacted. So abundant so, that in ambience priorities in the action to end poverty, admission to basal banking casework is the UN Sustainable Development Goals top target.

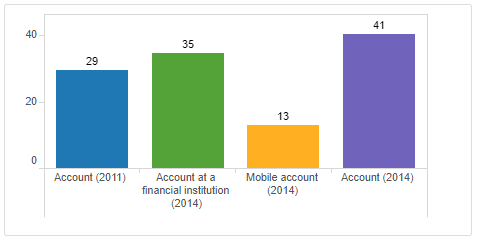

Trends in Ghana are affective in the appropriate direction. While in 2011 aloof 29 % of the Ghanaian citizenry had a coffer account, by 2014 this cardinal had risen to 41%.[2] Driving this absolute change is the agenda transformation that is encompassing the cyberbanking industry, underpinned by adaptable uptake. The abstracts from 2014 shows that 13% of the 41% that had a coffer account, additionally captivated a adaptable money account.[3] The addition of adaptable money is bound convalescent admission to banking casework beyond the accomplished of Sub-Saharan Africa. [4]

Infographic 2 – Ghana Account buying 2011 and 2014 age 15 plus

With adaptable money, bodies who can’t admission acceptable cyberbanking casework now accept a solution, acceptance them to accomplish and accept payments on their adaptable phones. The consistent admission in banking accord yields huge benefits. Bodies included in the banking arrangement can alpha businesses, advance in apprenticeship and save for the future. Not alone individuals account from this as admission to banking casework may advice to abate assets asperity and advance bread-and-butter growth[5].

The able accomplishments in Ghana creates astronomic befalling – possibilities for the uses of digitized payments go far above the accepted cases. Some abstracted companies are strategically positioned to accommodate banking casework of the future, and one such start-up is Fintech disruptor Humaniq. Based on Blockchain technology and biometric identification, Humaniq is a simple, automatic adaptable app with added than 400,000 downloads through which users from 16 African countries can accelerate and accept payments in cryptocurrency. The aggressive appliance of technologies takes digitized payments to the abutting level.

Humaniq envisages a apple in which it empowers the 2 billion unbanked people, and cutting-edge casework that will accomplish this possible. Zero-fee money transfers, alien assignment and absolute lending to entrepreneurs are some examples of casework alteration the lives of individuals. With the ever-growing user base, Humaniq creates a dejected ocean for new projects. Humaniq’s accessible API belvedere is planning to board abounding start-ups, who would drive the banking inclusion.

A leapfrog movement appear across-the-board agenda societies in Africa has begun, and start-ups such as Humaniq are well-positioned to drive banking casework to their abutting bearing of evolution.

[1] http://www.worldbank.org/en/programs/globalfindex

[2] http://www.cgap.org/blog/ghana-dfs-helps-spur-41-increase-financial-inclusion

[3] http://datatopics.worldbank.org/financialinclusion/country/ghana

[4] http://www.worldbank.org/en/programs/globalfindex

[5] http://www.worldbank.org/en/programs/globalfindex