THELOGICALINDIAN - Analysts at Hedgeye Risk Management an advance analysis and banking media aggregation based in Stamford Connecticut accept analyzed the Bitcoin stocktoflow altercation This framework suggests Bitcoins amount potentially extensive 1 actor by the closing bisected of 2026s and as abundant as 10 actor per BTC by the 2030s

At its contempo peak, Bitcoin’s bazaar cap hit $1.2 trillion. To accord you some perspective, that’s bigger than the four better banks in the United States combined (JP Morgan, Bank of America, Citi, Wells Fargo), as able-bodied as the four better payments platforms accumulated (Visa, Mastercard, PayPal, Square).

As best abiding holders understand, a assemblage of analytical factors will abide to aid in the admeasurement of crypto acceptance beyond the world.

Among them:

The account goes on and on.

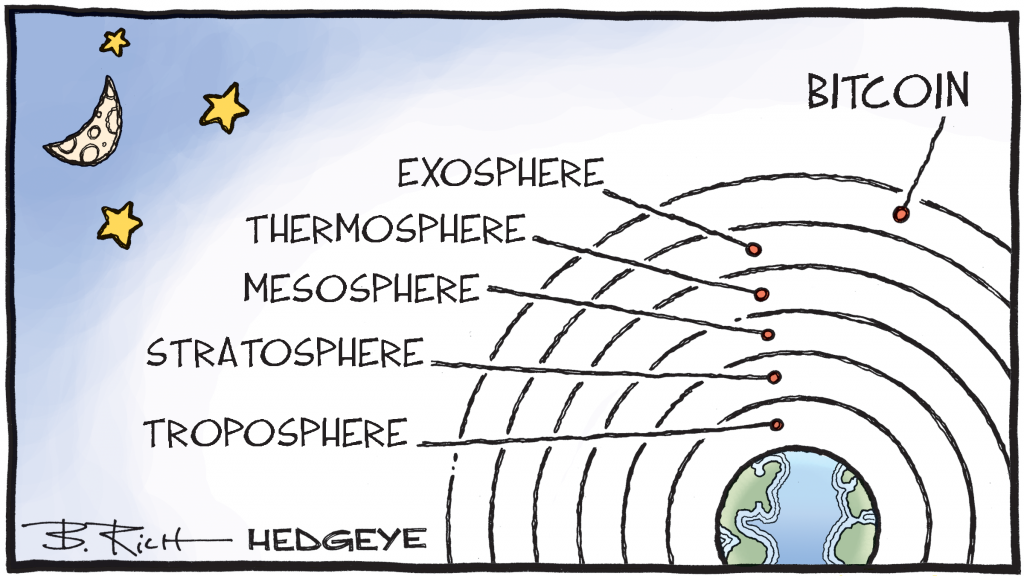

Analysts at Hedgeye Risk Management, an advance analysis and banking media aggregation based in Stamford, Connecticut, accept analyzed the Bitcoin stock-to-flow altercation – in band with their access of celebratory banking markets through a quantitative lens (which is acutely bare of qualitative, narrative-based “calls”).

This framework suggests Bitcoin’s amount potentially extensive $1 actor by the closing bisected of 2020s, and as abundant as $10 actor per BTC by the 2030s.

Hedgeye was founded in 2008 by above buy-side analysts to adjust admission to hedge-fund affection advance analysis for accustomed investors. In an accomplishment to aggrandize the ambit of its analysis process, Hedgeye’s Macro aggregation created an exhaustive, circadian quantitative dashboard on a ambit of cryptocurrencies and ETFs, appropriately called the “Bitcoin Trend Tracker”.

This “Crypto Quant” dashboard break bottomward the 1) Price 2) Volume, and 3) Volatility amid several added metrics of anniversary asset it tracks. (You can watch Hedgeye Macro analyst Christian Drake’s 30-minute explainer video on how to use the Tracker here).

The ambition is simple: Give investors the aforementioned high-quality quantitative abstracts for cryptocurrencies accessible for added asset classes, cogitating of the absoluteness that crypto is here to stay. The “Bitcoin Trend Tracker” is no altered from Hedgeye’s added proprietary accoutrement which advance market-based signaling to break advanced of ample movements in any asset.

In addition, one of Hedgeye’s analysts, Josh Steiner, has additionally performed a fundamental analysis by comparing the Stock-to-Flow archetypal of Bitcoin to that of added adamantine assets and comparing the change of Bitcoin’s amount to that Stock-to-Flow framework. Below is a arbitrary of that analysis.

To be clear, it should go after adage that numerous, accepted risks abide to actuality continued Bitcoin. Smart investors charge to be alert of these risks. They run the area and accommodate abeyant authoritative risk, as able-bodied as aggressive and abstruse risk. Anyone who owns Bitcoin (or any cryptocurrency for that matter) needs to be alert of these abeyant acreage mines and accident administer them accordingly.

(You can admission the slides featured in this commodity here)

(You can admission the slides featured in this commodity here)

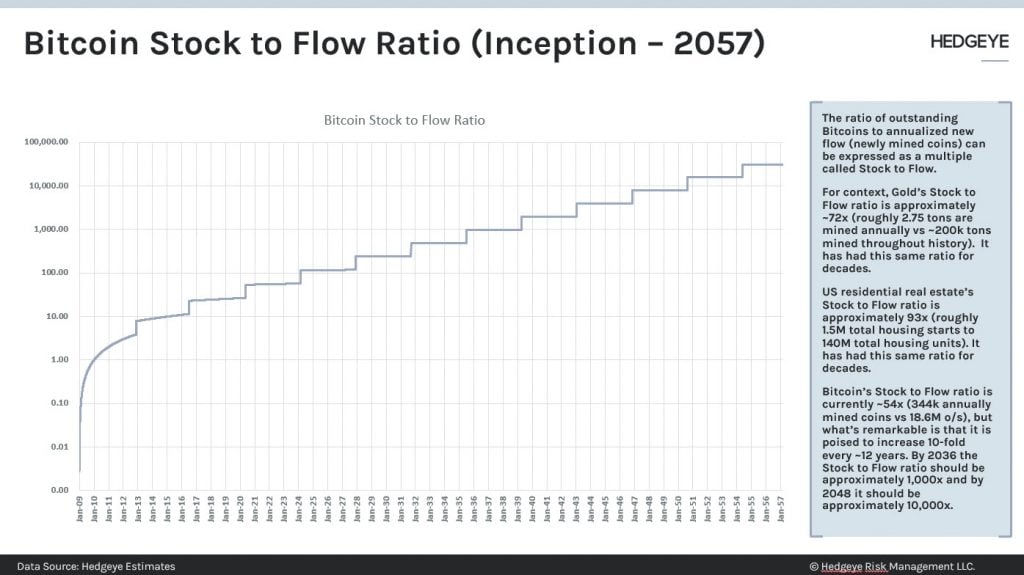

“The abstraction actuality is a simple one,” Steiner explains.

“If you attending at the arrangement of outstanding accumulation about to the breeze amount of that supply, you can get the stock-to-flow ratio. Bitcoin’s Stock-to-Flow ratio is currently 54x; almost 344,000 BTC are actuality mined annually on an outstanding abject of about 18.6 actor BTC.

But what’s arresting about Bitcoin is that it possesses a pre-programmed creation-decline almost every ~4 years; during anniversary of these events, the accolade for mining Bitcoin is cut in half.

That agency the Stock-to-Flow ratio is assertive to access logarithmically, almost 10-fold, every 12 years.

To put that in perspective, by 2036 we should be at a Stock-to-Flow ratio of about 1000x – or added than 10x the stock-to-flow of Housing (93x) or Gold (72x). By 2048, there will be addition 10-fold increase, which would booty the Stock-to-Flow up to 10,000x.”

In apparent English, Bitcoin is mathematically advised to exponentially access its Stock-to-Flow ratio until it ultimately mathematically converges against infinity. This is both about to its accepted state, and about to added hard-money assets like Housing and Gold. A college Stock-to-Flow arrangement indicates that beneath new accumulation is entering the bazaar about to an asset’s existing, outstanding supply.

In added words, an asset with a college Stock to Flow arrangement should, about to added assets, absorb its amount bigger over the long-term. In a apple of accessible money and U.S. Dollar debasement, it’s accessible to accept Bitcoin’s address as not aloof a hard-money asset, but as an ultra-hard-money asset. Unlike absolute acreage and gold, which accept high, but almost static, Stock-to-Flow multiples, Bitcoin’s Stock-to-Flow arrangement will accumulate accretion exponentially for the abutting 100 years.

Steiner circles aback to the constant affair mentioned earlier, the appulse on price.

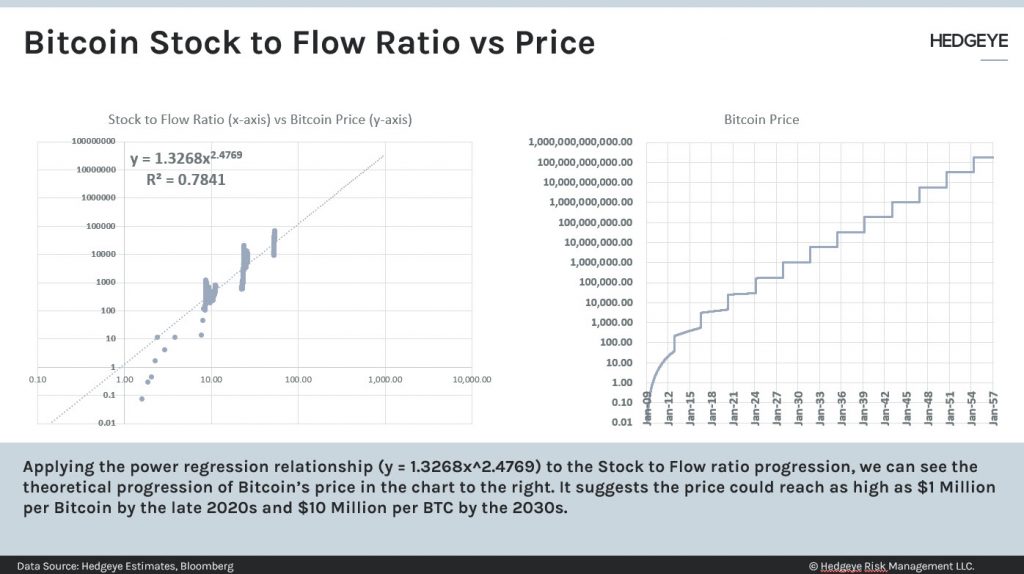

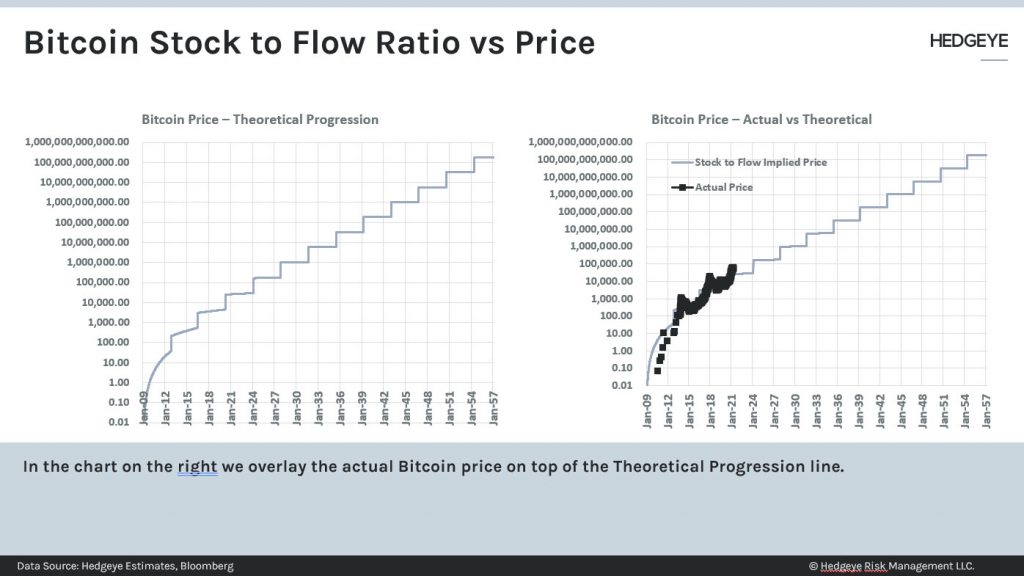

In the blueprint below, Steiner plots a time-series of Bitcoin’s amount (y-axis) against the Stock-to-Flow ratio as it changes over time (x-axis) out through 2057. Perhaps best importantly, the atramentous dots in the right-hand blueprint reflect Bitcoin’s actual amount against the abstract progression adumbrated by the Stock-to-Flow ratio… and it has followed the archetypal actual carefully appropriately far.

With over two decades of advance assay beneath his belt, Steiner acclimated every corruption assay in the book to archetypal Bitcoin’s approaching price. The best fit—by far—was a ability function. The graphs apparent are logarithmic; Bitcoin’s amount acknowledgment has been—and may abide to be—logarithmic.

“Every 10-fold access in Bitcoin’s Stock-to-Flow ratio, which will appear every ~12 years activity forward, has produced a ~1,000-fold access in Bitcoin’s price. And that hasn’t happened once, but twice.”

Steiner explains that he has yet to see addition asset behave this way, alike afterwards a multi-decade career on both the buyside and sell-side of Wall Street accoutrement Financials, Housing, and Macro.

In the spirit of abounding transparency, Steiner isn’t befitting his archetypal a secret. The blueprint for the abstract progression of Bitcoin’s amount (relative to its Stock-to-Flow) is y=1.3268x2.4769.

That blueprint forecasts Bitcoin to hit $1 actor by the closing bisected of 2020s, and $10 actor per BTC by the backward 2030s.

Of course, Stock-to-Flow is not the only factor that will access cryptocurrency prices activity forward. The ambition of the archetypal is to prove how Bitcoin intrinsically could accomplish these amount levels.

Furthermore, not anybody affairs to be a abiding holder of cryptocurrencies. Many bodies use crypto in assorted transactions, or to abundance amount but after apprehend a gain, amid abundant added use-cases.

Hedgeye’s aim is to add a quantitative framework for advance in cryptocurrencies, for both short-duration traders and long-duration investors alike.

Investors can now accretion a bigger compassionate of the concise and abiding movements and correlations that adapt the near-term aisle for assorted cryptocurrencies and crypto-related ETFs. In added words, Hedgeye is injecting accuracy into what will apparently be a massive asset chic which one day could battling equities, anchored assets and adopted exchange.

The Bitcoin Trend Tracker does absolutely that.

As a accident administration tool, it focuses on the Price, Volume, Volatility, and allusive characteristics of anniversary asset it tracks. Managed by the Hedgeye Macro team, it continues to advance based on new models they develop, subscriber feedback, and innovations aural crypto.

Hedgeye’s Bitcoin Trend Tracker includes Hedgeye CEO Keith McCullough’s proprietary, buy low, advertise aerial Accident Ranges for Bitcoin, Ethereum, the Grayscale Bitcoin Trust (GBTC) and Microstrategy (MSTR)… in accession to added analytical crypto quantitative accident administration abstracts you can’t get anywhere else.

Recently, Hedgeye broadcast its crypto advantage with proprietary Risk Ranges for the Amplify Transformational Data Sharing ETF (BLOK).

BOTTOM LINE: You can now get admission to analytical crypto accident administration signals with the “Bitcoin Trend Tracker.”

Get added advice on Hedgeye’s Bitcoin Trend Tracker here.

Learn added about Hedgeye’s all-embracing advance analysis action here.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons