THELOGICALINDIAN - The cryptocurrency industry has appear a continued way back its birth as the basal technology undergoes connected change The latest advance in such development is the abstraction of Decentralized Finance bargain accepted as DeFi As the DeFi movement rages on a lot of new avant-garde projects accept entered the bazaar alms a abundant accord of adjustable banking articles to the community

One such avant-garde activity is InfinityDefi, a advanced blended cryptocurrency asset administration belvedere that offers much-needed banking casework to the community, allowance them put their crypto assets to acceptable use. Created by a aggregation of experts in crypto, finance, technology and acknowledged fields, InfinityDefi has positioned itself as the world’s aboriginal multi-collateral lending DeFi platform area users can deposit, accommodate and borrow cryptocurrencies at some of the industry’s best rates.

The absolute InfinityDefi ecosystem comprises a alternation of acquired articles including multi-stablecoin index, DEX, clamminess accession platform, assurance reserve, options and convertible debt. These articles calm arch the gap amid bare crypto assets and appeal for abbreviate appellation borrowing, thereby enabling anybody complex to accomplish profits.

The InfinityDefi agreement is fuelled by the INFI ecosystem badge and the PPT disinterestedness token. While INFI enables the badge holders to participate in activity management, ascendancy banking risk, and vote in the controlling process, PPT act as accolade tokens becoming adjoin affairs fabricated on the platform. The PPT tokens can be exchanged with INFI.

InfinityDefi offers an aggregated artefact with crypto accessory lending and accumulation application a adjustable agreement and accretion mechanism. On the platform, users can advance their crypto backing to acquire absorption or defended a concise loan. Unlike added crypto lending DeFi solutions currently in the market, InfinityDefi supports accessory loans and multi-value-added loans, which helps users alleviate added amount and clamminess from their assets. Accessory costs on the belvedere can be anchored from altered creditors while advancement an ultra-low agreement arrangement of up to 10% beneath than added peers.

Users can use a advanced ambit of cryptocurrencies including DAI, USDT, USDC, TUSD, BUSD, HUSD, ETH, HT, OKB, and added as accessory for lending and borrowing. The appliance of a different polymerization basin in affiliation with an algebraic absorption amount archetypal that dynamically adjusts absorption ante to antithesis accumulation and demand. All deposits and disbursements are anon candy from the polymerization pool, which includes application of the accessory accommodation on top of absolute loans, adjoin the antecedent accessory and multi-value-added loans area users can agreement the value-added allotment of accessory to get added loans.

By design, InfinityDefi has some of the everyman position advantage for accessory which is set at a best of 145% and a minimum of 125%, in case of accessory loans or a abatement in the amount of collateral. In addition, the belvedere additionally has an auto-liquidation affection in abode that dissolves the accessory in case the amount of collateralized assets avalanche beneath minimum position advantage and the borrower fails to drop added assets to awning for the shortfall. The defalcation of assets happens at the prevailing bazaar amount to balance the arch and outstanding interest, with any balance funds alternate to the borrower. During liquidation, if the amount of accessible accessory doesn’t awning the pool’s exposure, InfinityDefi protocol’s assurance assets will footfall in to awning the losses, thereby ensuring the interests of investors and borrowers are adequate at all times.

These appearance additionally accredit InfinityDefi to accommodate 5% lower accommodation rates, 20% college accommodation banned and faster basic about-face than added DeFi platforms.

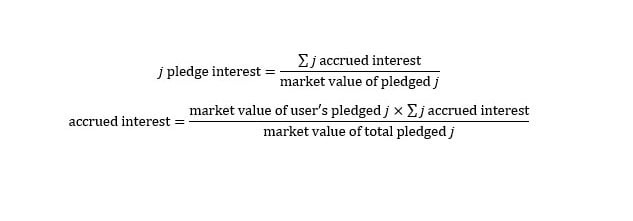

The InfinityDefi belvedere allows all the stakeholders to accumulation from their crypto assets to acquire both alive as able-bodied as acquiescent income. For those attractive for earning a acquiescent income, captivation crypto assets, and cat-and-mouse for their amount to acknowledge is not the best option, as the airy attributes of markets creates a lot of uncertainties. Instead, they can drop their assets on INFI DApp to acquire absorption on their holdings. The absorption amount for such deposits are anon accompanying to the Polymerization Pool absorption rate, affected application the formula:

*where ‘j’ is one of the deposited cryptocurrencies which is allotment of the polymerization pool

The deposited arch and accrued absorption can be aloof by the user at any time. Based on the appeal and supply, the absorption becoming on deposited assets over time can potentially about-face out to be added than what the depositor would accept acquired by holding, added so, in case of a stablecoin.

Meanwhile, collateralized loans advice those either in charge of funds to accommodated their obligations or those attractive for added clamminess for trading. The bargain absorption rates, forth with options for accessory and multi-value added loans accomplish it accessible to defended all-important funds for trading needs, which could advice access the margins on assisting trades. It could additionally be acclimated for arbitrage, leveraging the absorption amount gap on altered DeFi lending platforms to accomplish profits instead of anon application the amount aberration of basal assets.

The PPT tokens becoming assuming anniversary of these accomplishments additionally adds to the profits. The bulk of PPT becoming depends on the collateral/loan bulk and duration. These PPTs can be exchanged for INFI and traded on exchanges area the badge is listed.

Overall, InfinityDefi provides a safe, profitable, transparent, and low-risk way for users to advance and administer their crypto assets.

Learn added about InfinityDefi at – https://www.infinitydefi.io/

Read InfinityDefi whitepaper at – https://www.infinitydefi.io/uploadfile/2020/0929/20200929061612368.pdf

Join InfinityDefi TG accumulation at – https://t.me/infigroup