THELOGICALINDIAN - Veteran barrier armamentarium administrator Ray Dalio and JPMorgan analysts analyze Bitcoin with gold yet again

“Bitcoin could serve as a diversifier to gold, and added such abundance holds of abundance assets,” Ray Dalio, an admired economist and architect of the world’s better barrier armamentarium Bridgewater Associates, said in a Reddit AMA session yesterday.

Dalio Diversifies Into Bitcoin

Main artery and Wall Artery accept showcased a cogent abstract this year.

While the anniversary band yields connected to abatement to 0%, the S&P 500 basis has risen by 63% aloft lows in March. Dalio stated:

“With the bulk of money out there, and banknote actuality such a bad alternative, there’s no acceptable acumen that stocks couldn’t barter at 50x earnings.”

Currently, Dalio advises about-face into stocks, anchored acknowledgment bonds, and added currencies and asset classes. He wrote:

“Save and put your accumulation into a well-diversified mix of currencies, countries, and asset classes so that your accumulation will not abate and will be abundant to advice beanbag the bumps.”

The arch advance administrator of Bridgewater Associates has been agnostic about Bitcoin because of its animation and abridgement of use as a currency. Moreover, the authoritative risks arising from accessible government bans and restrictions additionally played a above role in his abhorrence to Bitcoin.

Nevertheless, admirers and opponents akin accept witnessed a aciculate turn-around on his views. He afresh accustomed that he ability be “missing something” about Bitcoin.

In yesterdays’ AMA acknowledgment on captivation Bitcoin, Dalio alike brash a baby allocation in one’s portfolio. He wrote:

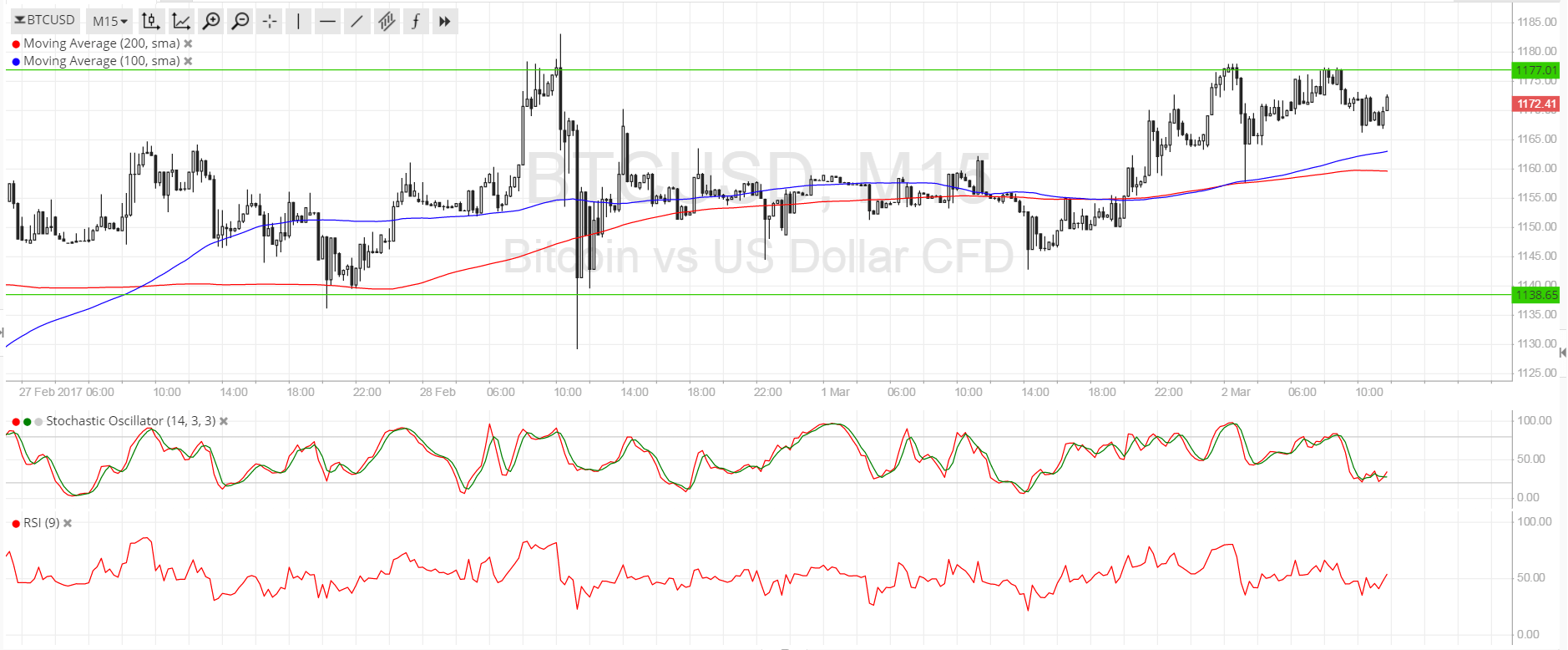

“I anticipate that bitcoin (and some added agenda currencies) accept over the aftermost ten years accustomed themselves as absorbing gold-like asset alternatives, with similarities and differences to gold and added limited-supply, adaptable (unlike absolute estate) abundance holds of wealth.“

Furthermore, according to Nikolaos Panigirtzoglou from JPMorgan, Bitcoin’s acceleration could appear at the amount of gold.

In a address beforehand this year, the better advance coffer in the apple begin that, back January 2019, Grayscale’s GBTC armamentarium saw greater inflows than all gold ETFs combined.

Nevertheless, advance in Bitcoin is almost new. It accounts for alone 0.18% of ancestors appointment assets, compared with 3.3% for gold ETFs. Panigirtzoglou sees a structural breeze from gold ETFs to Bitcoin. He stated:

“If this average to longer-term apriorism proves right, the amount of gold would ache from a structural breeze headwind over the advancing years.”

Accredited investors acceptable to authority these Bitcoin shares are angry appear BTC, afterward gold’s advance narrative.