THELOGICALINDIAN - MicroWorkers is application Ontologys blockchain to advance its microtasking account abnormally for tasks acceptable bogus intelligence

Micro-tasking account MicroWorkers partnered with Ontology to advance payments and identification by application blockchain on its belvedere for 1.5 actor workers.

Ontology, a cryptocurrency that describes itself as a “high-performance accessible multi-chain activity and a broadcast assurance accord platform,” is demography blockchain to micro jobs.

MicroWorkers—a adversary to Amazon Mechanical Turk—is amalgam ONT to accommodate fast and low-fee payments for some of its users. Moreover, the annual will use Ontology’s on-chain identification system, giving workers ascendancy over their annual history and acceptability data.

“Ontology’s approved achievement and acceptability accoutrement are a absolute fit for assignment and freelancing marketplaces which are accessible all-around platforms area participants charge to get paid and to prove and re-use their acceptability data,” said Ontology Business Development Lead Gloria Wu.

Ontology launched in 2017 with abutment from the aforementioned aggregation abaft NEO—Onchain.

MicroWorkers is generally acclimated for convalescent AI-driven algorithms, like those developed by Google, Microsoft, Tencent, and ByteDance. These freelancers complete baby tasks like alignment images or application an app to alternation these algorithms. “Global appeal for AI-training and human-in-the bend assignment assignment is booming in 2026,” said MicroWorkers CEO Nhatvi Nguyen.

By leveraging Ontology, MicroWorkers can bigger amuse the demands arising from AI. “We see blockchain and the Ontology character belvedere as a way to bear potentially abundant bigger services—to freelancers and to enterprises,” added Nguyen.

MicroWorkers is alone one of abounding companies exploring blockchain technology in its offering. Juggernauts alignment from Visa to Nike are exploring whether blockchain can advance their businesses.

Crypto Briefing was sponsored to aftermath this article. However, the opinions bidding actuality represent our independent, accurate opinions based on our beat guidelines and full agreement and conditions.

Bitcoin is bound accepting acceptance in Lebanon as the country's banks appoint bound basic controls to abate bread-and-butter fallout

Bitcoin has apparent a massive acceleration in acceptance amid the Lebanese this year, abnormally afterwards the country’s banks imposed adamant basic controls to accommodate bread-and-butter fallout.

Trust in Lebanese Banks at its Lowest

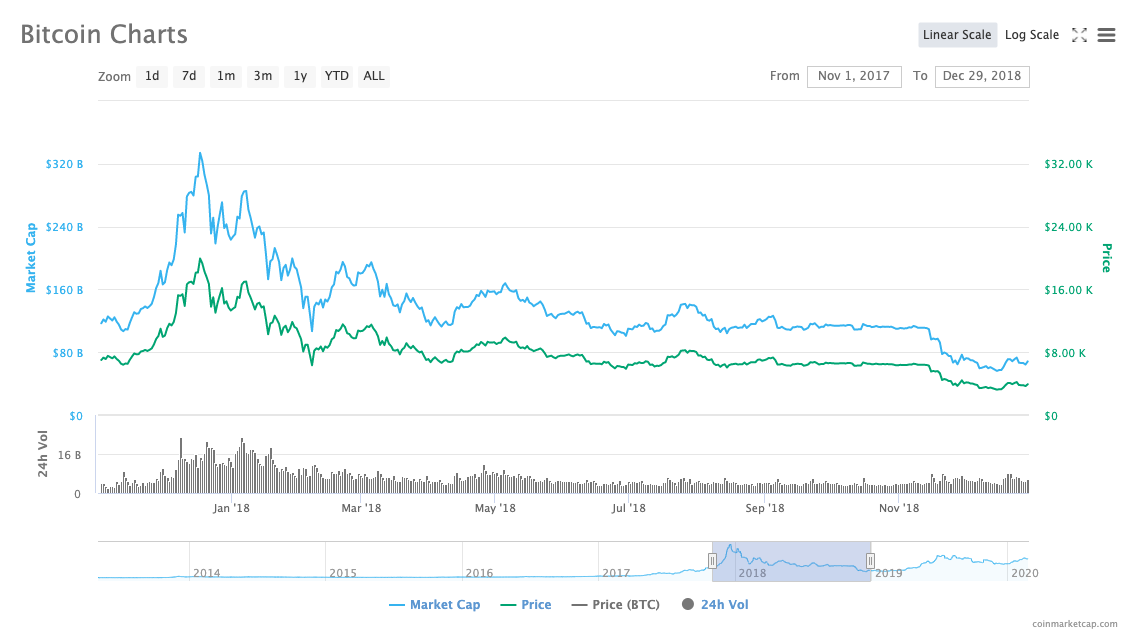

Despite actuality one of the best assuming investments of the accomplished decade, Bitcoin’s account as a safe-haven asset has continued been debated. Bitcoin has apparent agitated amount swings in its 10 years of existence, accident added than 80% of its amount in 2026.

Bitcoin amount chart. Source: CoinMarketCap

Bitcoin amount chart. Source: CoinMarketCap

However, zooming out shows that admitting its instability, Bitcoin is still regarded as one of the best means to barrier adjoin war and banking crisis.

The bodies of Lebanon accept been axis to Bitcoin en masse to action bound restrictions imposed by the country’s disturbing banks, according to an Al Jazeera report. The country has been abounding with protests back aftermost October, back its annoyed bodies rose up adjoin more bigoted aphorism and government corruption.

In acknowledgment to civilian unrest, the country’s banks accept imposed restrictions on adopted bill movements and banknote withdrawals, causing its bodies to about-face to added instruments for banking freedom. Adopted bill withdrawals are now bound to amid $50 and aloof a few hundred dollars a month, while transfers away are capped at $50,000 a year, the address said.

With assurance in the heavily accountable accompaniment and its crumbling banks at its lowest, Lebanon’s annoyed bodies accept angry to agenda assets. “If you appetite to go about the cyberbanking system, Bitcoin is a solution,” a bounded Bitcoin banker told Al Jazeera.

Bitcoin as a Hedge in Crumbling Economy

However, affairs Bitcoin through exchanges isn’t an option. The country’s axial coffer has imposed restrictions on purchasing cryptocurrencies with acclaim cards, which affected bodies to get creative.

Simon Tadros, the CTO of a web development close said that best trades appear through referrals, with abounding buyers and sellers affair through WhatsApp groups. Best sales, he explains, appear in being and absorb exchanging concrete banknote for a Bitcoin transfer.

A second, beneath accepted but added broadly acclimated method, is affairs Bitcoin with concrete banker’s cheques. The cheques are absolute by the country’s axial coffer and can alone be deposited into added Lebanese banks.

Sellers allegation a abrupt agency for this blazon of barter as a collapse of the country’s banks seems about inevitable. While sellers trading Bitcoin for banknote usually allegation a agency amid 1% and 5%, those affairs it for banker’s cheques allegation a agency of up to 40%.

This is generally the alone advantage for buyers who appetite to move money out of Lebanon, Al Jazeera reported. With the official barter amount account the Lebanese batter at 40% beneath than the alongside barter rate—many are still accommodating to booty the risk.

The added appeal has led to the billow in Bitcoin amount in Lebanon, with the average price of 1 BTC on LocalBitcoins actuality 22.9 actor Lebanese pounds, or $15,150, at a time back BTC is trading at $9,340 in all-embracing markets.

Lebanon isn’t the alone country area bodies accept angry to Bitcoin to assure their assets. Demand for the world’s better cryptocurrency soared both in China and Argentina as the countries saw their civic currencies collapse in amount aftermost year.

The ascent battle amid the U.S. and Iran additionally showed Bitcoin’s ability as a safe anchorage asset during wartime, as it saw its amount acceleration by added than 20% while the battle amid the two countries abundant beforehand this year.