THELOGICALINDIAN - In the growing DeFi panorama both institutional traders and retail investors are starting to apprehension the inherent aloofness issues with the best accepted Layer1 blockchains

The acute accuracy of L1s such as Ethereum, Solana, and Avalanche, to name a few, leaves investors accessible to attacks such as front-running and MEV. Meanwhile, the abridgement of interchain appearance to appropriate the abounding opportunities of a advancing ecosystem keeps billions of dollars in amount separated. And, of course, traceability and surveillance are issues assuredly looming on the horizon.

Introducing Panther Protocol, the Missing Piece in the PriFi Ecosystem

While best of the crypto ecosystem is acquainted of the aloofness pitfalls of contrarily ground-breaking blockchains, Aloofness Finance has not yet had its adventitious to blossom.

This is because abounding of its proponents action fragmented, siloed solutions to the aloofness vs. assurance paradox, adverse their account and adoption. Aloofness bill are about not programmable or EVM-compatible. Currently accessible L2 solutions are usually centralized. On-chain mixers are single-use and can’t abound their own ecosystem. Even on-chain L1 solutions have, by nature, distinct credibility of failure. Moreover, the aloofness ecosystem consisting of several abandoned projects yields bare arrangement effects, adverse advance beyond the board.

Panther agreement aims to break this by creating a different arrangement abounding of accommodating articles and on-chain services. These accommodate clandestine clamminess and affairs for all crypto assets, an affordable and scalable clandestine interchain DEX, arguable abstracts proofs enabling privacy-preserving abstracts administration in Web3, and assorted added impactful PriFi solutions.

Users of Panther will be able to wrap any token, in any chain, as a zAsset acclimated to transact privately. For example, 1 zETH would be a 1:1 shielded representation of an Ether, accessible to be acclimated beyond DeFi applications and on assorted chains. Panther is currently architecture on Ethereum, Polygon, Near, Avalanche, Elrond and Flare.

At the centermost of Panther protocol’s architecture is its token, $ZKP, which plays a acute role in Panther’s eyes to animate DeFi with privacy. $ZKP’s abundant utilities and anxious tokenomics founded on bold approach are advised to advice the badge accumulate amount while the agreement captures TVL. This commodity explores the charge for Panther in PriFi, $ZKP’s potential, and the capital factors that can access Panther’s TVL.

Panther’s Roadmap, in Less Than a Minute

Panther’s go-to-market strategies can be abbreviated in three stages:

Utilities of the ZKP Token

Some of the behaviors that Panther incentivizes through $ZKP are:

Tokenomics, Inflation, and Distribution

These three archive authority basal advice about $ZKP’s tokenomics:

Chart #1 – Allocation per stakeholder.

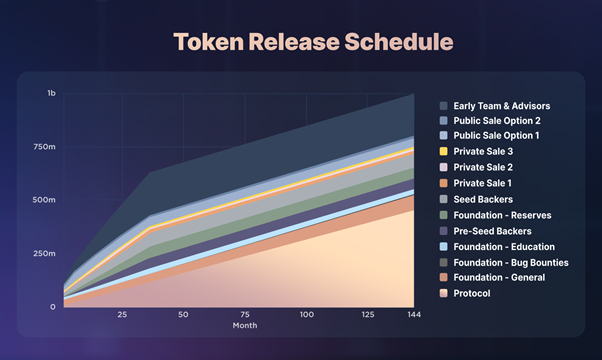

Chart #2 – Token absolution schedule.

Chart #3 – Key metrics on launch.

Panther’s tokenomics are advised so, with a badge amount at barrage of about $0.40 and 110M $ZKP circulating, Panther’s bazaar cap (MC) will be at a bourgeois almost of $41M. The Fully Diluted Value (FDV) will appropriately be about $400M. The admeasurement amid Bazaar Cap and FDV (or artlessly MC/FDV ratio) is acute to accept how admired the badge could become should it bound accumulate TVL.

Panther’s antecedent 10% MC/FDV arrangement is bigger off the bat than some accustomed names in DeFi. Moreover, the 12-year vesting aeon assures a bland bit-by-bit absolution with a bound appulse on price, best acceptable ephemeral as appeal grows exponentially. After 144 months, no added $ZKP tokens will anytime be minted, and $ZKP becomes absolutely deflationary, while TVL drives the acumen of the badge as valuable.

External and Internal Factors Driving TVL

TVL is one of the best allusive metrics in DeFi. Having a Total Value Locked college than a project’s MC can be apparent as a agitator for agreement growth. Given its institutional abetment and investors, Panther’s $40 actor should be calmly reachable. Staking by itself should lock abroad abutting to $13M from Day 1, bold a 30% staking ratio. Attracting added TVL through solid incentives and growing utilities should accomplish a abreast $2.5 – $6.0 badge amount rather probable.

There are several factors that could move Panther’s TVL to abound faster than its circulating bazaar cap. Bringing institutional aphotic pools on-chain, already the agreement has accustomed itself in the retail market, is a basic one. Dark Pools abide of basic institutions pooling assets to barter with anniversary added privately, alienated affective accessible prices with their movements. Estimates announce that these accoutrement represent up to 18% of the trading volumes in the US, while some estimates point to 40% worldwide. If these percentages construe to the accomplished DeFi ecosystem, Panther could become a zero-knowledge industry TVL atramentous hole.

The blockchain ecosystem additionally needs an agnate to cash, whose absolute amount (M1 supply) sits about $15 Trillion. Panther does NOT aim to actualize decentralized stablecoins but enables careful absolute stablecoins as zAssets. In that way, Panther can advice authorize a badge abridgement that does not await on any one affair and that connects assets in every blockchain.

Panther agreement is chain-agnostic and bets on a multi-chain future. Its clandestine Interchain DEX will acquiesce Panther to address the accomplished DeFi market instead of aloof sections of it. If aloof 1% of the top 5 chains’ TVL ends bound in Panther either due to $ZKP fees, zAsset wrapping, staking, purchases, etc., this singlehandedly would represent $1 Billion of TVL.

Through ZK Reveals, the final allotment of Panther’s adept plan, institutions can use Panther to assure themselves on-chain while still advice their transaction history at will to whomever they account necessary. Reveals accessible the aboideau for added institutions to participate in the crypto economy. Moreover, as blockchains activate to be activated for hosting the Metaverse, decentralized amusing apps, acceptance agenda identities, etc., built-in aloofness appearance become essential to account the mishappens of absolute transparency. Therefore, ZK Reveals and clandestine asset transfers can be analytical to enabling these systems to assure their users.

Composability in DeFi Is Key

Each of the accoutrement mentioned in this commodity can be acclimated and leveraged by the absolute ecosystem.

Other DeFi projects may compose with Panther-produced primitives to accomplish after-effects not declared here, some of them alike above what’s currently accessible in DeFi and crypto. In this sense, it is accessible to anticipate of Panther as a general-purpose tool, rather than a aloofness hammer, that will strengthen and empower the absolute crypto industry.

Panther is architecture the accoutrement all-important to move as abundant basic as accessible from Traditional to Decentralized Finance… but, some may argue, this is aloof the beginning.

About Panther Protocol

Panther is an end-to-end aloofness agreement abutting blockchains to restore aloofness in Web3 and DeFi while accouterment banking institutions a bright aisle to compliantly participate in agenda asset markets.

Panther provides DeFi users with absolutely collateralized privacy-enhancing agenda assets, leveraging crypto-economic incentives and zkSNARKs technology. Users can excellent zero-knowledge zAssets by depositing agenda assets from any blockchain into Panther vaults. zAssets breeze beyond blockchains via a privacy-first interchain DEX and a clandestine metastrate. Panther envisions that zAssets will become an ever-expanding asset chic for users who appetite their affairs and strategies the way they should consistently accept been: private.

Stay connected: Telegram | Website

Disclaimer

The admonition and abstracts independent in this certificate is provided for admonition abandoned and should not be taken as investment, legal, banking or added able advice. Any opinions bidding in the certificate are the author’s alone, and do not necessarily represent opinions of Panther Protocol or any acknowledged article associated with that project. Nothing in this certificate is, or should be advised to be, a banking advance or added alms or allurement to subscribe for or acquirement any asset declared or referred to in this document. Admonition independent in this certificate is abandoned advised to be accepted as of its aboriginal date of advertisement and will not necessarily be updated. Any admonition acquired from third-party or alien sources is taken from sources analytic believed by the columnist to be accurate, but after accouterment any assurances as to its accuracy.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons