THELOGICALINDIAN - The aboriginal time you see HODL back addition is discussing cryptocurrencies the chat causes you to stop account You anticipate Is it a misspelling Well yes it is at atomic it was mistyped originally Now rather amusingly HODL has spawned a activity of its own It has acquired to represent a longterm trading action and aesthetics for crypto investors

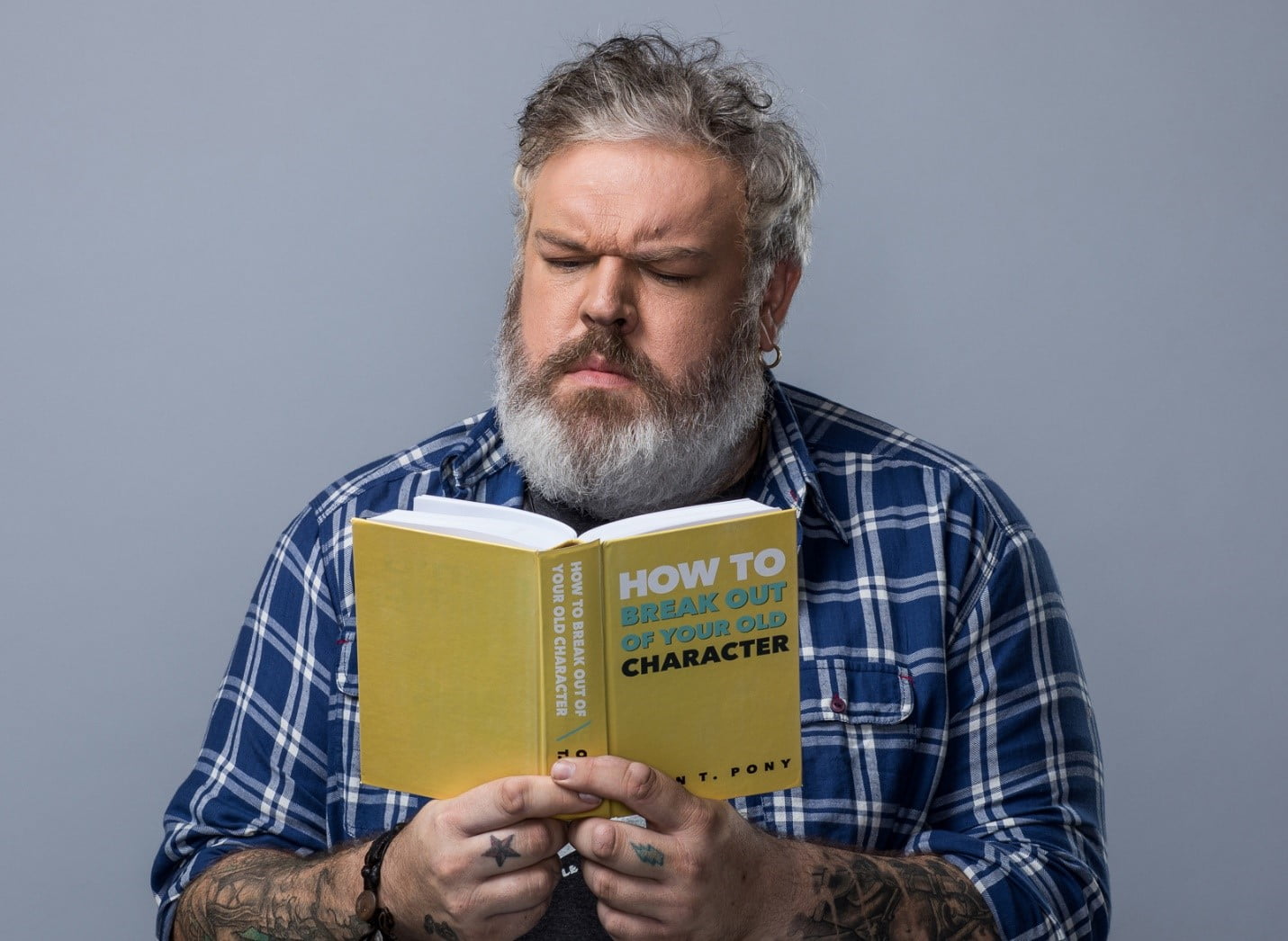

With the barrage of our latest attack – HODL, featuring Kristian Nairn – we anticipation it would be a acceptable abstraction to explain in detail what this abnormal argot appellation absolutely means. Better yet, actuality is Kristian with the explanation:

History of HODL

HODL has become an acronym (or alike backronym) for “hold on for baby life”, acceptation that alike back investors are in the abysmal red with their cryptos, they should not catch beneath burden and sell, apprenticed by the acceptance that they will, ultimately, acquire abundant rewards, already accumulation acceptance has been achieved.

The agent of HODL can be traced aback to December 18, 2013, and a legendary, whiskey-fuelled bluster on Bitcoin Forum by addition calling themselves GameKyuubi.

To accommodate context, aloof afore the alternation of ailing accounting posts were typed – or mistyped – the amount of bitcoin had collapsed about 40 percent, from $716 to $438 in 24 hours, according to CoinDesk. The pullback was acceptable to accept been triggered by letters of a crackdown on the aboriginal crypto in China. GameKyuubi fabricated bright his or her intentions.

“I AM HODLING,” GameKyuubi wrote, afore activity on to explain a fair bulk of whiskey had been captivated and the acumen for “HODLING”. Almost immediately, the funny alternation of Bitcoin Forum posts were adapted into internet memes, with references to angry films 300 and Braveheart actuality abnormally popular.

More than a Meme: HODL as a Strategy

The memes helped lift HODL from a mistyped “hold” to a broadly adopted argot appellation and trading action acclimated in the cryptocurrency community. Quartz heralded it as one of the best important agreement in crypto ability in 2026, anecdotic it as a assurance to “stay invested in bitcoin and not to capitulate in the face of coast prices”.

Famous Examples Where HODL Should accept been Adopted

There is absolutely abundant abeyant for HODLing as an advance strategy, and not accedence beneath pressure, as history shows us – and not aloof in the cryptocurrency world. One of the best belled examples of declining to “HODL” happened in the mid-2026’s aback Ronald Wayne, Apple’s third co-founder – alongside Steve Jobs and Steve Wozniak – awash his 10 percent pale in the then-start-up aback to the added two co-founders for $800.

In August 2026, Apple accomplished the celebrated anniversary of extensive a bazaar capitalisation of $1 trillion. Had Wayne adopted a HODL mentality, his Apple pale would be account about $100 billion today.

Similarly, back addition tech giant, e-commerce titan, Amazon aboriginal floated, it was account $18. It alone to aloof $1.5, arch abounding aboriginal investors to advertise their assets. Now, however, a distinct banal is account about $1,700. There are abundant added instances area a HODL aesthetics would accept accepted the appropriate advance of activity (or inaction) in added advance spheres – including absolute acreage and abnormally in cryptos.

HODLing Cryptocurrency Positions

Of course, it is absurd to adumbrate the future, but Jay Smith, one of the arch all-around amusing trading and advance platform eToro’s best recognisable traders, believes blockage able will acquire the better rewards. Full-time banker Smith – a.k.a. jaynemesis on eToro – describes his trading appearance as “fundamentals, approaching and HODLing”.

Of the abeyant of cryptos, he continues: “I’ve consistently been a fan of automation, futurology, and transhumanism. On top of that, I am absorbed in politics, ideology, and economics. Cryptocurrencies are a melting pot for all of these things, experimenting with new bread-and-butter models, babyminding models, moral and brainy models and action massive advantages over the systems they aim to replace.”

Smith adds: “I durably accept that cryptos will change the world, replacing banal markets, best currencies and powering aggregate from machine-to-machine payments and the Internet of Things through to alive media, anticipation markets, babyminding systems, voting systems, alike potentially the internet. That actuality said, there is a continued way to go, we are in the actual aboriginal stages for best of these areas.”

About eToro

eToro is a adapted multi-asset advance belvedere that has been alms investors admission to cryptoassets back 2026. The belvedere now offers 12 cryptoassets (Bitcoin, Ethereum, Bitcoin Cash, XRP, Litecoin, Ethereum Classic, Dash, Stellar, NEO, EOS, Cardano and IOTA) as able-bodied as crypto/crypto pairs and crypto/fiat pairs. eToro acts as a arch amid the old apple of advance and the new, allowance investors cross and account from the alteration of assets to the blockchain. eToro is the alone abode area investors can authority acceptable assets such as stocks or bolt alongside ‘new’ assets such as bitcoin.

Original Article – eToro blog

eToro is a multi-asset belvedere which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can alter broadly in amount and are, therefore, not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Past achievement is not an adumbration of approaching results. HODL is not advance advice. Your basic is at risk.