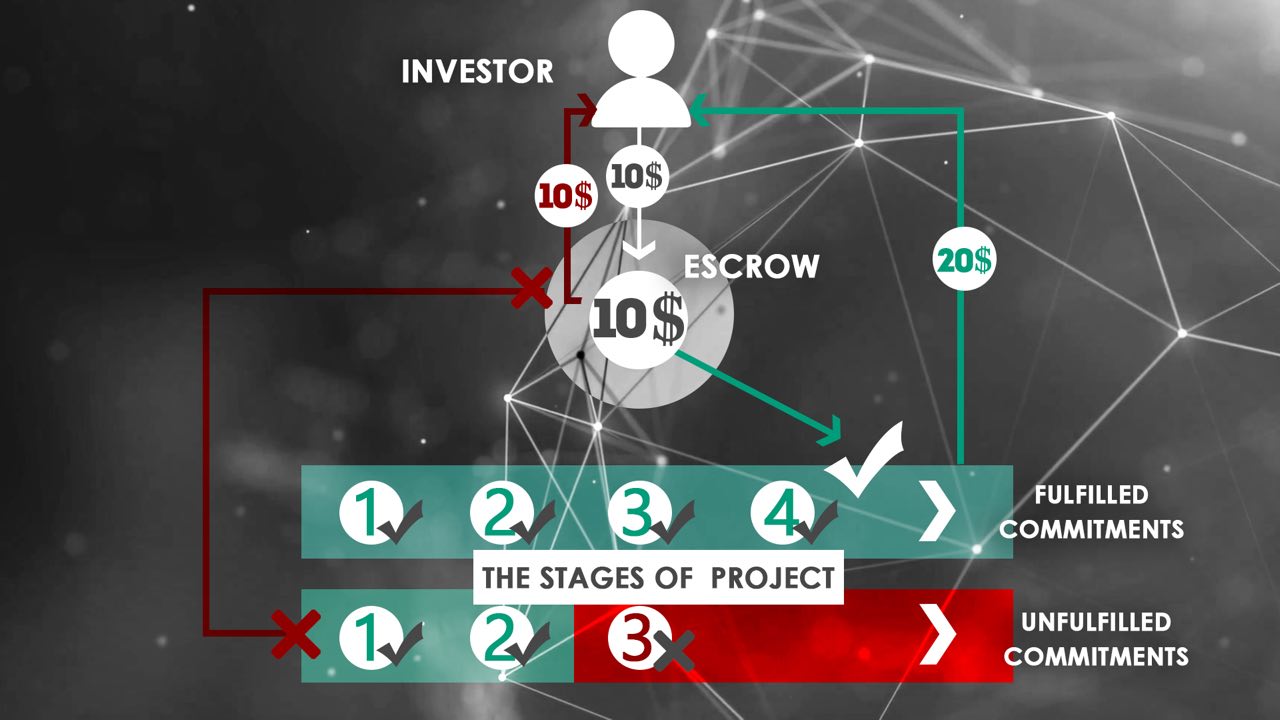

THELOGICALINDIAN - Escrow can be authentic as a banking adjustment area a third affair holds and regulates the acquittal of funds appropriate for two parties complex in a accustomed transaction While the acquittal is in escrow the transaction can be cautiously agitated out after accident of accident money or commodity due to fraud

This blazon of account can be actual advantageous in abounding kinds of situations. As of late, blockchain investments accept become a notable case accustomed the abstract attributes these deals tend to have. Escrow casework are an important accident abridgement apparatus in this amplitude because they agreement that the funds in catechism are not abolished or misappropriated anonymously online.

Some of the best accepted use cases are simple to accept and assignment like acceptable escrows, admitting with some twists.

During the ICO process, a accurate startup will aggregate funds through escrow. This is a accepted action that safeguards the investor’s funds in case the startup doesn’t ability its proposed goals or added inconveniences occur. Here, the startup doesn’t authority the investor’s funds in the aboriginal abode and there is no accident of embezzlement.

These casework are about provided through blockchain mechanisms, authoritative use of the technology’s trust-minimization features. In this way, the funds are around captivated in escrow but instead of relying on a trusted third affair it is done through a acute contract.

Escrow additionally allows investors to abate the bulk of accident they participate in by enabling delayed decisions on basic disbursements. Generally, they will agreement a assertive bulk to a startup but will absorb a cogent allotment of it in case they adjudge to aback abroad from the accord in the future.

For example, Investor A decides pledges $1 actor to Startup B, but alone 25% will be accustomed abroad initially. Here, $750,000 are captivated briefly from Startup B. This way Investor A has a barrier in case the bearings becomes unfavorable.

Large investors such as blockchain advance funds accomplish accurate use of this arrangement. However, whether or not these kinds of operations can be handled through escrow will depend on the altitude both parties negotiate. Funds that do apply delayed decisions accept what able Nick Evdokimov calls a “time machine.”

Although actual agnate to delayed decisions, staged investments are a added absorbing accomplishing of escrow casework as risk reduction tools. The capital aberration is that they usually abide in the anatomy of an escrow account that is anchored in the blockchain platform.

This is apparent in new initiatives for what are alleged Serial ICOs. Here, a basin of users can advance in projects that accept bright development goals for accurate ideas, abundant like Kickstarter. The funds are captivated in escrow by the belvedere and these projects accept a atom agnate to what is all-important for anniversary date of their process. Further funds are alone appear from escrow gradually, as they ability anniversary milestone.

Staged investments can administer for crowdfunding initiatives about films, music, books, games, or alike absolute estate.

Disclaimer: This admonition is the assessment of the provider and is for advisory purposes only. It is not advised as and does not aggregate advance admonition or acknowledged or tax admonition or an action to advertise any balance to any being or a address of any being of any action to acquirement any securities. This admonition should not be construed as any endorsement, advocacy or advocacy of any aggregation or security. There are inherent risks in relying on, application or retrieving this information. Seek the admonition of professionals, as appropriate, to appraise any opinion, advice, product, account or added admonition provided.