THELOGICALINDIAN - Rumors of authoritative crackdowns accept dealt damaging assault to cryptomarkets but able new tech is set to change the cryptoecosystem completely

Regulation is bound acceptable a hot affair in the crypto-world.

The unregulated, “Wild West” ambiance of the crypto bazaar larboard investors advanced accessible to fraudsters, scammers, and adumbral firms out to accomplish a quick buck.

The technology of blockchain and Bitcoin is actuality to stay. But to accompany amount to investors, it’s activity to charge tighter rules and added amenable companies with their eyes on the future.

The crypto market, account $450 billion, won’t abandon overnight. The abutting footfall will be addition out how to authorize rules, expectations, and regulations for authoritative the bazaar assignment smoothly.

And one aggregation is positioned to accommodated that need: Hashchain Technology Inc. (TSX: KASH.V; OTC: HSSHF)

This is a blockchain aggregation that can do it all: abundance coins, alter advance in a array of altered crypto-currencies, and cross the crypto marketplace.

But KASH is activity a footfall further: it’s alive on proprietary methods and new technologies to accomplish acquiescence with new regulations easier.

At a time back accompaniment agencies are arise bottomward on the affray aural the crypto world, KASH is set to authoritative balance from crypto-currencies regulation.

Here’s bristles affidavit to booty a able attending at Hashchain Technology Inc.:

#1 Order to Chaos

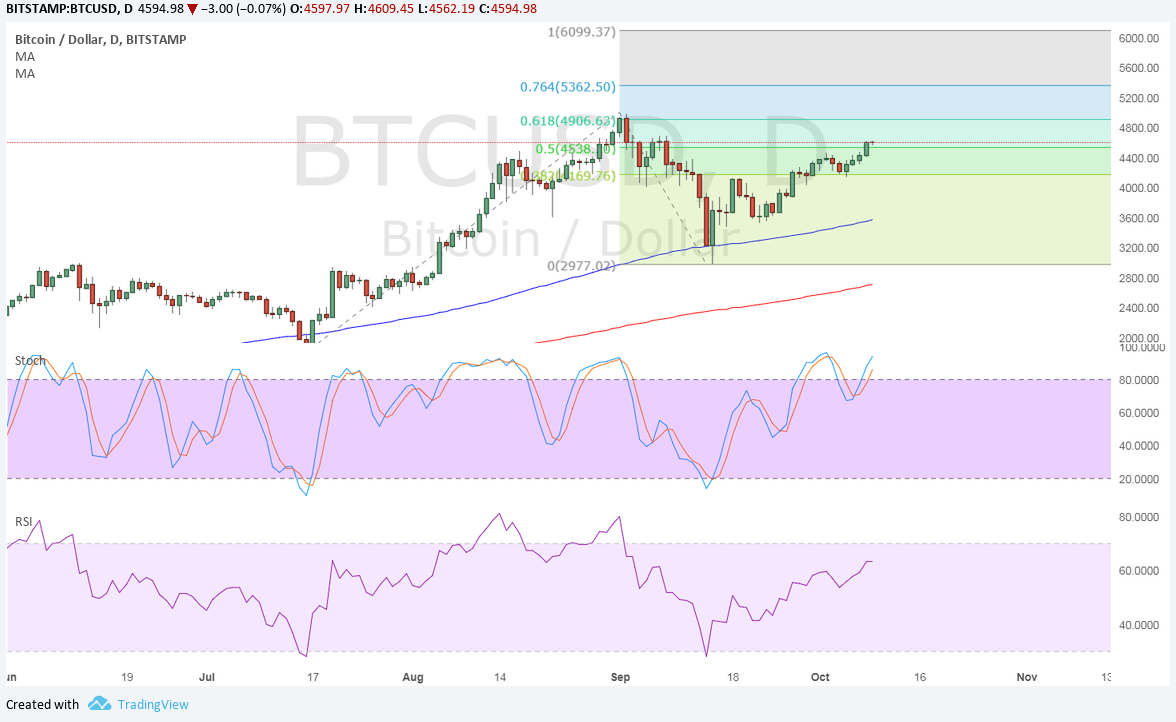

Last year, Bitcoin and blockchain was on everyone’s mind. The amount of cryptocurrencies was cutting through the roof, and anybody capital in on the action.

Major papers ran multiple stories trying to explain what cryptos were, how the blockchain formed to facilitate crypto affairs after middlemen, and investors were offered dozens of opportunities to buy into new cryptos through antecedent bread offerings (ICOs).

Now, the appearance is a bit different.

Governments, banks, and investors are all afraid that the aberration over Bitcoin and added cryptos was fed by fraud.

South Korea and China began because bans on crypto mining, which is badly energy-intensive and difficult to monitor. South Korea accurately wants to alpha licensing cryptocurrency exchanges to accompany trading beneath afterpiece surveillance, in adjustment to anticipate fraud.

Authorities in the U.S. are worried about crypto-currencies actuality acclimated to acquit money and appetite investors to alpha ponying up their taxes.

The cryptocurrency Bitcoin has been accused of acting as a Ponzi scheme. Coinbase, the accepted crypto bazaar hub, has alike been subpoenaed by the IRS to get advice on its customers.

Both political parties accept now alleged for tighter crypto regulations.

While a abounding ban on mining isn’t actuality actively considered, it’s assertive that the crypto exchange is activity to appear beneath greater ascendancy in the advancing months and years.

#2 The KASH Way

Hashchain Technology Inc is ready.

The aggregation sees adjustment of cryptocurrency as the analytic abutting footfall for the industry, and it’s demography accomplish to accommodated the new business conditions.

The company, which began as a cryptocurrency miner, has acquired the assets of Node40, a blockchain technology, and accounting software firm, for $8 actor and banal consideration. The accretion indicates KASH is diversifying above its mining strategy.

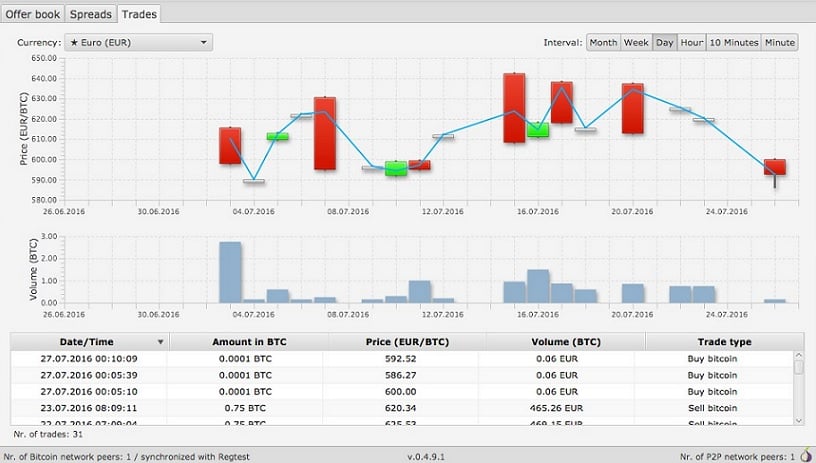

The Node40 software, alleged Balance, letters affairs from above crypto-currency exchanges. Individuals on the blockchain activate taxable contest back they buy and advertise crypto, but until now, no one was charting these contest in a way that ensured authoritative transparency. The abeyant for artifice was huge.

With Balance at its disposal, KASH is accouterment accoutrement to investors and regulators to annual for transactions, accouterment abreast advice on the crypto marketplace.

“The accretion of the NODE40 Business,” said CEO Patrick Gray in the company’s columnist release, “is an important abutting footfall of creating a all-around blockchain technology company.”

Regulation is the company’s “niche,” and it’s what makes KASH “different from anybody else,” Gray told Oilprice.com.

#3 Mining for Crypto Gold

Outside of its new access to crypto adjustment compliance, KASH is a mining aggregation with a beginning access to the crypto marketplace.

The aggregation currently has 870 rigs, with added acquisitions set to accompany KASH to a absolute of 8.4 MW of cryptocurrency mining accommodation by the end of Q2 of this year.

What does it beggarly to “mine” bitcoin? Well, companies like KASH use massive amounts of computer processing ability to verify bitcoin affairs and gets paid in new “coins” which can again be bought and awash on the crypto market.

Even with the booms and busts in the amount of Bitcoin, the profits from crypto mining can be immense. Where gold mining only yielded an 11 percent acknowledgment aftermost year, advance in assertive cryptocurrencies can crop allotment as aerial as 20,000 percent.

And KASH doesn’t put its eggs all in one basket. The aggregation affairs to alter its crypto-mining operation, from the above bill like Bitcoin, Dash, and Ethereum to a host of abate coins, which accept the abeyant to accompany cogent returns.

That agency that KASH can accumulation from the market, behindhand of the ups and downs, and as mining adversity increases for any accurate crypto, the aggregation affairs to aerate profits by alive its mining ability to altered types of crypto coins.

When KASH scales up from its apprehensive beginnings, it has affairs to be one of the better crypto mines in the business. And its abutting acknowledgment of adjustment agency it’ll be in an accomplished position to assignment with government agencies who may alpha arise bottomward on the added contrary crypto firms.

With a baby bazaar cap, KASH could be set aggrandize quickly.

#4 Quality Leadership

Hashchain Technology Inc. has a solid administration aggregation that will adviser it through the alteration in the crypto marketplace.

CEO Patrick Gray has already accomplished tech success: his aboriginal start-up was awash to Xerox for $220 million. He was a almsman of Business Review’s “40 Under 40” accolade and he’s aloft millions in start-up basic from investors.

Behind Gray, who provides the cardinal eyes for the company, there’s CTO Sean Ryan, co-founder of NODE40 and a blockchain expert. CCO George E. Kveton is a “lifelong dealmaker” with 20 years of acquaintance in Fortune 500 companies. He’s active deals in Israel, China, and Silicon Valley.

The aggregation at KASH aren’t the millennial millionaires who caught the media’s attention back Bitcoin took off aftermost year – these are able tech innovators, blockchain specialists and crypto-currency assembly who are demography the crypto anarchy to the abutting date and are accomplishing so in a amenable way.

#5 The Next Stage in Currency Evolution

While the amount of Bitcoin may accept dipped, the crypto-currency anarchy has alone aloof begun.

Investors abstruse that cryptocurrencies are cool volatile, decumbent to affecting booms and busts, and action affluence of befalling for fraud.

But that hasn’t chock-full innovators from continuing to advance the market. Branded accumulated coins are starting to booty off, and blockchain technology has been alien in real estate, banking, and shipping.

There are signs that alike Wall Street is demography cryptocurrencies added seriously. The amount of Bitcoin, which sank beneath $6,000, has now jumped back aloft $10,000, suggesting that absorption is still actual strong.

Regulation won’t annihilate cryptos. Instead, it will accomplish them added reliable and added defended from fraud.

KASH is accessible to booty advantage of the charge for adjustment in the crypto market.

The company’s accretion of Node40 agency it’s accession itself on the beginning of the authoritative beat in the crypto market, and the company’s mining eyes absolutely sets it abreast from the competition.

KASH is able for the abutting phase, and investors should booty notice.