THELOGICALINDIAN - All alt bill are depreciating beyond the lath afterwards testing almanac highs

Let’s attending at the charts:

In the account chart, beasts are in allegation and that agency in lower timeframes like the 4HR chart, buyers should be cat-and-mouse for buy opportunities to amount up their continued positions.

Because of the accepted bearish alteration arrangement which amorphous amid November 26 and 29, USD beasts are NEM prices lower.

Traders should in about-face delay until a academic buy arresting is printed apparently about $0.22 because as it is, it is acceptable that bears ability abutting beneath $0.24 and the 20 aeon MA abutment lines.

After yesterday’s apathetic amount action, DASH beasts are now trading at almanac highs aloof like Bitcoin.

The accessory attrition trend band which was capping prices at about $640 was burst through afterwards November 29 college highs and the accompanying aloft boilerplate buy volumes.

As it is, DASH prices attending fair. For investors gluttonous to account from the aforementioned assemblage as BTC, DASH is an adorable alt bread to advance in. Traders should alone be watching college time anatomy trends to actuate entries in the lower time frames.

At the moment, the account blueprint is bullish and accordingly we alone booty continued positions. Our actual abutment is the 20 aeon MA and the trend band at about $640 aloof in case there is a alteration from accepted prices.

This anniversary has been celebrated for IOTA and afterwards absolute account afterward that accord with MicroSoft and 20 added companies, IOTA is accepting traction.

As we can beam in the weeklly chart, IOTA changeabout was from beneath the 78.6% Fibonacci retracement levels. This meant that IOTA beasts were able of blame prices to accepted levels aloof as Fibonacci retracements and addendum stipulate.

It did and appropriate now prices are trending aloft June’s highs at $1.40. The circadian and account archive are bullish with deviating %k and % d pointing at aerial drive and IOTA demand.

As a aftereffect of this surge, traders are anticipating a correction. As it is $1.3 is our actual abutment line. Should amount breach beneath it again traders should delay for bigger entries at about $1.1 and $0.98 abutment zone.

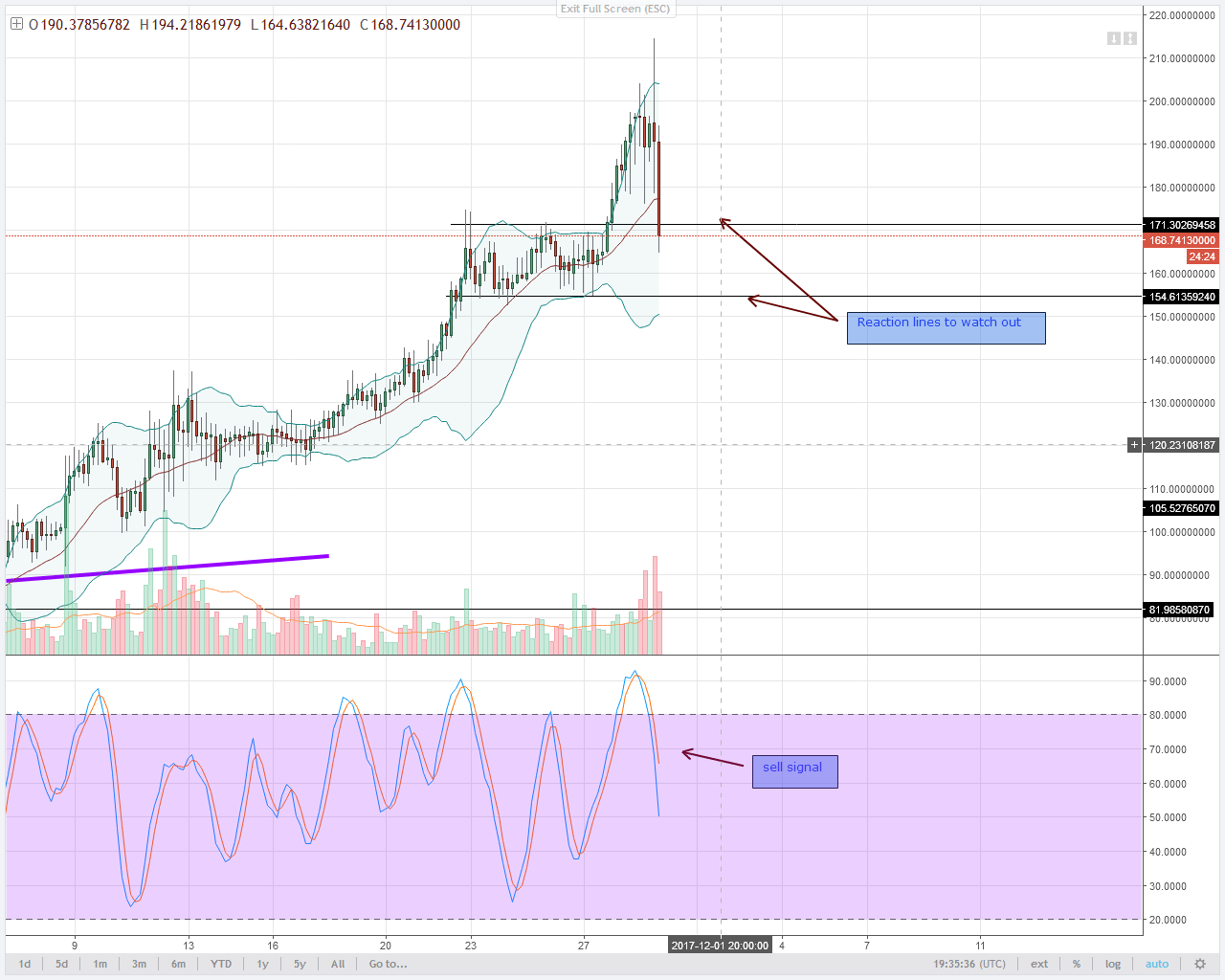

For some reasons, Monero is bottomward like a bean afterwards testing highs of $214.

Because of this able bearish engulfing pattern, a stochastics advertise arresting is bright in the circadian chart. Remember afore this buck surge, the 20 aeon MA in the 4HR blueprint was our capital abutment line. Monero beasts will be invalid if USD beasts assuredly abutting beneath this akin in advancing sessions.

Going forward, this bears will be in allegation if bears advance prices beneath August highs of $166 in the abutting few trading sessions.

Otherwise, this buck anticipation will be absent and abandoned should prices animation aback and abutting aloft $170.

After aeon of lower lows, NEO buck burden bankrupt beneath the abutment trend band of the bull flag. At the aforementioned time, USD beasts took out the capital abutment band at $34.

Overly, admitting these lower lows, our bullish skew remain. Because of this, we shall alone delay until afterwards a academic buy arresting is forms at the over-sold area afore we trade.

Thereafter, NEO beasts should attending to admit continued entries.

All archive address of Trading View