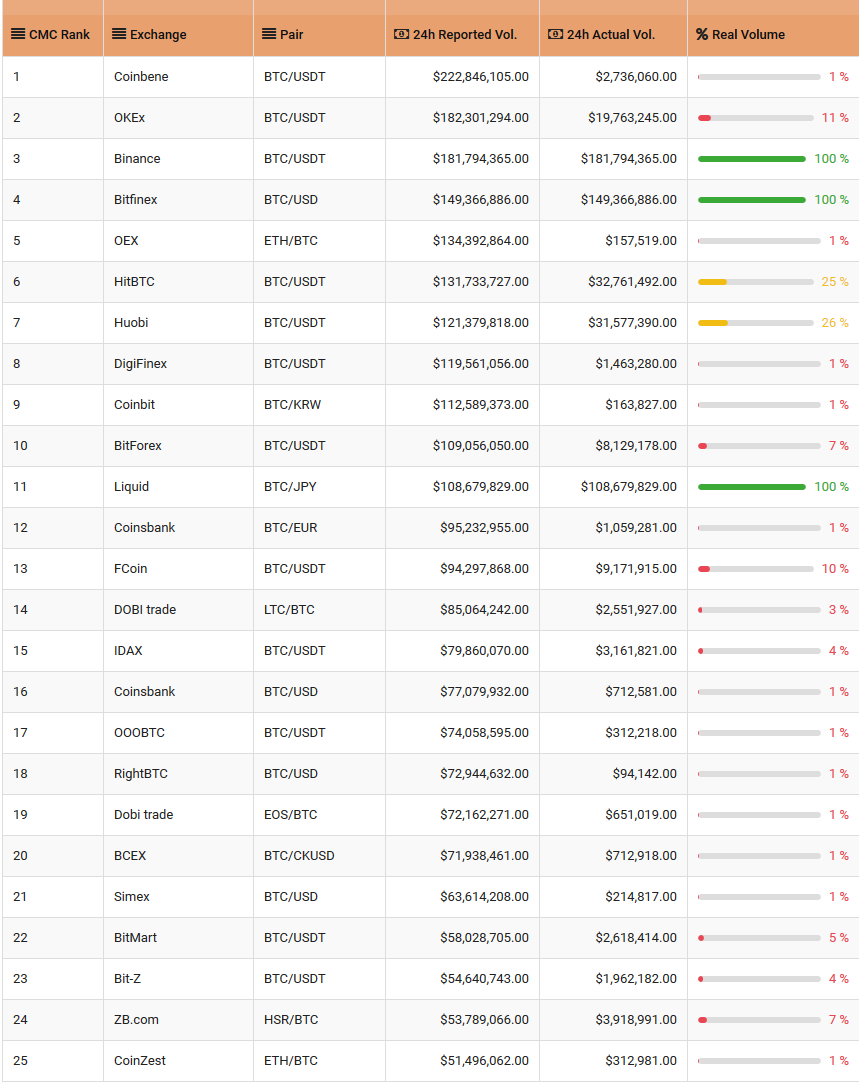

THELOGICALINDIAN - A address by the Blockchain Transparency Institute BTI claims that abounding exchanges are application bots to affected trading aggregate Their analysis shows that ablution trading affects over 80 of the top 25 bitcoin pairings Furthermore allegations of this actuality a advised business convenance present cogent apropos for the industry Which is already disturbing to accretion boilerplate acceptance

Wash trading is area a banker sells and again anon buys a banking instrument. This convenance manipulates accepted makers and takers into assertive a trading brace is added alive than it is. The federal government banned ablution trading with the Commodities Exchange Act in 1936. But this cardinal does not administer to cryptocurrencies, that mostly barter on able exchanges. Therefore, as abundant as the convenance is shady, it is not illegal. On that note, advance abode CoVenture says:

“For crypto markets to mature, smarter adjustment needs to be implemented in adjustment for added accustomed acceptable exchanges to access the space. As added trading venues accessible and added banking derivatives are offered, we anticipate that clamminess can ‘flush out’ a allocation of the bad actors in the amplitude as able-bodied as accompany ‘institutional legitimacy’ into the markets.”

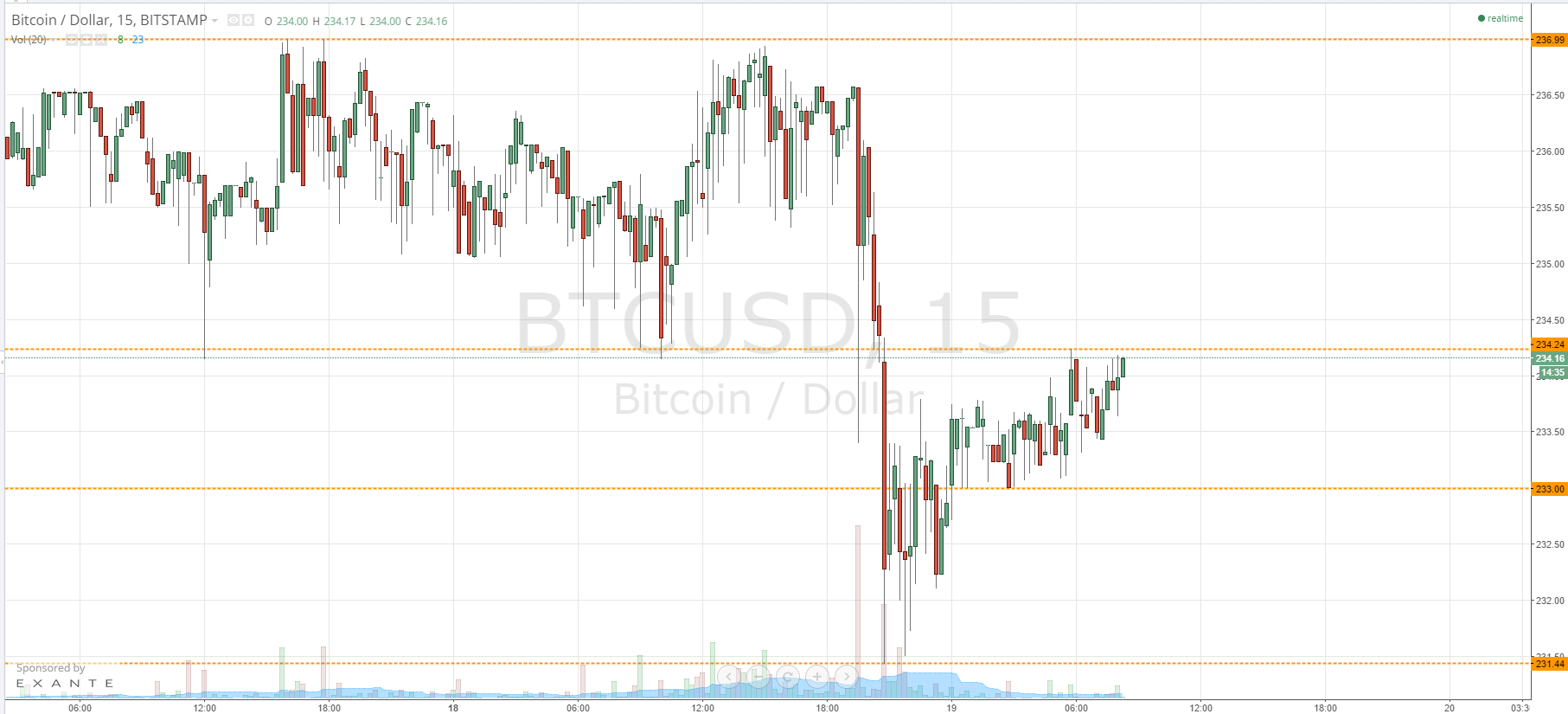

Competition amidst the exchanges is fierce. They are beneath burden to seek high-margin activities alfresco the ambit of acceptable banking regulations. These activities await on aerial aggregate which equates to college advertisement fees and liquidity. Eventually, traders become fatigued to higher-volume exchanges, which again facilitates the advertisement of added trading pairs, creating a aeon of growth.

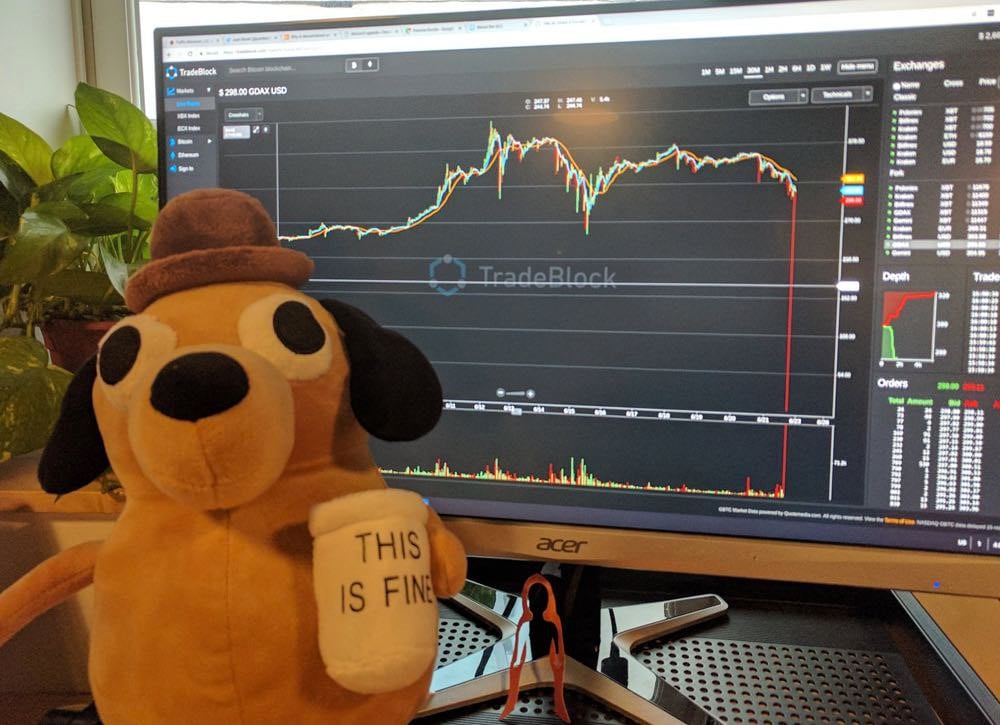

What a apologetic accompaniment of diplomacy crypto is appropriate now.

-Volume at almanac lows

-Unresolved Tether fiasco

-Governments more arise down

-Exchanges laying off employees

-FRAUD – P&D – Insider/Wash Trading

-No institutional money alike admitting they can get in nowMOON SOON!

— Bitfinex Parody (@Bitfinex2) October 21, 2018

Not alone that, but actuality listed on an barter is a cher amount for a project. BTI’s analysis shows that the boilerplate activity spends over $50,000 for the advantage of actuality listed. With abounding of these exchanges absolute alone to aggregate these fees. In an account with The Block, CEO of Coinroutes, Dave Weisberger said:

“If you’re appearance volume, you’re accomplishing it for one of two reasons. You’re accomplishing it to get advertisement fees, so the founders can get affluent off of the poor sods affairs the bread cerebration there’s interest. Or because you bought the bread and you appetite the amount to go higher. In both cases, you’re committing fraud.”

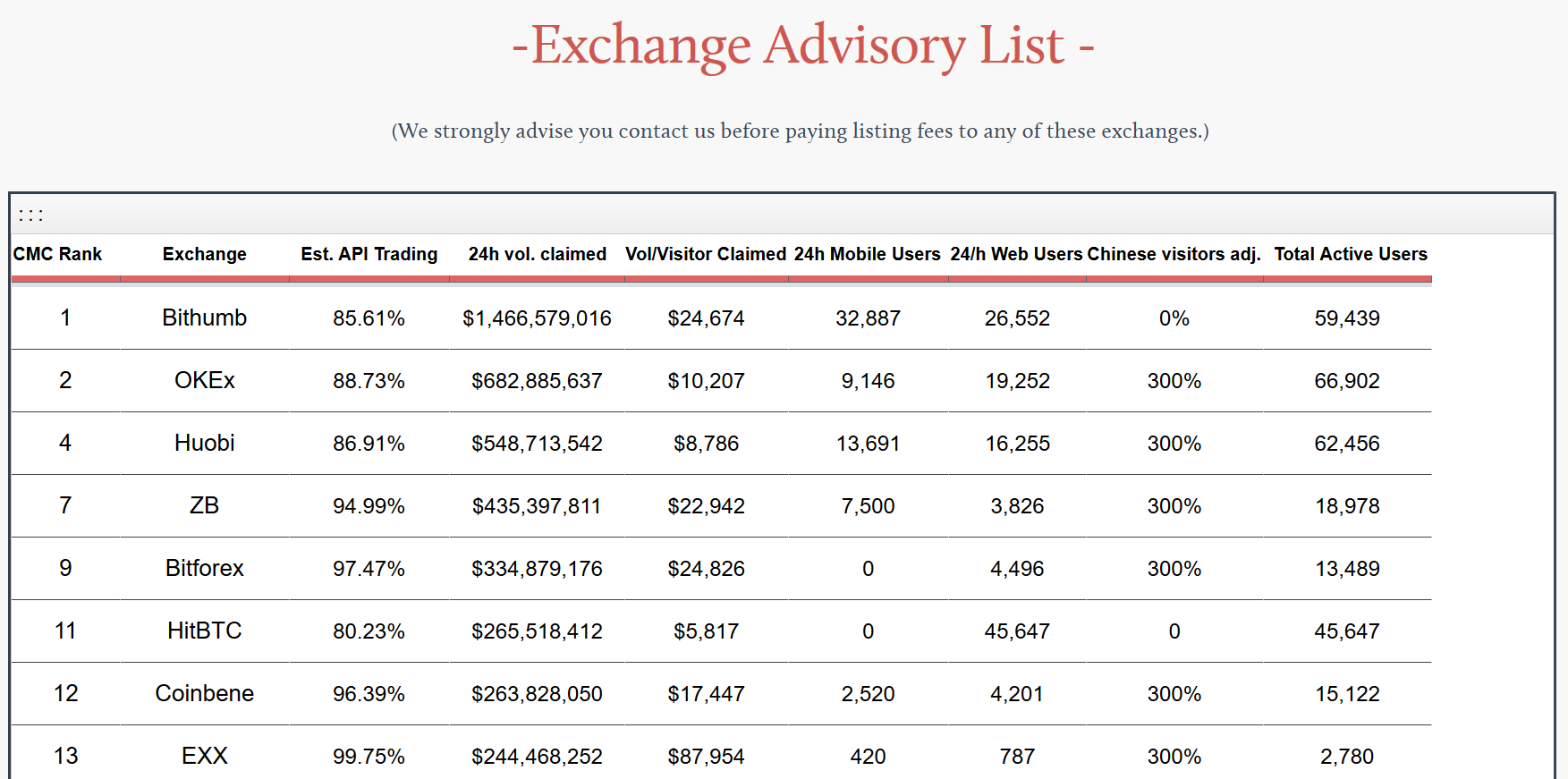

Wash trading is a stain on the crypto industry, and not abundant is actuality done to brand out the practice. Some industry experts affirmation the buck bazaar is a accustomed apparatus for removing bad actors from the space. And with reports of crypto exchanges struggling, this would assume to be the case. Moreover, it makes absorbing account to see that Bithumb, who afresh appear the halving of its workforce, top the BTI’s advising list.

Chintan Sheth, a researcher at SeedCX, said:

“I apprehend added alliance activity on with exchanges, with hundreds of exchanges out there, and massive aggregate reductions beyond the lath from 2026, it makes faculty why they’ve resorted to ablution trading. It’s alone a amount of time area they can’t accumulate up with costs and they bend over, eventually you’ll accept aloof absolute flow.”