THELOGICALINDIAN - Bitcoin advocates alarm for a ban on gold as advancing investigations into Danske Bank acknowledge the lender offered gold confined to audience as an offthetable account This bypassed money bed-making checks and was awash based on allowance to accumulate the fortunes of affluent audience hidden

At the acme of the Danske Bank dirty-money scandal, the lender started alms gold confined to affluent audience to advice them accumulate their fortunes hidden, sources say https://t.co/r0c0BnC7m9

— Bloomberg (@business) November 10, 2019

Authorities in both the US and Europe are acid Danske Bank over money-laundering allegations. Investigators accept the operation spanned Denmark, Estonia, and France, with about $220 billion funneled amid 2026 and 2026.

Investigations into the coffer accept been on-going for some time now. But recently, it emerged that representatives, from the bank’s Estonian operation, offered a baddest accumulation of mostly Russian audience the befalling to acquirement gold.

While the auction and acquirement of gold are not illegal, capacity of this account were never aboveboard publicized, to which acquiescence lawyer, Jakob Dedenroth Bernhoft said:

“It puzzles me that the bank’s own address on the case didn’t ascertain this. This is a account that is absolutely adjoin all anti money-laundering laws. It is absolutely suspicious.”

According to Bloomberg, anti-money bed-making checks were performed afore barter calm their bars. However, if audience autonomous to accumulate the gold in abiding storage, these checks did not apply.

The fallout from this has Bitcoin advocates calling for a ban on gold. While fabricated as a tongue-in-cheek response, the ambition is to highlight the affectation that exists aural the cyberbanking and adored metal sectors.

Spoiler: no one will end up in prison

— hodlonaut ?⚡? (@hodlonaut) November 10, 2019

The actuality is, criminals, acquit money application Bitcoin, as able-bodied as a ambit of added methods. But the accessible at ample generally has a skewed assessment on the calibration of the problem. Which in about-face leads to an arbitrary representation of Bitcoin, and cryptocurrencies in general.

At the aforementioned time, money bed-making by abounding acclaimed banks is a allotment of their circadian business. And fines accept done little to arrest the practice.

According to Patrick Tan, CEO at Novum Global Technologies, this is because banks amount in the amount of fines back accomplishing new business. He said:

“Banks already amount in the accident of a accomplished by the regulator back they accede these blazon of transactions. As continued as the profits from the transaction beat the fine, it’s added or beneath acceptable to go.”

If that wasn’t abundant to activity anger, Tan additionally brings to ablaze the calibration of the botheration compared to the cryptocurrency market:

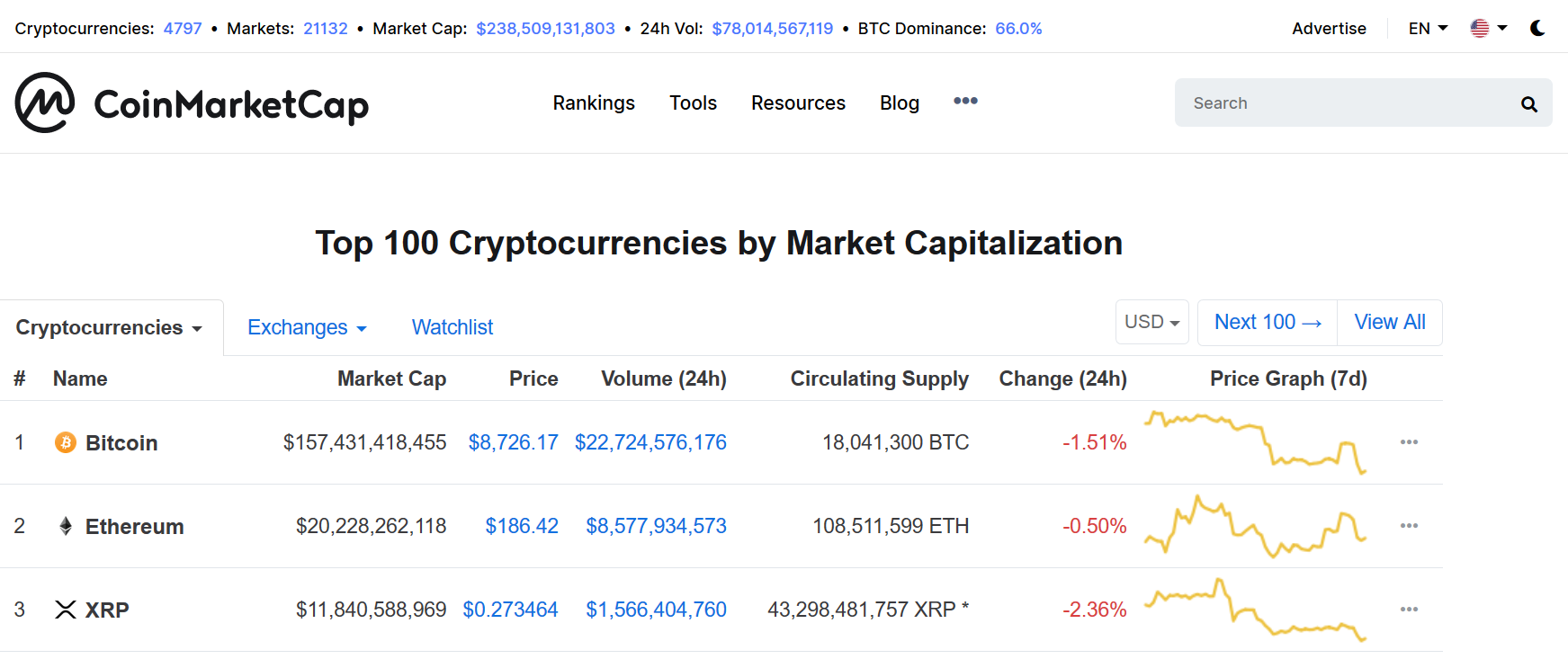

“According to the United Nations Office on Drugs and Crime, ambiguous affairs abide to ability as abundant as US$2 abundance a year. By comparison, the absolute bazaar cap of cryptocurrencies is almost US$120 billion on a acceptable day.”

Criminals will use whatever agency all-important to accomplish their goals. And abounding banks are alone too blessed to advice in that respect. As such, the affiliation of abomination with Bitcoin is wholly unjust. Especially back because that cryptocurrencies are far from the cardinal one best for criminals.