THELOGICALINDIAN - To all those who clue banking markets and asset classes bygone was a bright Black Monday The all-around disinterestedness markets and bolt comatose as fears over the slowing Chinese abridgement already afresh acquired prominence

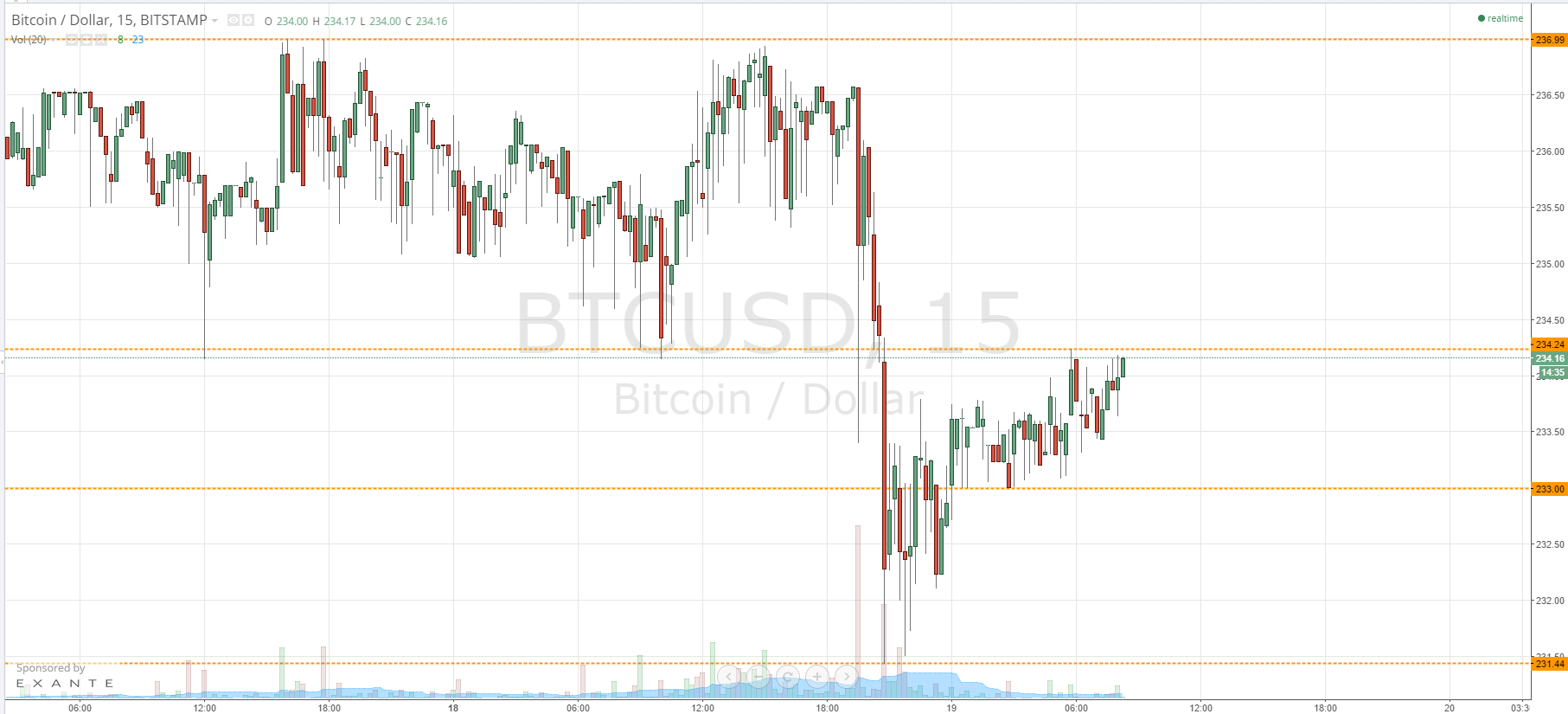

Bitcoin too had its forgettable affair bygone as it absurd added than 13 percent intraday to hit a sub-$200 low. What’s alike added apropos is that the acute abutment of $220-225 has been breached decisively, which has opened up the downsides to the target of $170-190.

Image: https://www.tradingview.com/x/kFNLAN05/

Technically, the abuse of this abutment is a abundant adumbration that bears will apply alike added burden in the advancing sessions and rallies up to the antecedent abutment charge be acclimated to go short.

Bitcoin Chart Structure – As the all-around asset classes fell, agitation advance to the Bitcoin markets as able-bodied as assurance of funds became added important. The abutment was broken on a actual aerial aggregate suggesting that both the investors as able-bodied as concise beasts were larboard with bloodied hands.

Moving Average Convergence Divergence – The MACD has collapsed to a 7-month low of -15.7274 advertence acute bearishness. Historically low MACD levels may additionally announce a concise rebound.

Momentum – The Momentum indicator has recorded -54.4600, a low not apparent back February.

Money Flow Index –The MFI has angry on its arch and is attractive to revisit its contempo low. The accepted MFI amount is 13.3929.

Relative Strength Index – Bitcoin’s oversold action is additionally depicted by the 14-day RSI amount of 21.8146.

Conclusion

Any asleep cat animation charge be acclimated to actualize abbreviate positions in Bitcoin. With abstruse indicators absolute awful oversold conditions, a abatement assemblage may appear eventually than later.

There is addition assignment here. Those who anticipate that Bitcoin is the new safe-haven and that investors will automatically alteration their backing into the cryptocurrency on any adumbration of a crisis accept been accepted wrong. There is no arete in alike because that.