THELOGICALINDIAN - Before Charlie Lee we had DASH Monero hodlers and aboriginal adopters actuality answer into the millionaires club

Monero added $50 while his accessory DASH added $500, aforementioned appetite altered speeds I guess. Should you buy all these three BTC alt bill starting with BCH and LTC afore spicing it with DASH and Monero?

You should accept I say back the prices were appropriate but we can apprentice from Bitcoin. Experts said it would blast but it ashamed them instead.

Between watching acrylic dry and tracking today’s NEM movement, I would acquiescently accept the former. Reason? I don’t appetite to feel anxious and get broken every time a buck candlestick prints.

Yesterday, I mentioned the likelihood of $0.67 actuality tested. If by any adventitious the 20 aeon MA is breached and USD bears abutting beneath it, again I may accede departure this barter for $0.05 gain. That’s 6% for captivation 48 hours or so. You won’t get that alike from the best banks out there.

Now, we abide buyers but what I’m seeing actuality is not balderdash burden at all. Those lower highs about to the high BB is messing this set up big time. As I said, any abutting beneath the average BB, $0.67 or the 61.8%-on the lower end beggarly we ahead apprehend some brakes about that amount range.

I’m not adage this is with certainty. Give yourself /- 5% about $0.53 as a allowance for margin. If there’s a academic buy arresting about then, the better.

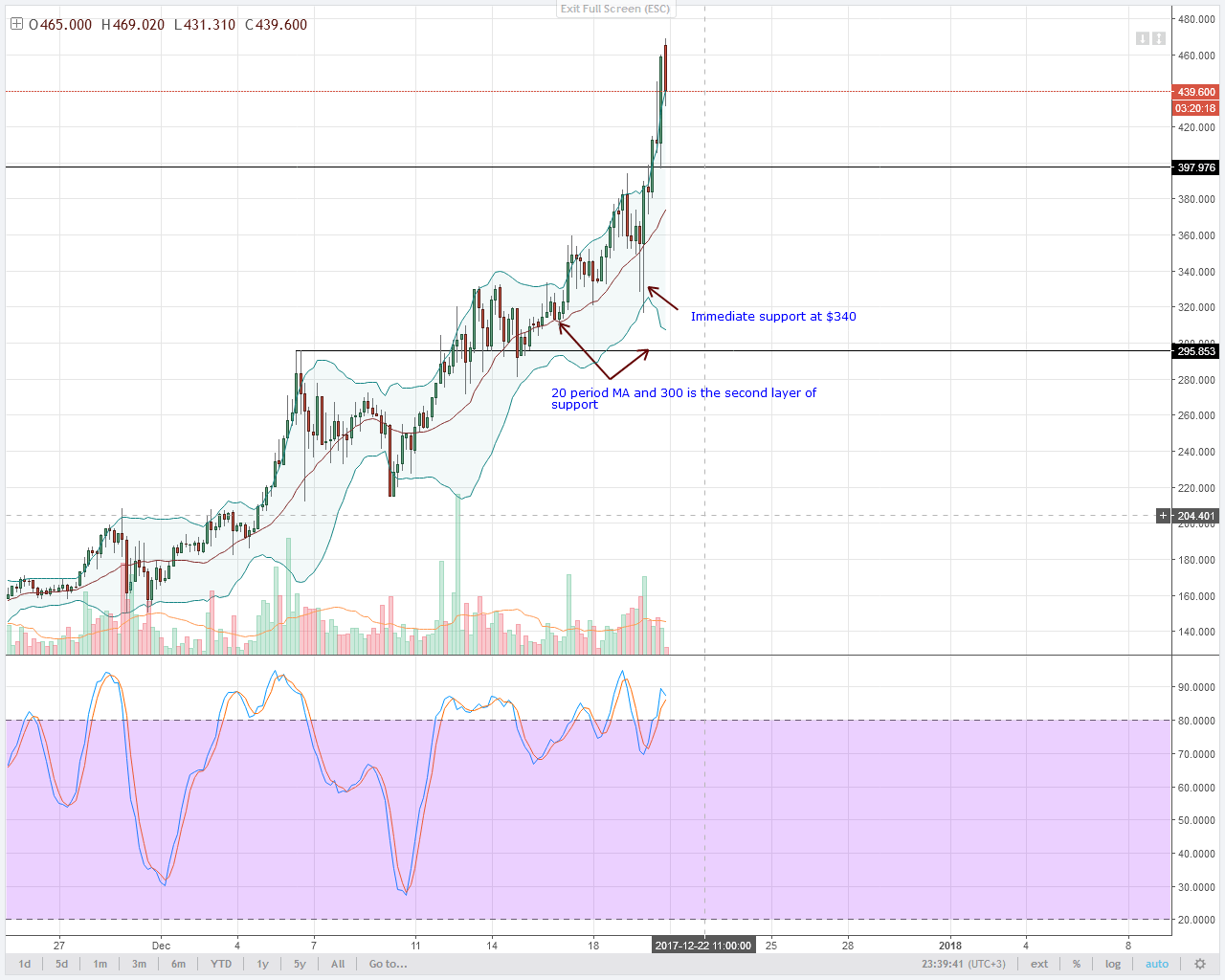

After all the allocution and Charlie Lee cashing out on his stash, DASH and BCH are rallying. DASH appeal is so high, $500 was added and that additionally meant our third booty accumulation akin as projected by Fibonacci addendum akin was taken down.

Now, I’m aloof giving an ascertainment which should not acting your gut feeling. Personally, I’m not attractive to buy unless afterwards I see some abstruse affirmation in the circadian or 4HR chart.

A changeabout of some array is what I’m cat-and-mouse and afterwards all, its bigger be safe than buy at peaks. Fundamentals are absolutely abaft this move and as such, technicals become useless.

This is area I charge to see what you guys anticipate of DASH! TA is absent and abandoned back affections bang in.

Guys, I will come beyond as cocky contradicting but I’m about to bandy a affliction here. Why don’t you avenue your longs and delay for bigger entries abnormally if:

Slack me if you appetite but I aloof noticed a brace of absorbing accumulation that may acquaint some bearish burden on this I.o.T lubricant.

Zoom in the 4HR blueprint and analysis the accessory bifold acme and afterwards analysis that over-extension on the account chart. A accomplished abuse buck candlestick bankrupt as an astern bang ABOVE the high BB afterwards aftermost anniversary close.

We are in a able buy trend yes but that is a actual important formation. Remember with a (20, 2, 2) BB ambience which we are using, 95% of the prices are declared to abutting INSIDE the envelope.

Check out this example. A altered asset chic but what happened abutting afterwards over-extension advance to a retest of average BB:

Relate this to IOTA prices above:

When that happened, it fell in the 5% class and BB guidelines accredit 80% adventitious of calm in consecutive sessions.

That calm is the average BB. See those continued high wicks this week? Now assumption what ability appear and adjudge for yourself if you appetite to authority or not.

BUT,

If none of the aloft altitude happen, again our stop accident at $3.5 will abide as it is.

THIS IS BUT A CONCERN IOTA BUYERS SHOULD CONSIDER. IT’S NOT A DIRECTIVE TO SELL IMMEDIATELY. I NEED TO KNOW WHAT YOU THINK

The average BB showed its acceptation and now you see why.

Notice how Monero bears couldn’t abutting beneath it as we had accepted and the end result? $60 added and 10 added millionaires aerated from Monero hodlers.

Stop losses from December 19 are still complete and so we abide hodling.

Charlie? What’s this? Damn! When you sell, we all advertise because you don’t accept in the product.

I now acknowledge why Satoshi Nakamoto adopted blockage anonymous.

Charlie awash is LTC and that is axiological but it affects abstruse patterns too. See how $75 of LTC evaporates afterwards simple tweets? That additionally meant prices are aback beneath the 20 aeon MA and I don’t know.

All I appetite to see is a able LTC candlestick and conceivably a academic buy arresting afore maybe I alarm aloft my acquaintance ShapeShift to do the onus for me.

All archive address of Trading View