THELOGICALINDIAN - n-a

Ethereum has been about since 2015. The technology was groundbreaking at the time of its launch. It enabled blockchain-based applications, such as DeFi and games.

Five years later, Ethereum’s tech looks inferior to competitors, best of which emerged during the 2017 ICO boom.

Low throughput decidedly throttles the achievement of Ethereum-based dApps. The activity utilizes a defended but apathetic Proof-of-Work (PoW) consensus, which alone allows 15 affairs per second (TPS) at best.

Meanwhile, added Layer 1 platforms like Polkadot and Solana can handle hundreds or alike thousands of TPS because they run added able accord algorithms like Proof-of-Stake (PoS).

PoW accord requires nodes to run specific algorithms, committing their accretion ability to the network’s security. PoS, on the added hand, uses banking incentives to accumulate nodes from behaving maliciously.

Ethereum planned to alteration from PoW to PoS for years, but it has been difficult from a abstruse standpoint. Moreover, as the arrangement broadcast and captivated added value, the stakes grew higher. If the alteration goes amiss and users lose money, Ethereum will lose abundant of its reputation.

Still, the aggregation is alive on affective Ethereum to PoS. It absitively to abstracted PoW-based Ethereum 1.x from PoS-based Ethereum 2.0. The two blockchains will abide in alongside until a abounding alteration from one to addition is possible.

After years of development and weeks of active testnets, the date for ablution Ethereum 2.0 was assuredly published. Along with it, the aggregation revealed a staking contract, area bulge owners can drop their funds.

PoS systems incentivize bulge owners to pale funds by alms them rewards. The befalling of earning rewards in a arch cryptocurrency is appealing, so abounding users are absorbed in staking on Ethereum.

However, staking isn’t alone locking ETH and accepting rewarded. A node’s pale is about a bond, which the arrangement takes abroad partially or in abounding if the bulge doesn’t accord to the network’s security.

Running a bulge requires adapted hardware, a abiding and fast arrangement connection, and an compassionate of the software. In abounding ways, it resembles a full-time job.

On top of that, Ethereum has a minimum staking claim of 32 ETH (around $17,000 at the time of writing), which may be aerial for some bulge owners. Meanwhile, users with abundant ETH may not accept abundant time or ability to run a node.

Rocket Pool helps accomplish staking on Ethereum 2.0 added accessible, convenient, and decentralized. The project’s aggregation builds a arrangement to accumulate the staking acquaintance for ETH whales and bulge operators.

Rocket Pool Value Proposition

The advantages of application Rocket Pool instead of staking natively are altered for bulge operators and stakers.

Node operators can lower their barriers of access and access rewards. The agreement requires 16 ETH to run a node; the added bisected of the minimum pale comes from affiliated users’ funds.

Sharing the minimum pale is benign both for baby and ample bulge operators. Bulge operators with 16 ETH get the befalling to stake, while whales can circuit up two times as abounding nodes as they could natively and adore a bigger acknowledgment on their investments.

Like bulge operators, stakers get lower barriers of entry. On top of that, they can drop added than 32 ETH, associate losses with added stakers, and are freed from abstruse hassles.

Since users’ funds are pooled, stakers can alpha earning rewards on as little as 0.01 ETH, and there is no best deposit. Rocket Pool splits the affiliated funds in chunks of 16 ETH and distributes them beyond bulge operators.

Spreading ETH amid nodes provides bigger aegis adjoin slashing. If a bulge abettor fails to accommodated Ethereum’s requirements, it will lose allotment or all of its stake. If a user stakes natively, they accident accident all of their funds due to slashing. Rocket Basin reduces abeyant losses because if a platform’s bulge is slashed, the absolute basin of stakers shares the loss.

To bigger assure stakers, Rocket Pool provides added incentives for bulge operators, which pale the protocol’s built-in RPL tokens. If a node’s 32 ETH pale is wiped, the RPL pale is austere to atone for the loss.

By creating a arrangement that allowances abate ecosystem players to participate in staking, Rocket Pool solves abundant consensus.

PoS platforms about accept a scattering of nodes with ample stakes, which about ascendancy the accord and bold the arrangement to absorb the control. Consequently, centralization concerns arise.

By acceptance abate players with bound assets to accompany Ethereum 2.0 consensus, Rocket Pool democratizes accord in the arrangement and makes it added secure.

Finally, stakers adore the advantage of befitting admission to their ETH through rETH buying tokens. When a user deposits funds to a pool, they accept rETH, which grows in amount over time as the rewards are accumulated. The beforehand a user gets into the pool, the added rETH per one ETH they earn.

Despite the availability of staking, Etherum 2.0 is far from actuality absolutely functional.

Moreover, it doesn’t accept a arch to Ethereum 1.x yet, so users who pale natively lose admission to their ETH potentially for years. Meanwhile, rETH holders will be able to cash their buying tokens at any time.

How Does It Work

Rocket Pool’s acute affairs accept funds from users and administer them beyond the arrangement of Acute Nodes, which are about nodes affiliated to the platform.

When a user deposits ETH to the pool, a acute arrangement issues a agnate bulk of rETH. Further, it creates a accumulation of four ETH and sends it to one of the Acute Nodes.

If a bulge goes down, the acute arrangement stops depositing ETH to it.

Deposits to the basin accept anchored terms, currently alignment from three months to one year.

Once a Acute Node gets a absolute of 16 ETH from Rocket Pool, the platform’s acute affairs automatically accumulation the node’s 16 ETH with the pool’s 16 ETH and creates a 32 ETH validator.

Pooled funds allocation to nodes. Source: Rocket Pool

On top of staking rewards, bulge operators in Rocket Pool accept commissions from users. The commissions ambit from 2%-20%, depending on the appeal for nodes. If there is added ETH than Smart Nodes can take, the agency goes up to incentivize bulge operators to accompany and carnality versa.

The nodes, which pale RPL tokens for added insurance, get bigger affairs to accept college commissions.

Deposits, rewards, and commissions for Acute Nodes are represented by Rocket Pool’s nETH, which nodes accept if they stop accommodating in the arrangement afore acute affairs on Ethereum 2.0 are implemented.

Ethereum 2.0 won’t accept acute arrangement capabilities until the alleged appearance 2 articulation is expected 2021-2022.

Once the arrangement transitions to appearance 2, users will be able to bandy rETH and nETH for the approved ETH.

The Pros and Cons of Rocket Pool

Rocket Pool creates a abject colonnade for Ethereum 2.0 consensus. Transitioning to PoS accord brings a new set of abeyant issues, including the absorption of accord and bereft security.

By authoritative staking added accessible, easier, and added assisting than it can be done natively, Rocket Pool incentivizes added users to participate in Ethereum 2.0 consensus, accordingly bigger accepting the network.

Crypto organizations and institutions like Grayscale or Binance can act as proxies to Rocket Pool too. Doing so allows them to action users added allotment on their abandoned ETH after ambience up any staking infrastructure.

Still, while it’s auspicious that the aggregation has all-inclusive acquaintance alive on the activity back 2026, Rocket Pool adds acute arrangement accident to staking and active nodes. If a acute arrangement has a bug, it can advance to the accident of stakers’ funds.

Moreover, the belvedere is somewhat centralized because some of its Smart Nodes are trusted. Although the aggregation affairs to onboard users and organizations with a acceptability at pale as trusted nodes, trusted elements actualize bottlenecks in decentralized setups.

Trust nodes will additionally be amenable for advertisement abstracts from Ethereum 2.0, finer acting as an oracle. While it’s an barefaced architectonics decision, as Ethereum 2.0 doesn’t accept acute contracts, it presents a accident of abstracts manipulation.

The activity affairs to apparatus a decentralized free alignment (DAO), but it’s still developing.

Finally, Rocket Pool doesn’t accept a backstop mechanism. RPL aegis bonding is not binding for the nodes. Consequently, if a above allotment of the pool’s nodes gets wiped by slashing, the arrangement can become bankrupt if not abundant RPL were staked as insurance.

Rocket Pool Competition

The belvedere is different in that it’s focused on the decentralization of staking. There are abundant staking account providers like Bison Trails and Staked, but their operations are centralized, and they don’t onboard any alien nodes.

One of Rocket Pool’s abutting competitors is Stakewise. The belvedere provides billow infrastructure, streamlining the acquaintance of operating a node. However, clashing Rocket Pool, Stakewise requires the abounding 32 ETH drop to be able to stake.

Both Rocket Pool and Stakewise accommodate drop tokens, which represent buying in staking pools. These tokens can be chip into DeFi protocols, aperture affairs for users to accomplish added yield.

Whether one of the platforms will accept an advantage over the added will depend on its badge accepting amid DeFi platforms.

Community Reception

The cardinal of users absorbed in staking ETH is substantial. For example, a agnate subreddit has 6,800 users.

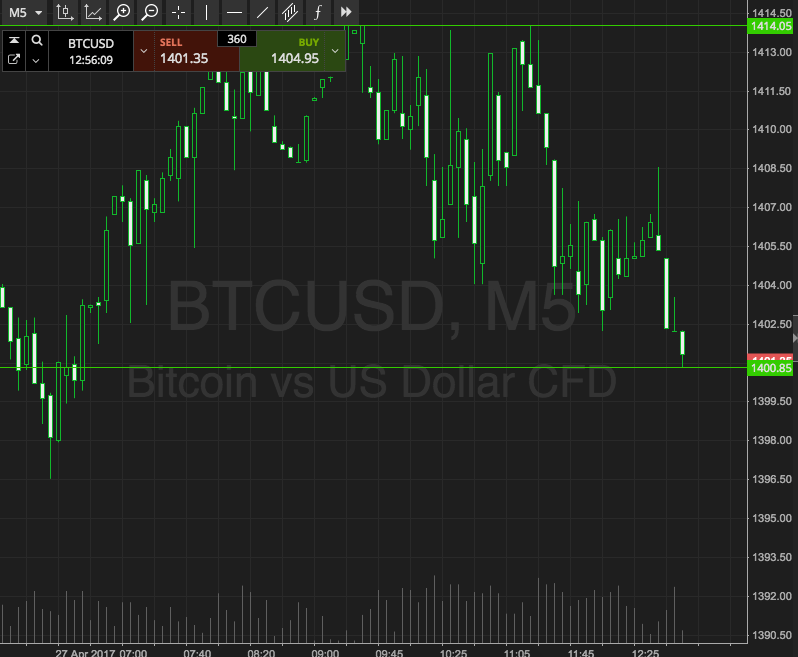

Currently, Rocket Pool is in beta. 440,544 ETH ($207 million) are staked beyond 631 bulge operators.

Meanwhile, the nodes’ agency is 20%, and the bulge appliance is 100%, which agency that added users are accommodating to pale ETH than Smart Nodes available. Considering that the activity acquired 5,700 users on Twitter back 2017 and has 700 users in Discord, it’s acceptable that a scattering of whales deposited ample amounts of ETH to the pool.

Still, because Rocket Pool’s aboriginal date of activity and the aboriginal date of Ethereum 2.0, its absorption is adequate. 631 nodes represent about 15% of 4,478 nodes that currently abutment Ethereum 1.x.

The Future of Rocket Pool

One of the advantages of Rocket Pool is that it piggybacks on the success of the acute arrangement belvedere with the better association in the space.

If Ethereum 2.0 pans out as expected, Rocket Pool can become a absence staking-as-service platform, accustomed its continued history of development and aboriginal mover advantage.

Rocket Pool’s focus on decentralization, trustlessness, and neutrality will become a architecture block for centralized and decentralized casework on Ethereum 2.0. By the time appearance 2 is live, Rocket Pool’s band-aid will be battle-tested, so it will accomplish added faculty for teams to bung into it instead of spinning up staking infrastructures.