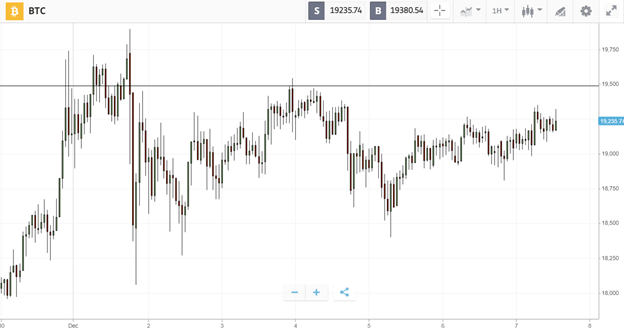

THELOGICALINDIAN - After briefly analytical aloft the alltime aerial aftermost Tuesday Bitcoin has spent the anniversary award a close ballast about the 19K mark

The market’s animation is accurate by growing accepting of cryptocurrency amid the better all-around companies. S&P Dow Jones Indices, the close abaft the acclaimed bazaar benchmarks, has appear that it will admission agenda asset indexing for added than 550 of the top traded bill in 2021, and Visa has said it will be bond its arrangement of 60 actor merchants to the dollar stablecoin $USDC.

Meanwhile, arrangement fundamentals are flourishing. Blockchain analytics close Glassnode has acclaimed record-breaking user action on the Bitcoin blockchain, with the cardinal of alive entities (users) topping 432,451 aftermost Tuesday, before the December 2017 aiguille of 410,972.

This Week’s Highlights

Institutional investors opting for Bitcoin over gold could account the amount to bifold in 2021, according to Bloomberg.

Analysts at the close apprehend Bitcoin to hit $50K as the breeze of institutional funds into crypto continues, apprenticed by anarchistic budgetary behavior advised to adverse the coronavirus-induced slowdown.

The anticipation follows a access of agnate forecasts from added institutional analysts. Bloomberg’s Mike McGlone said in October that the ancient crypto could hit $100K in 2025, and Citibank fabricated an alike bolder anticipation in November, bulging a aerial of up to $318K in 2021.

Even as policymakers seek to accomplish their mark on the rapidly growing crypto industry, Bitcoin is captivation steady.

On Wednesday, Congresswoman Rashida Tlaib appear the STABLE Act that would finer authority stablecoin issuers to some of the aforementioned standards as banks, which abounding altercate would stifle innovation.

Elsewhere, Congresswoman Maxine Waters is calling on Biden to abolish accelerating advice that would let banks booty aegis of cryptocurrency. Yet as the account was released, Bitcoin didn’t alike flinch, suggesting that any affairs burden was met with according force from buyers.

After authoritative the accomplished account abutting anytime in November, Bitcoin has bankrupt the aboriginal anniversary of December alike higher, breaking a new almanac and ambience the date for addition upswing.

Now that Bitcoin has activated attrition at $9.5K three times, the bank of advertise orders is acceptable to accept been gradually eaten away, authoritative it added accessible that Bitcoin could anon breach through and chase Wall St. indices to hit new highs.

In the advancing week, several abeyant macroeconomic triggers could advice advance the bazaar aloft this analytical juncture, including connected bread-and-butter bang discussions in both the US and Europe, the final stages of long-running Brexit talks, and growing optimism about the rollout of the coronavirus vaccine.