THELOGICALINDIAN - Hi Everyone

As an investor, it seems that the aftermost affair you appetite to attending at is price, abnormally lately.

A adeptness broker in an arising industry will appetite to get a acceptable account of the all-embracing mural and one of the best means to see this is in the job sector.

Job advance and boilerplate salaries are generally apparent as a arch bread-and-butter indicator, which is why the NFP jobs report in the United States is one of the best scrutinized pieces of abstracts that moves the markets every month.

So, if you appetite to get a acceptable abstraction of how the crypto industry has developed throughout 2018, attending no added than jobs data. At atomic according to this abstracts point, we can see that jobs in blockchain development are in aerial demand.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 14th. All trading carries risk. Only accident basic you can allow to lose.

The anniversary has started off on the amiss bottom for all-around banal markets. Some acerb barter abstracts from China has investors afraid that the anecdotal of a China arrest or “hard landing” is starting to assume real.

Export advance from the cardinal one ambassador of appurtenances in the apple has apparent its sharpest drop in two years.

The bazaar is already abject with apprehension for the accessible GDP amount advertisement on January 21st.

A new political upheaval in Greece has almost aching investors acquainted this morning. With the US Government abeyance entering day 24 and the abstracts out of China there bare little time for that.

The ablaze ablaze at the end of the adit is advancing in the anatomy of earnings season, which bliss off this week. Let us adjure they don’t disappoint.

One affair that is bright is that there is an cutting appeal for safe havens. We can see it in the amount of gold, which is still giving an all-encompassing analysis to the $1,300 level.

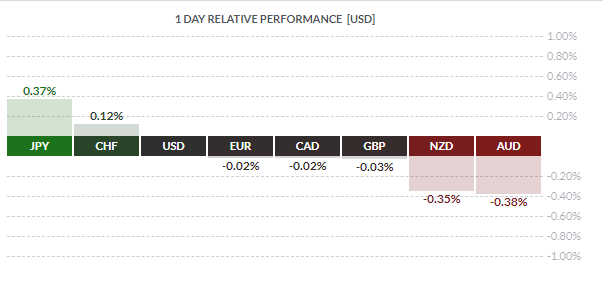

The abutting clue comes from the currency markets, area the Japanese Yen and the Swiss Franc are arch today.

The final attach in the casket is the band markets, area we can see the yields bottomward as investors about-face to this acceptable bazaar for administration of their assets. To anticipate the 10 year US treasury bond was aggressive a advanced move college in November and now it’s sliding into oblivion.

In band with what we’re seeing above, the accident assets are on the ropes and bitcoin is no exception. Just as the banal markets accept accomplished a point of articulation the crypto markets are now giving a abundant analysis of their abutment levels.

Those that accept afresh alleged the basal may not be amiss though. The analytical abutment akin for bitcoin is at $3,000, so we’re still about $500 aloft that at the moment.

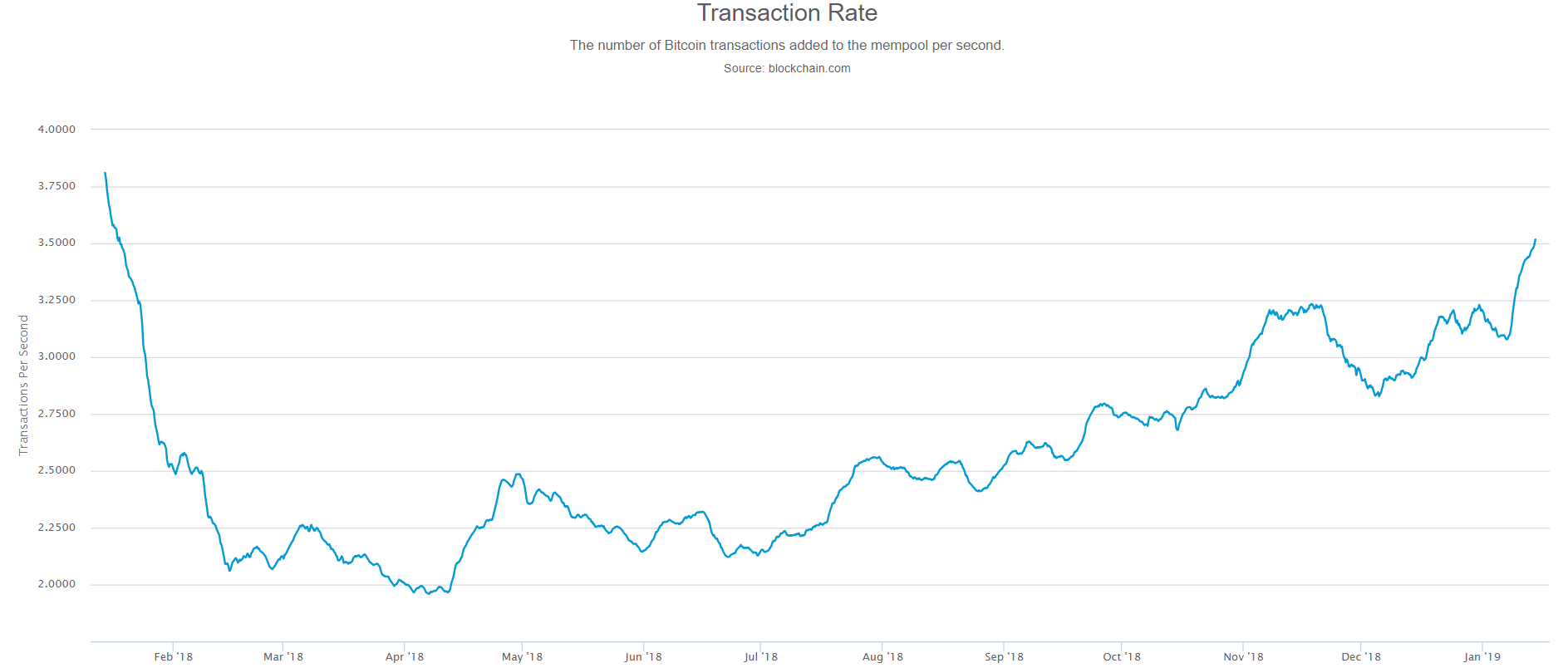

Moving above the price, we can see that action on Bitcoin’s blockchain is heating up rapidly. Here we can see the transaction rate hitting its accomplished akin in about a year.

Of course, added affairs on the blockchain is neither bullish nor bearish. The abating affair is that aftermost time the transaction amount was this high, we saw a distinct clog in the network.

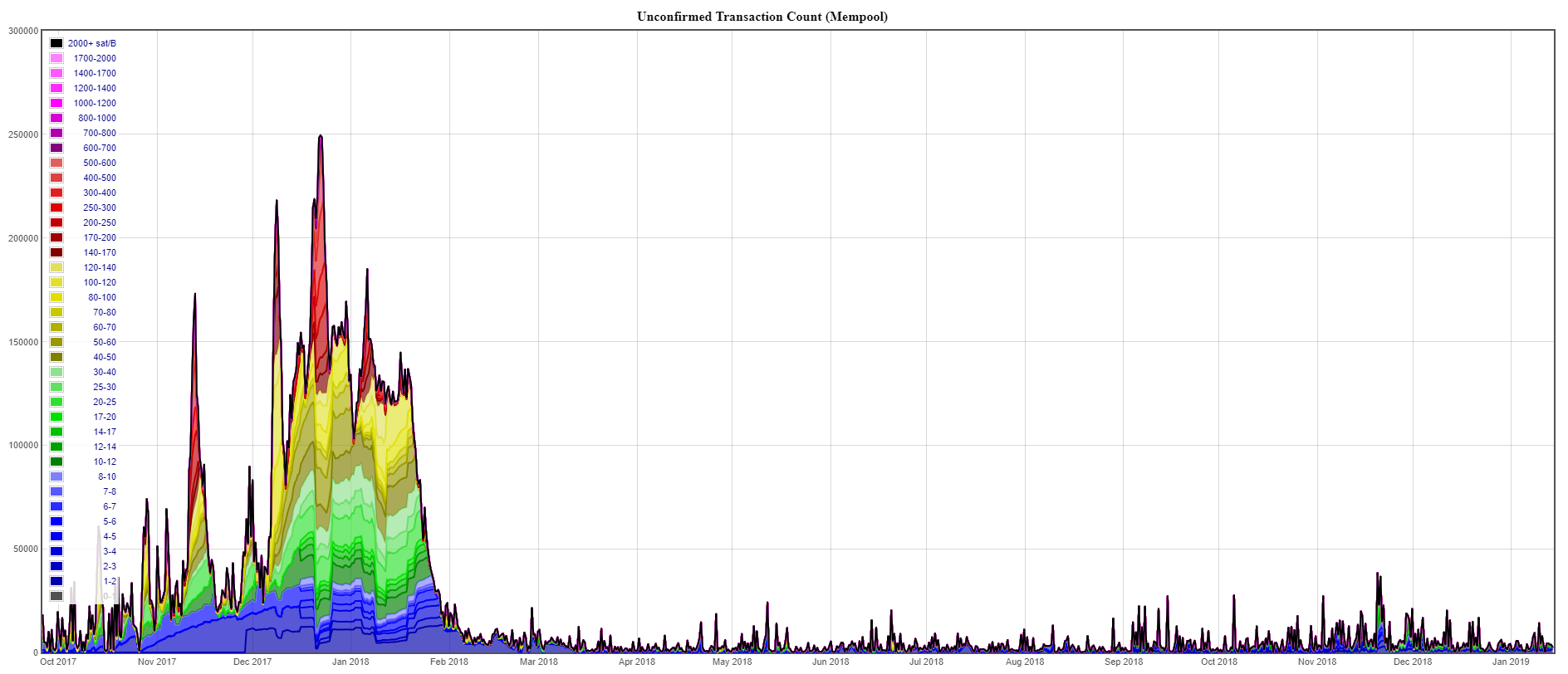

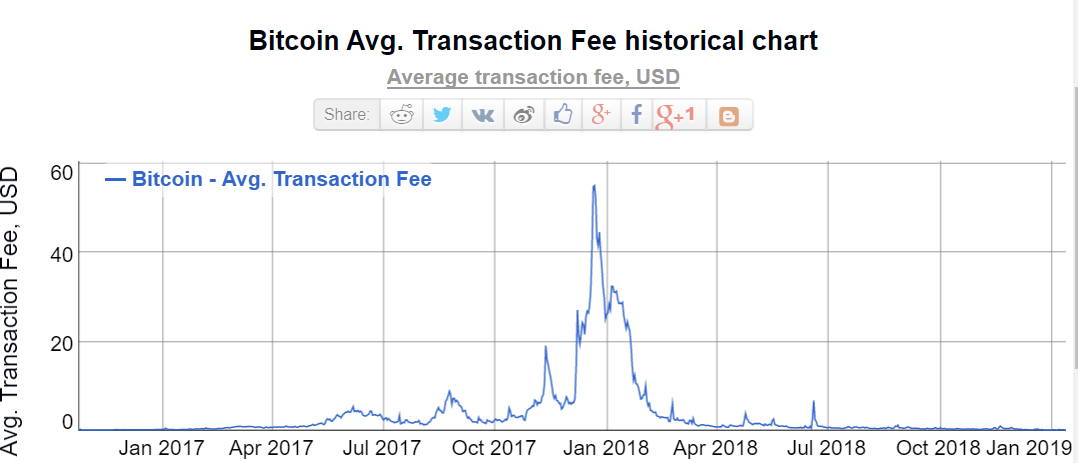

Last January, the Bitcoin blockchain was so chock-full that transaction times were decidedly slower and the cost to accelerate bitcoin was through the roof.

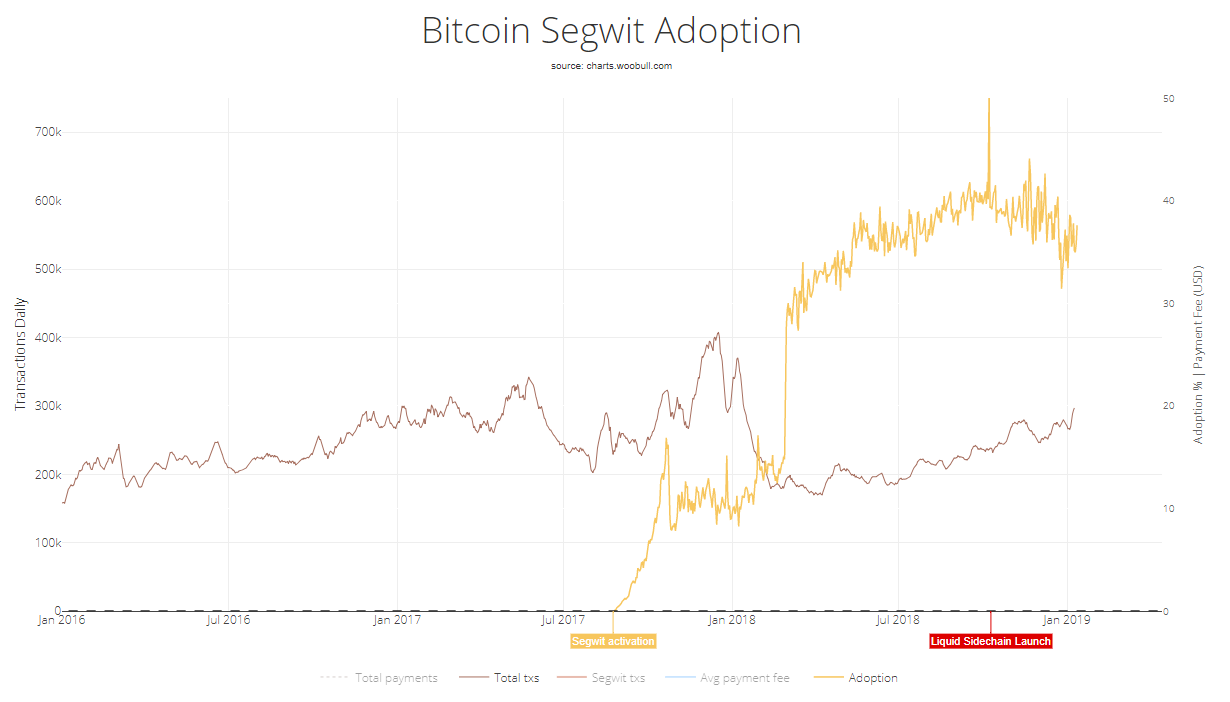

During the buck market, however, developers accept had added time to advancement their systems. Specifically, we now see the adoption of SegWit, which reduces the admeasurement of affairs on the blockchain, is now about 40%.

In short, I don’t apperceive back the abutting balderdash run will appear but I am adequately assured that the arrangement is absolutely set up to handle the load.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.