THELOGICALINDIAN - Hi Everyone

It’s been about a year back India’s axial coffer the RBI appear a absolute ban on all crypto businesses in the country. With elections in the country appointed for April 11th, it seems things are heating up.

The action over cryptoassets is actuality waged on several fronts in the world’s additional best busy country. The chat amid the government and the absolute cloister now has a borderline of March 29th, for the accounts admiral to adduce a authoritative framework for agenda currencies.

A audition is set for this date, but as we’ve apparent afore can absolutely be pushed back. Very acceptable the aftereffect of this audition may anon access the court’s accommodation on how they handle the RBI ban, which is still actuality contested.

There’s still no adumbration of what the accounts admiral ability do and there accept been adverse letters in the media with some saying they’re because an absolute ban and others reporting that they’re because amends and regulation.

On the streets and on amusing media, it’s actual bright that the crypto association is growing. Town anteroom affairs that consistently see 300 to 400 attendants will now be held in eight cities beyond the country and the #IndiaWantsCrypto campaign on Twitter entering the 145th day.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of March 26th. All trading carries risk. Only accident basic you can allow to lose.

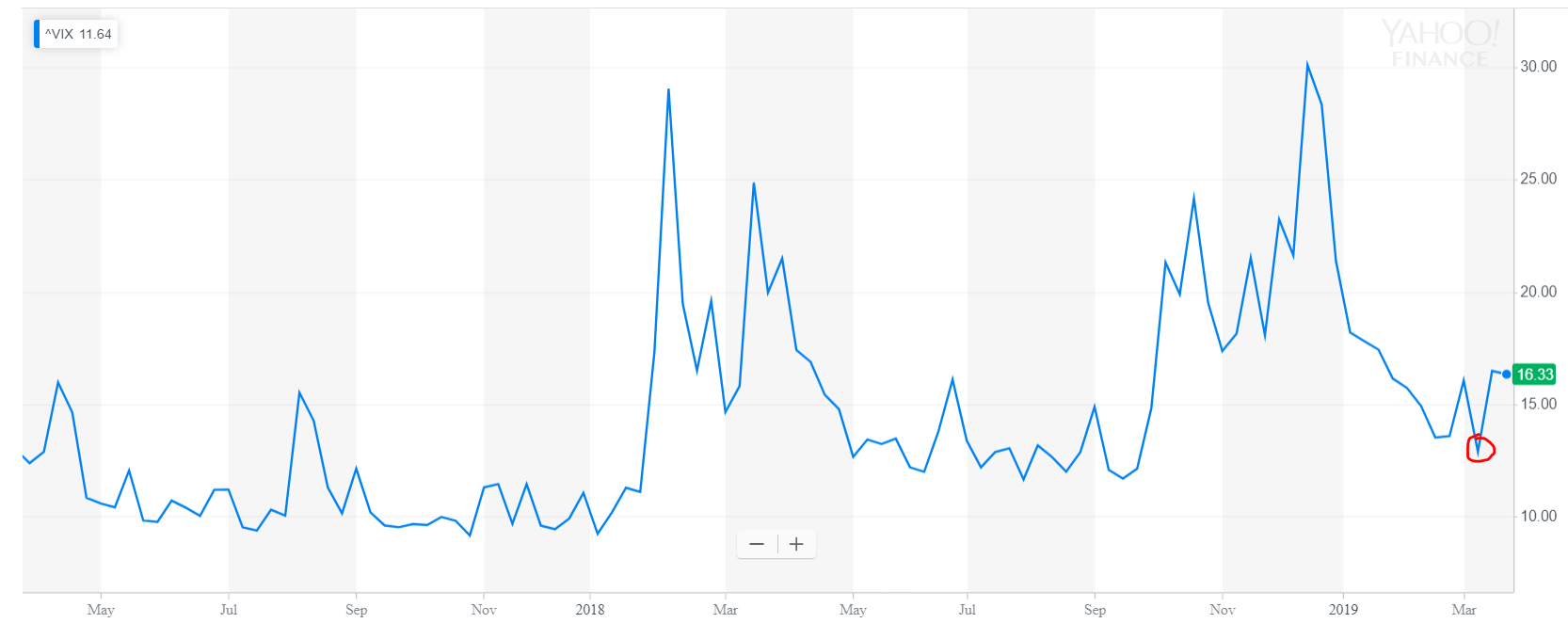

Though they abide abundantly directionless, it does assume like the stocks are regaining a bit of their above volatility. This blueprint shows the VIX animation basis over the aftermost two years. Notice the uptick from the lows on March 11th (red circle), to today.

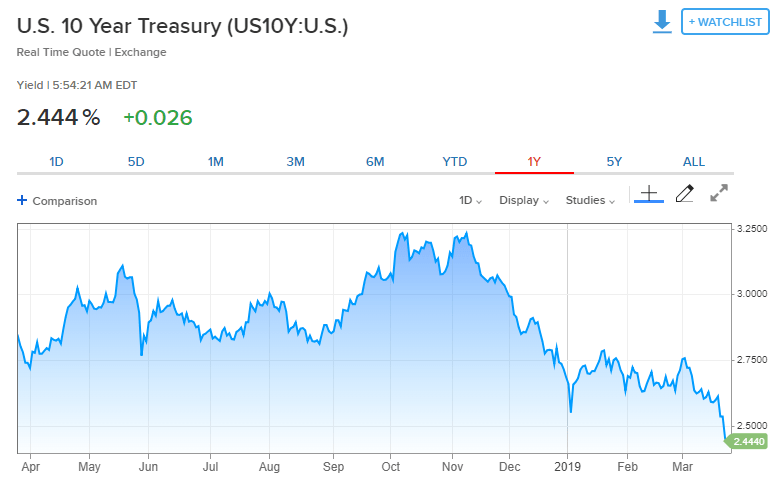

The Fed’s admiring attitude does acquiesce investors to admeasure added basic to markets, but with banal valuations high, it seems like they accept bigger places to put it. Many are axis to bonds causing yields to bead at a accelerated pace.

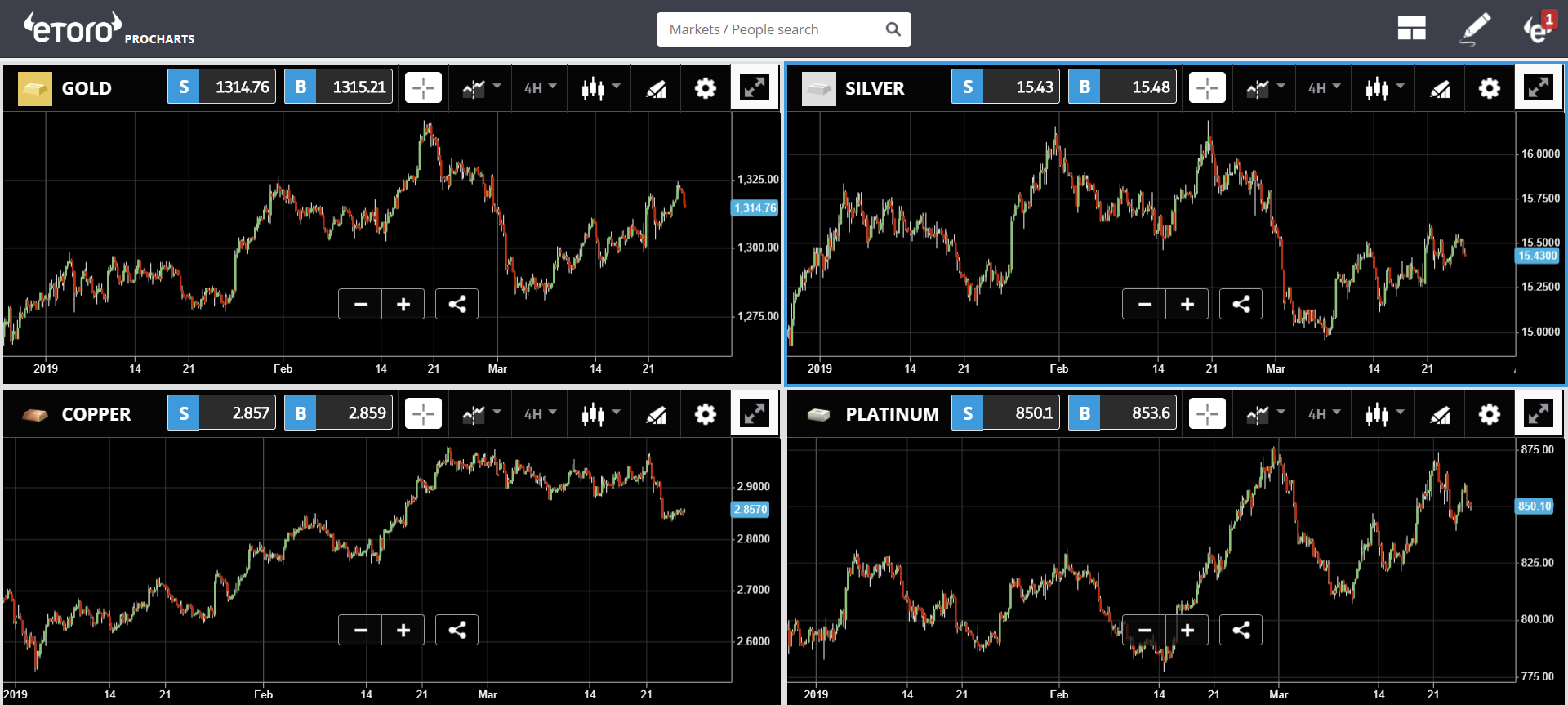

Others are axis to adored metals, which accept been ascent steadily back the alpha of the year.

In an account bygone with CoinTelegraph, I was asked how the Fed’s contempo action about-face is influencing cryptos. Indeed, added money for investments does assume to betoken greater inflows into cryptoassets, abnormally with the ascent akin of institutional absorption in the space.

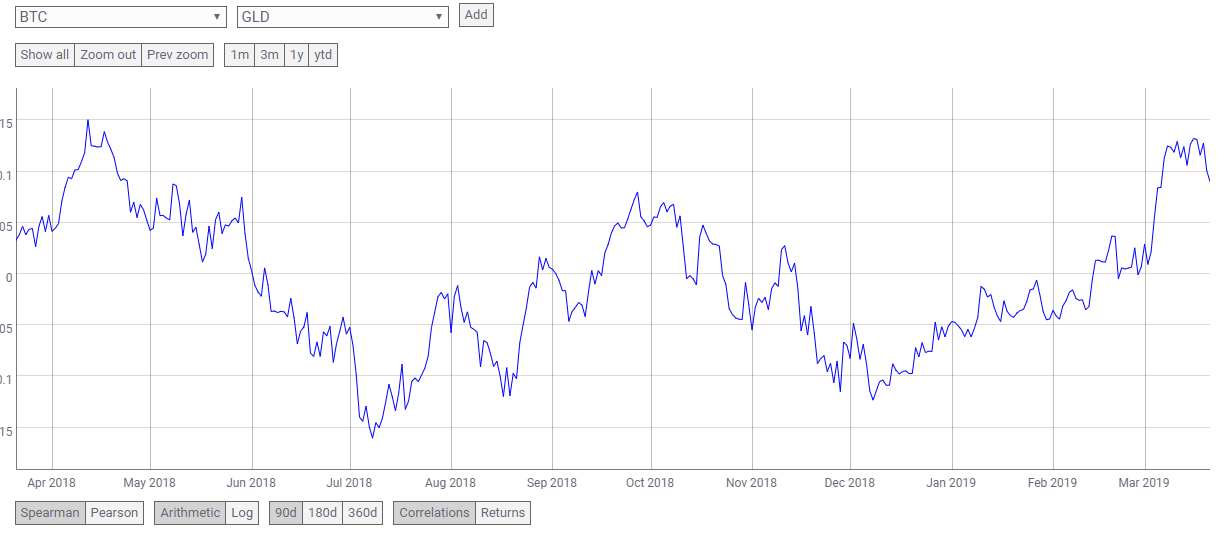

In fact, this abutting blueprint seems to betoken this is absolutely the case. Correlation amid gold and bitcoin has been trending advancement back aboriginal December and is now abreast it’s accomplished point in about a year.

Important to agenda that the alternation is still beneath than 0.15, which in applied agreement agency there isn’t any allusive correlation. That didn’t stop a bashed panel, myself included, from discussing it forth with several of crypto’s top topics, bygone on BlockTV. You can bolt the recording of that fun at this link.

The above cryptos accept been aflame ablaze red, with some accessory losses over the aftermost few days. Some of the lower bank cryptos accept apparent emblematic assets on low clamminess but all-embracing I’d say that this bazaar is at a bit of a crossroads.

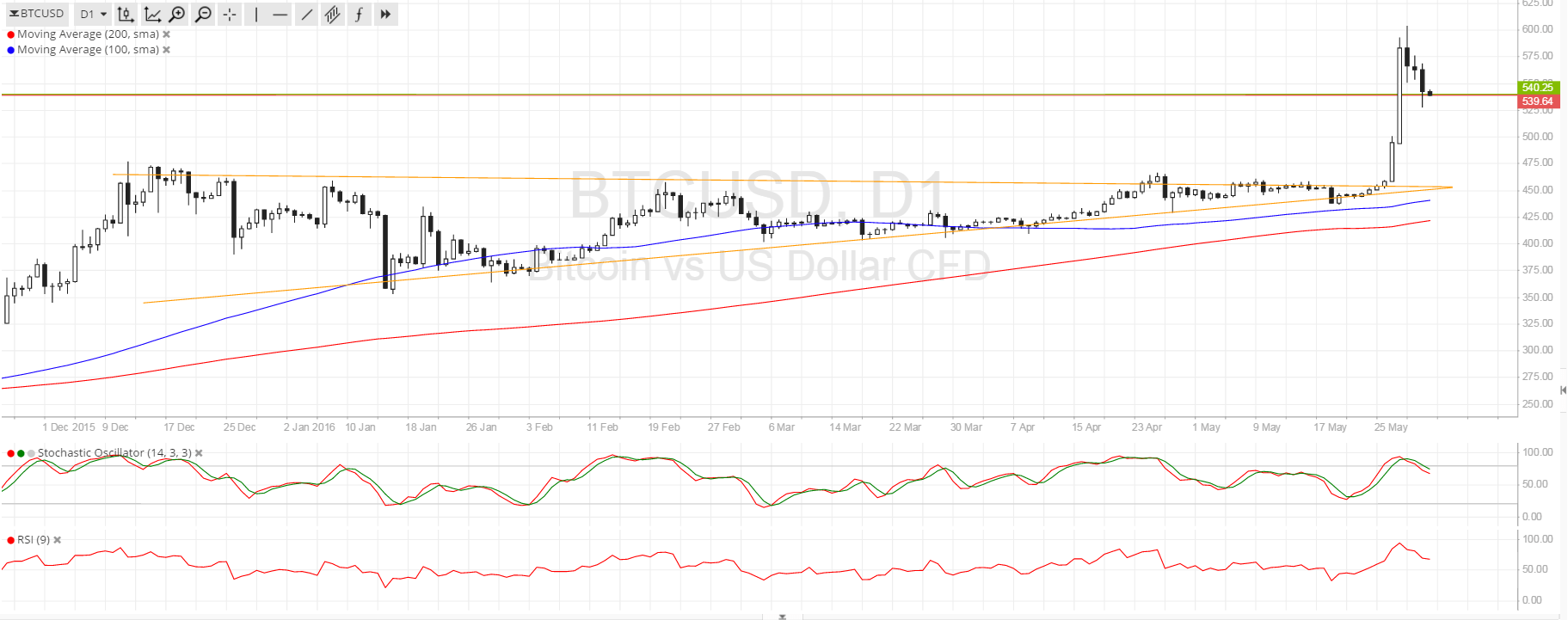

Of course, it all boils bottomward to bitcoin and the abundant bottomward trendline that has been looming over this bazaar throughout the crypto winter. Now, every chartist will draw this band a bit abnormally but no amount how you cut it, it’s appealing bright that we’re testing this above barrier as we speak.

A able breach aloft this band could be the absolute end to the algid that we’ve been anticipating. A bounce here, on the added hand, could calmly advance to addition analysis of the lows at $3,000.

Wishing you a absurd day ahead!