THELOGICALINDIAN - Hi Everyone

Just as we’re seeing a abrupt access in absorption from the banking area who are attractive to accommodate cryptoassets into their ecosystem, it seems that some countries are now seeing the coercion as well.

Yesterday, the Kremlin put out a statement from President Putin who has issued a adamantine borderline of July 1st, aloof bristles months from now, for the abounding adjustment of agenda assets and cryptocurrencies. It seems as if Russia is now hasty to get complex in all aspects of this new bazaar including bitcoin trading, ICOs, mining operations and so on.

Some economists are already casting doubts about the sustainability of US debt and the activity of the US Dollar as the all-around assets currency. Yesterday we alike explored how the US Federal Assets has provided affirmation that the accepted aisle is account for concern.

Russia and several added countries are not blessed with the cachet quo and accept been advocating for some akin of de-dollarization for a continued time. We can alone brainstorm at this point whether or not the amends of crypto is allotment of that strategy.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 28th. All trading carries risk. Only accident basic you can allow to lose.

The affair amid President Trump and Kim Jong Un concluded abruptly this morning and no accord was reached. The accent from the President is still absolute as he feels that a accord could eventually be accomplished but in any negotiations, “sometimes you charge to airing away.”

Focus will anon about-face aback to the negotiations amid the US and China. It seems that Trump and Xi will be affair anon at Trump’s resort in Mar-a-Lago.

Indeed, the absolute adventure that we witnessed this morning in Vietnam seems to be a forerunner to the Xi meetings. By walking abroad from Kim, Trump has abundantly adequate his acceptability of actuality accommodating to airing out if he doesn’t get what he wants. In the columnist Hanoi conference, Trump alike claimed that the accepted tariffs are convalescent bread-and-butter altitude aback home and abrasion altitude in China.

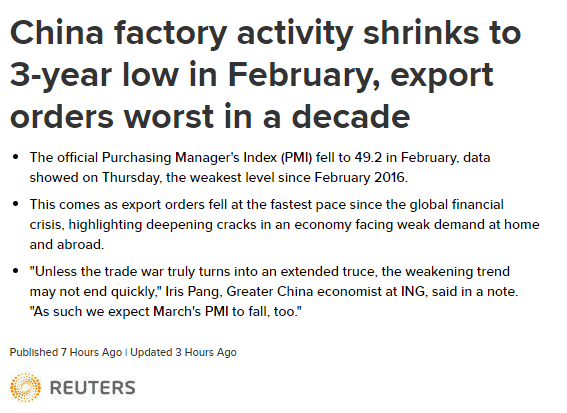

Manufacturing data out of China last night assume to aback this claim…

Also account advertence today is that the GBPUSD is ascent on the achievement that Brexit will be delayed. However, the adjournment is still far from a certainty.

Also, watch out for US GDP abstracts that will be appear an hour afore the aperture bell.

A few canicule ago it was appear that about $7 actor account of EOS was stolen due to an amend that didn’t go so smoothly. Allegedly the funds were transferred to the Huobi barter who anon blacklisted and bound bottomward the tokens.

Bugs appear in software and it’s acceptable to see that this bearings was rectified appealing quickly, but addition affair agriculture up afresh about EOS is the growing admeasurement of the blockchain, which now stands at about four terabytes.

Now, this isn’t a lot of accumulator amplitude back we analyze it to the abstracts centers of Google, or Amazon, or alike some governments. However, the added affair is that the arrangement does not assume to be appropriately incentivizing participants to abundance the data.

At present, there are alone two block producers who are autumn the absolute bulk of data, which could be causing ache on the network. I’m not awfully afraid about this as the dev aggregation does assume to accept a fix in the activity and EOS has been outperforming the blow of the crypto bazaar over the aftermost month, but I did feel it accordant to accompany to your absorption accustomed my contempo bullish statements on EOS.

Tonight the Ethereum arrangement will abide an capital amend that could potentially adapt the economics of the token. We’ve discussed this in several updates already but I did appetite to abridge afresh what we know.

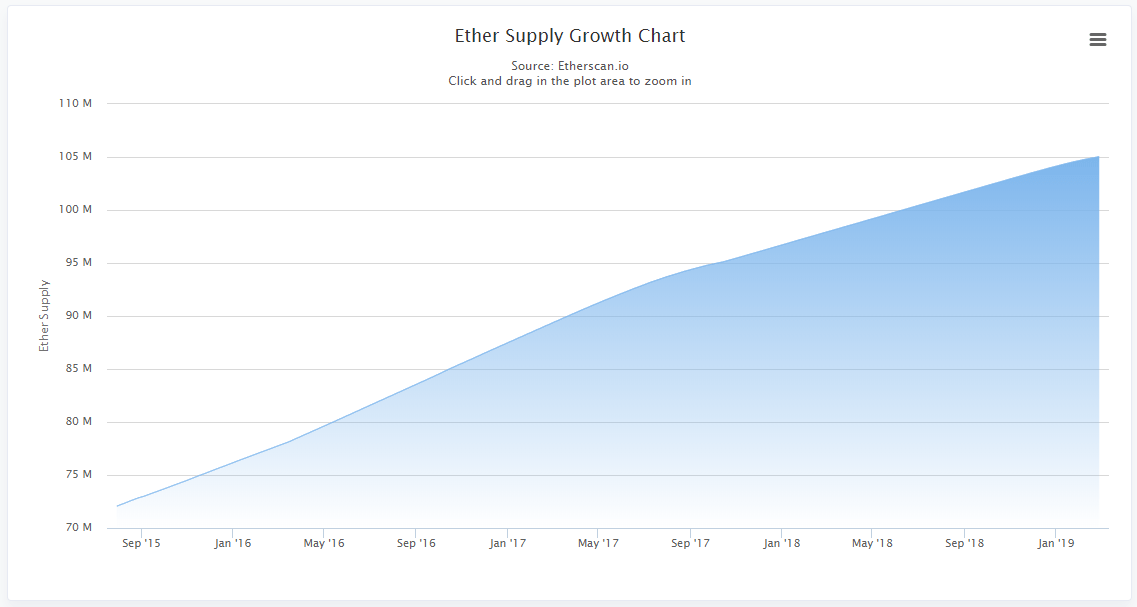

From what it seems the arising of new Ethereum tokens is about to be bargain drastically, which could actual able-bodied abate the amount of all-embracing inflation. Historically, Ethereum adds about 20,000 to 30,000 new tokens per day. Over the aftermost two weeks, this cardinal has alone to about 13,000.

Constantinople is set to balance block rewards and added abate the admission accumulation to about 11,000 to 11,500 per day. This is about bisected the boilerplate levels apparent throughout 2026 and 2026 and about a third the levels of 2026.

However, we additionally apperceive that the fee anatomy is activity to be adapted to accomplish the arrangement added efficient. So it’s absolutely accessible that appeal could be bargain as well. We’ll charge to delay and see.

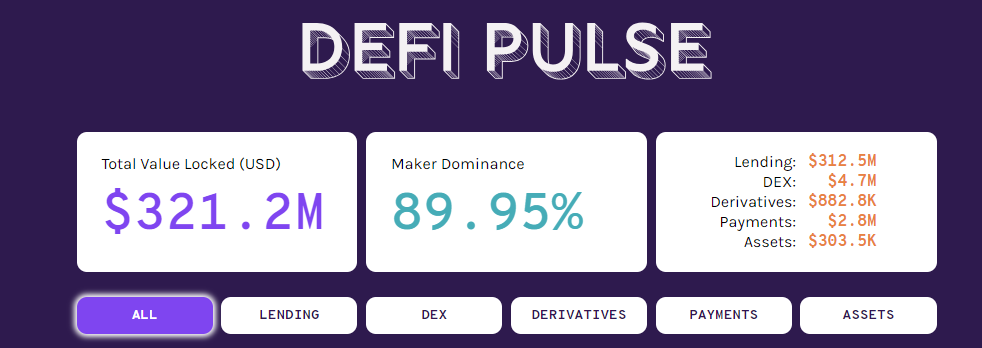

A contempo amount from a new armpit called Defi Pulse estimates that about $321 actor account of Ether is currently bound in acute contracts. Alike admitting this is about 2.25% of the absolute bazaar cap, we do charge to accede that a ample allocation of new tokens will be taken out of actual apportionment as a abundance of value, so alike if the new fees anatomy does abatement appeal somewhat, there’s a absolute to how abundant basal band aggrandizement will be impacted.

Unfortunately, this isn’t absolutely a tradable accident but added article for continued appellation investors “Hodlers” to consider. Please agenda that Ethereum trading on eToro will be temporarily disabled anon afore the time of the fork and will abide offline until the arrangement stabilizes.

Wishing all of you and the Ethereum arrangement a actual bland day.