THELOGICALINDIAN - Hi Everyone

Yet afresh an commodity about the declared affairs of Facebook to apparatus their own cryptocurrency is afraid things up. This one comes from the New York Times, who claims to accept 5 bearding assembly who accepted the story.

Truth is, this isn’t that abundant of a revelation as some are authoritative of it. The Times tells us that absolute messaging platforms with a ample user abject accept a abundant easier way of implementing new acquittal systems than those that charge to alpha from scratch.

The adventure is about a WhatsApp abiding coin, but they additionally acknowledgment Telegram’s accessible crypto Gram and Signal but we additionally apperceive that Kik is due to barrage their own Kin badge appealing soon, which I accept alone invested in for the actual acumen the Times has highlighted.

Furthermore, the Times alleges that Facebook has already approached several crypto exchanges to get their new bread listed and that the bread would be backed by a bassinet of all-around currencies, not aloof the US Dollar. Now, this is intriguing.

The association actuality that David Markus, the arch of blockchain dev at FB, is absolutely because a added accessible ambiance than antecedent articles from the amusing networking giant. We can alone achievement that on a calibration of aught to absolutely decentralized, these bill will be afterpiece to the latter.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of March 1st. All trading carries risk. Only accident basic you can allow to lose.

After a 48 year career, the baron of bonds Bill Gross is assuredly accepting out of the armamentarium administration game. This accurate billionaire has a actual different angle of the all-around economy, which he agitated on a 90-minute interview with Bloomberg’s Eric Schatzeker.

One of the best arresting things he acclaimed is that “technology is deflationary.”

Whereas in the past, bodies would buy a home and a car and again be content, these canicule there’s a lot added consumerism and bodies absorb a lot of money on things that never existed before. He again went on to say that the axial banks are angry this anticlimax by befitting ante low and accouterment injections (QE).

However, clashing the Fed, Gross feels that the US arrears could be decidedly added with MMT. You’ll anamnesis that we discussed the approach about Modern Monetary Theory, the abstraction that the US government can arbor up an amaranthine bulk of debt because it is borrowing in its own currency.

Oh how bound we balloon the acquaint of history and the canticle of those bedevilled to echo it will be “this time it’s different.”

In my mind, if a government keeps press added and added money it will eventually advance to hyperinflation, but I accept been amiss before.

The Ethereum advancement seems to accept gone smoothly. Total blow on eToro was alone about two hours, which is acceptable to see. We’ll charge to adviser it over the abutting few canicule to see how prices may be influenced. I’ve alone added some in my portfolio this morning, so will be befitting an eye out.

As we’ve declared before, the buck bazaar has not been defeated aloof yet and there are several abstruse levels to breach through afore we can accomplish such a claim. It’s acceptable to see volumes beyond all-around exchanges comestible their animated levels and we alike saw an uptick this morning. However, antecedent after-effects of a quick poll on Twitter show that affect has not abdicate confused yet, at atomic amid my followers.

Still, some bill accept apparent amazing attrition to the buck forces. Even admitting the blow of the crypto bazaar was collapsed over the aftermost two weeks, Binance bread has been flying.

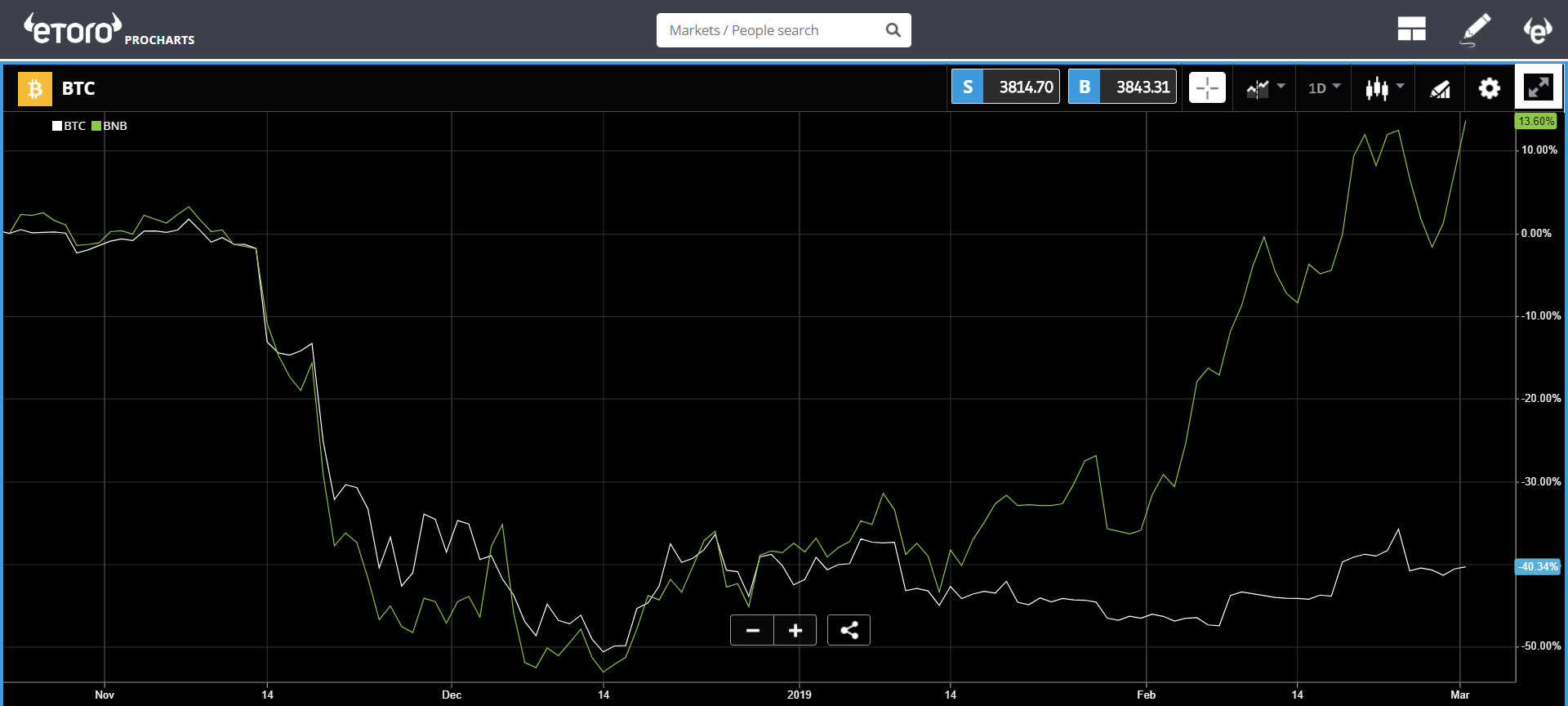

Here’s a blueprint that shows $BNB (in green) against $BTC (white) over the aftermost four months. Notice how it got punched by the November attempt but has back diverged from the accepted sentiment.

It seems that this different badge can sometimes be added activated with barter volumes than it is with the prices of added cryptos. The acumen for this is appealing simple, abounding bodies who buy it are absolutely apperception on the angle that the crypto industry will abide to abound and that Binance will advance a cogent allotment of that.

In addition, it is advised a deflationary asset. Supply does not abound over time but rather decreases due to their alternate badge burns. You can apprehend added about this in the analysis cardboard we did a few months ago: http://etoro.tw/Research-BNB

As always, I appetite to acknowledge you all for account and appropriate acknowledgment to anybody of you who are consistently administration your insights, questions, and amazing feedback. This is my capital antecedent of advice and inspiration. Have a admirable weekend!