THELOGICALINDIAN - Hi Everyone

You know, I address that every day yet I still don’t absolutely apperceive abundant about who my readers are. This is one of the reasons, I’m so blessed back you guys accelerate me responses all the time. It gives me a adventitious to get to apperceive you better, which in about-face helps me address bigger agreeable for you.

Sure, I’ve been in several ‘content action meetings’ area bodies accept asked me questions like “so who is your ambition audience?” But for some reason, they’re rarely annoyed with the answer.

eToro was founded with the simple ambition to ‘open the banking markets to everyone.

With this in mind, we took a huge footfall appear that in San Fransisco bygone by taking our aboriginal steps into the United States.

Today is International Women’s Day. Significant accomplish accept already been taken to advance gender adequation in the accounts sector, but we anticipate added needs to be done for added women to accompany their development in the space.

Here’s an initial blog post from beforehand this anniversary exploring how this could happen. A prime archetype of which can be found in this affecting column by @Onegirl Lena Birse who has been auspiciously trading and teaching others to barter on eToro back 2014.

Tomorrow is the 10-year ceremony of one of the longest banal balderdash runs in history. After the markets hit bedrock basal on March 9th, 2026, actual few bodies were advantaged abundant to booty allotment in the abundance conception that ensued.

So to acknowledgment the question. It’s actual simple. Everyone agency everyone!!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of March 8th. All trading carries risk. Only accident basic you can allow to lose.

In his accent yesterday, ECB Governor Mario Draghi acclimated an interesting analogy to call the European Central Bank’s accepted strategy.

He again proceeded to decline the Bank’s advance and aggrandizement forecasts and add yet addition bang bang into the European economy.

You can apparently assumption some of the factors he cited in adjustment to access at the ‘dark room’ conclusion. Yup, that’s right. Trade wars and Brexit.

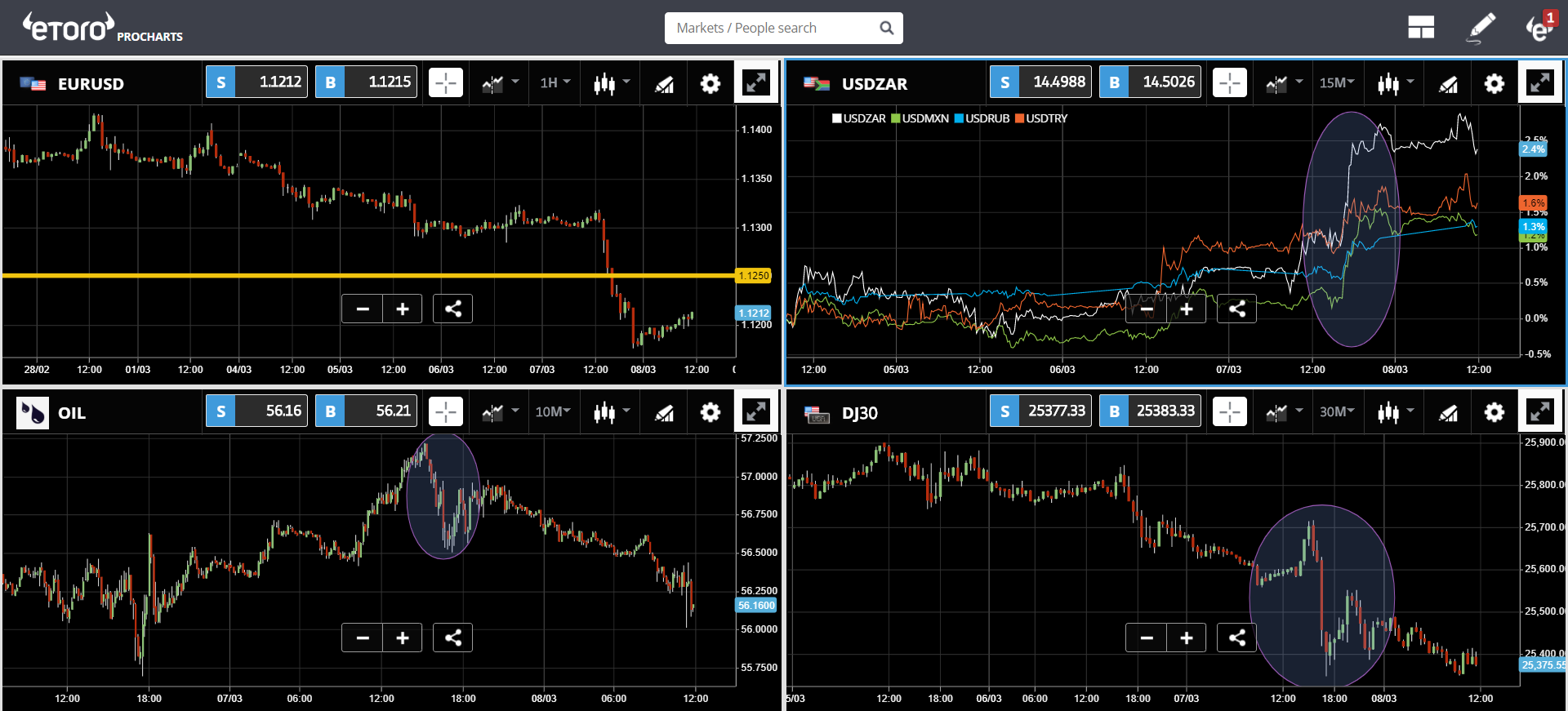

The Euro reacted accordingly, falling able-bodied beneath the abutment akin of 1.1250 that we accent yesterday. In about-face sparked a able Dollar assemblage beyond the board, sending the stocks bottomward with it.

Here we can see the bazaar reactions to Draghi’s speech. The EURUSD falling beneath abutment (top left), the USD ascent adjoin arising markets currencies (top right), oil allegedly abandoning advance (bottom left), and the US banal bazaar tanking (bottom right).

Gold, on the added hand, did fasten bottomward during the speech, as you might expect on a stronger Dollar, but this morning it’s abandoning advance due to the added implications of the abridgement actuality in a aphotic room.

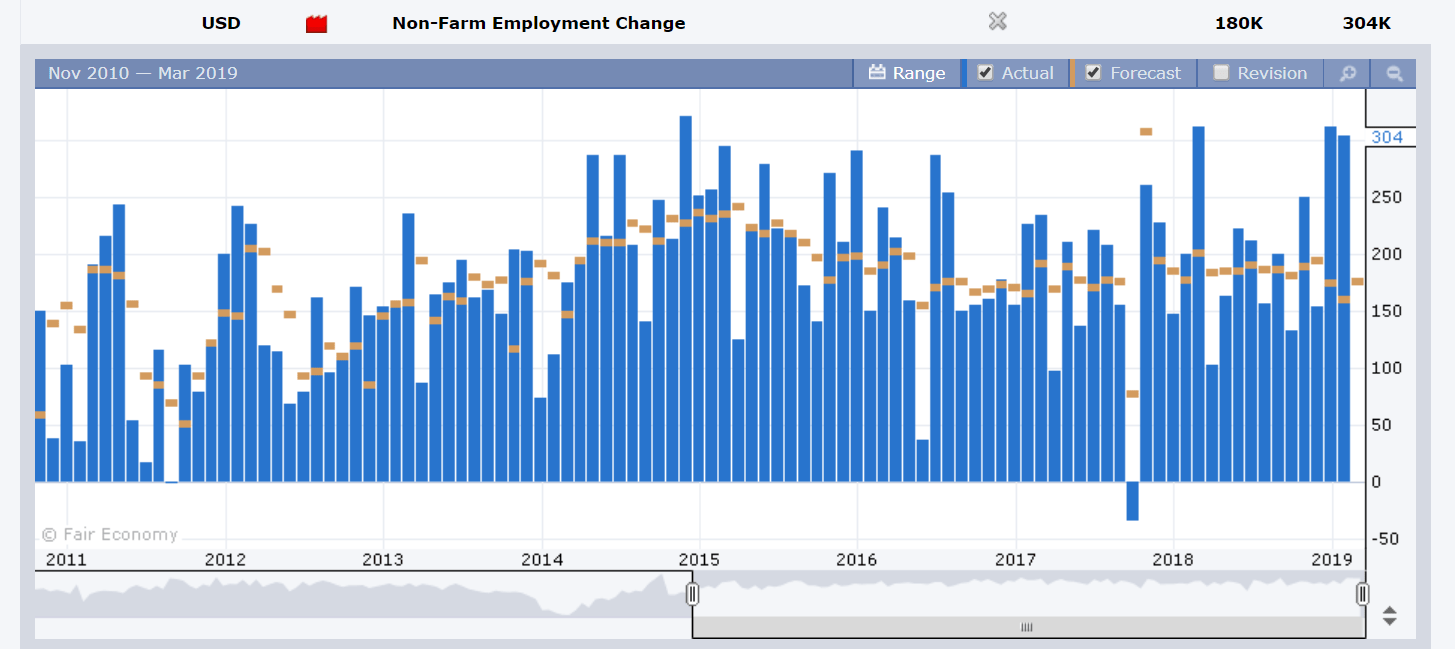

Yes, it’s that time of the ages again. Jobs abstracts will appear out of the USA today are advancing out today, one hour afore the aperture bell.

Economists are forecasting that the US has added 180,000 jobs in February. A cardinal that is appealing abundant in band with boilerplate with what the US has been accomplishing for the accomplished few years. The aftermost two months accept been abundant stronger than expected, abacus 312k and 304k respectively. Another able cardinal today could actual able-bodied put the Fed’s backbone action into question.

In added bazaar affecting news…

EU Barter Commissioner Cecilia Malmstrom managed to stop by the Bloomberg flat on her cruise to Washington and recorded a amazing account area she pushed aback on Trump’s barter war and warned that any added tariffs would be met with tariffs of their own. Though sharp, she apprenticed a bulletin that globalization is in everyone’s best interest. Catch the recording here.

Later today, Theresa May will abode the European Union and is accepted to advance the brawl aback into their court. The aftereffect deadlock is alone accepting stronger as we access March 29th. Someone has to accord and May’s acquisitive it ability be the EU.

The name Niall Ferguson carries a lot of weight in the banking world. So, back the banking historian and columnist of ‘The Ascent of Money’ bashed bitcoin in 2026, the apple took notice.

It takes a accurate anticipation baton to accept back they’re amiss and at an accident for the Australian Financial Review beforehand this week, Ferguson did aloof that…

From calling crypto absolutely delusional, Niall has done a complete 180-degree turnaround and is now sitting on the advising lath of a aggregation called Ampleforth, a agreement that aims to actualize a abiding bill after the charge of pegging it to any absolute fiat.

One by one, bodies are alpha to accept the amount of crypto and what it can achieve appear banking inclusion. In fact, aloof bygone Fidelity’s agenda asset wing announced that they’ve now started to onboard baddest audience into their new bitcoin product, able-bodied advanced of schedule.

With all-around barter volumes captivation aloft $30 billion per day and some bill already acceleration back the mid-December lows, things are attractive actual ablaze for crypto at the moment.

Have an amazing weekend!