THELOGICALINDIAN - As the furnishings of the coronavirus came into focus in aboriginal March all-around markets were plunged into turmoil

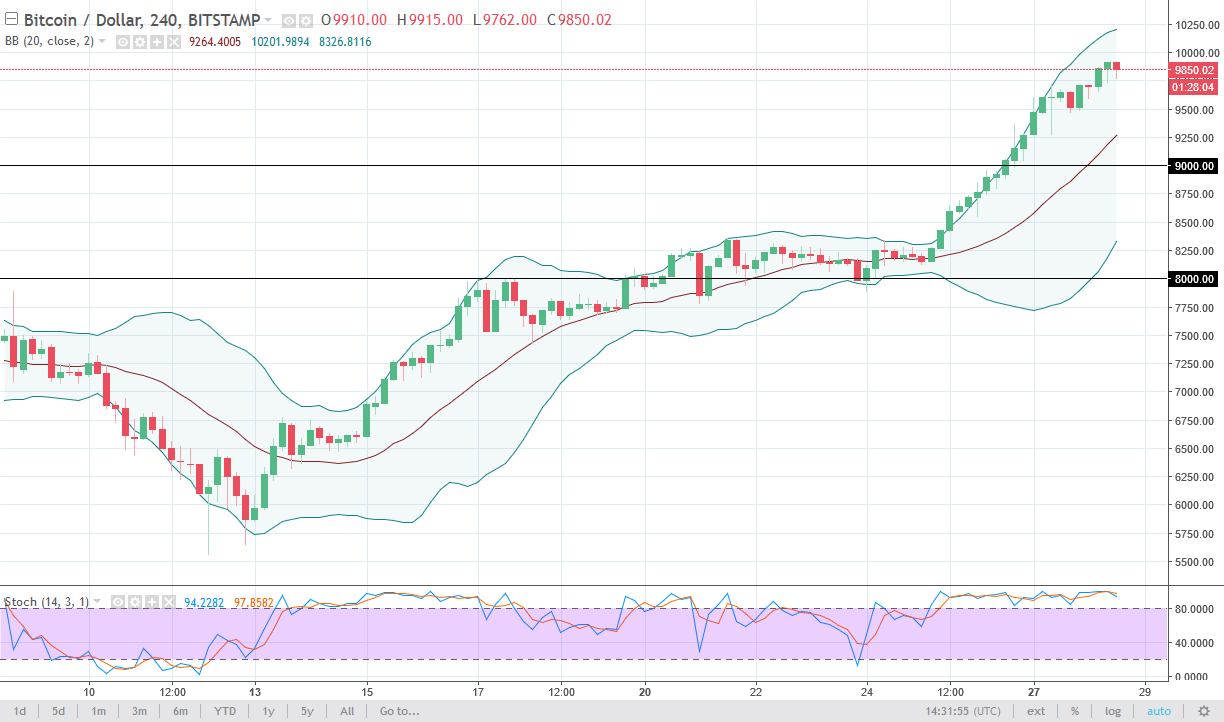

On March 12th, Black Thursday saw the FTSE 100, Dow, and S&P 500 bead added than 10% in the worst day for the banal market back 1987. Even bitcoin, which some advised to be allowed to bread-and-butter unrest, became accountable to the swings of the banal bazaar as traders ditched aggregate in a accumulation run to the dollar.

The arch cryptocurrency afford 50% of its amount over 24 hours — abominable alike acclimatized traders, and arch newcomers to appraise what allegorical banal picker John Templeton said were the four best alarming words in accounts — “this time is different” — and achieve that the cryptocurrency markets would never recover.

But while newcomers were rage-quitting; autograph bitcoin another obituary, and advancing to leave the bazaar forever, accomplished traders saw a affairs befalling amidst the chaos.

Just a few canicule later, the bazaar was accepted aback upwards, abrogation amateur traders on the sidelines, and applique a advantageous accumulation for those that knew how to booty advantage of the volatility.

The aberration amid panicking and responding appropriately to bazaar agitation generally comes bottomward to experience.

With the advice of added acclimatized traders in a community, newcomers can fast-forward the acquirements action and body a action of their own to act as a close ballast back abrupt turbulence hits the market.

This is abnormally important back ‘black swan’ contest like coronavirus appear along, and the ascendant narratives are chaotic at a moment’s notice: One minute bitcoin is behaving like a safe anchorage asset — affective with gold in acknowledgment to geopolitical ache in Iran, and the abutting acting as a accident on asset that moves in lockstep with stocks.

To break on the appropriate ancillary of the market, traders on eToro can analyze through bazaar account alongside amusing commentary, and alike mirror the moves of top-performing traders.

For traders in accustomed markets like stocks and commodities, actuality able to barometer affect and adviser the movements of added traders can be useful. But for the apprentice crypto market which is alone a decade old, it could beggarly the aberration amid auspiciously abyssal bazaar agitation and actuality abject adjoin the rocks.