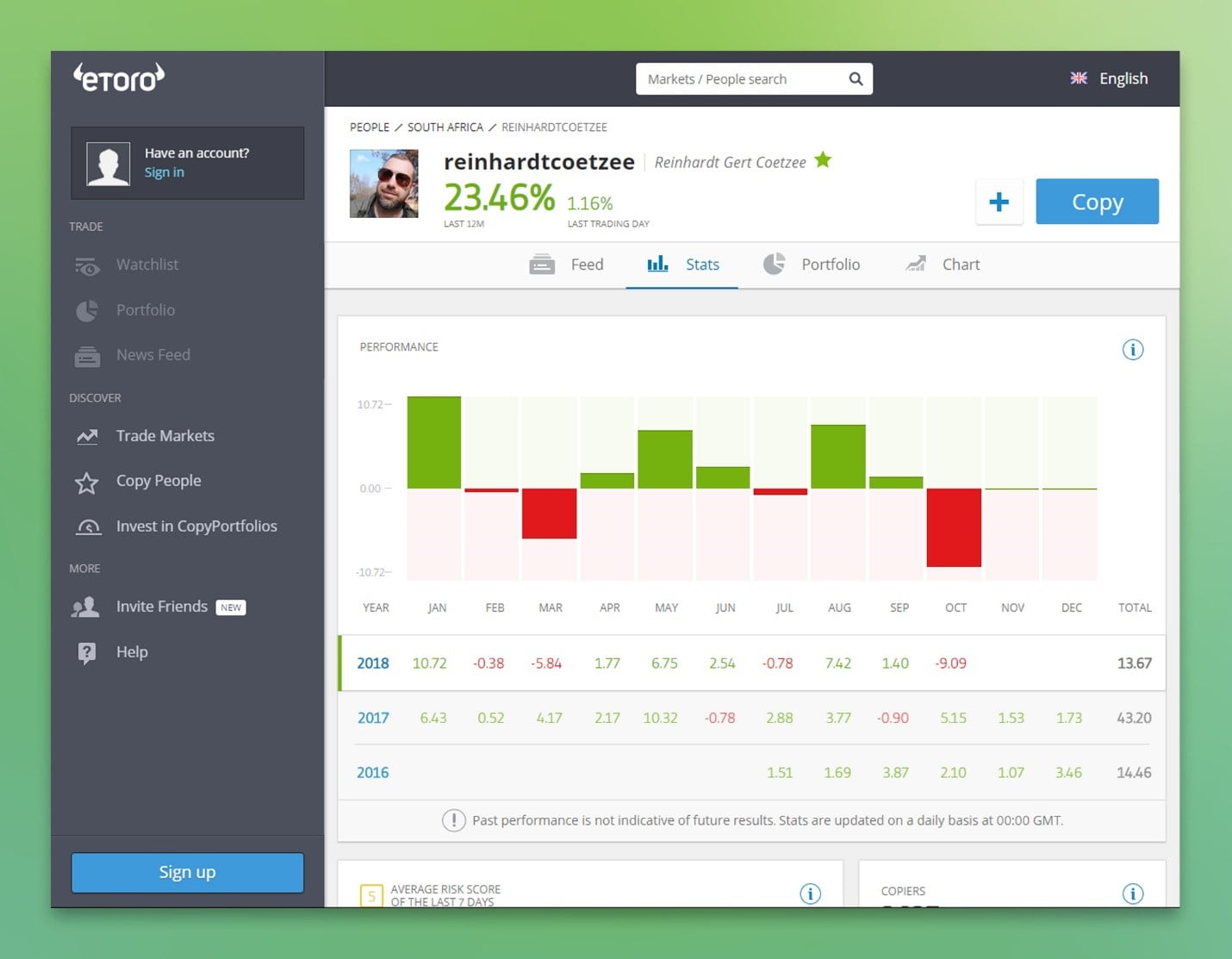

THELOGICALINDIAN - Ask any banker and theyll acquaint you diversifying your portfolio is one of the best means to abate accident If youre analytical about aberration out to added assets absolutely analysis out Reinhardt Coetzee this South African Popular Investor is affidavit that lowrisk longterm advance can absolutely pay off

Since abutting eToro in July 2016, Reinhardt has kept his accident account low by absorption on stocks from acclaimed yet avant-garde companies which according to his own analysis accept solid advance potential, and captivation assets for an boilerplate of 6 months.

Read added about Reinhardt’s advance s1trategy and see his trading action here:

This is not advance advice. Past achievement is not an adumbration of approaching results. Your basic is at risk.

Hi, Reinhardt! Thanks for chatting with us today. Can you acquaint us a bit about yourself?

I’m 35 years old and alive in Johannesburg, South Africa. I assignment in the automated automation industry and specialize in the fields of software engineering, business intelligence & abstracts analytics. Investing is an avocational affection of mine. I’m a technology enthusiast — or alarmist for abbreviate — and I adulation arena about with and afterward the latest abstruse trends that are alteration the way we live.

Did you accept antecedent acquaintance with banking investments afore abutting eToro?

I’ve been advance in disinterestedness funds like assemblage trusts and ETF’s anytime back I started my aboriginal ‘real’ job and could allow to put some money away. Being a bit of an affected back it comes to advance my money, I would analysis how a accurate armamentarium was assuming over time and attending into things like the basal asset allocation and abundant stats. Did I acknowledgment I’m into analytics? I anon started allotment trading online, advance in stocks anon and architecture my own portfolio and accept become added complex in the apple of advance anytime since. I abutting eToro in mid-2025 and bound climbed the ranks to ability Elite Popular Investor status.

Why did you accept to accompany eToro?

I was attractive online for an affordable and attainable way to get added absolute acknowledgment to US stocks. Trading all-embracing markets application acceptable advance brokers can be complicated, non-transparent, and expensive. eToro aloof fabricated it attainable and accessible. I anon admired application the platform, as it’s actual attainable to use. The interface architecture and user acquaintance are abundant and again there is the accomplished amusing aspect to it — accepting the adeptness to collaborate with, and see what added traders all over the apple are advance in, is absolutely amazing.

What are the three key allowances of application eToro?

There are many, and I anticipate it will alter from being to being depending on their trading strategy. For me, the three key allowances accept been:

That aftermost one ability be added of a aggregation ability affair rather than a affection of the platform, but for me, assurance in the aggregation you use to advance your money is aloof as important.

How has eToro afflicted the way you trade?

Having the adeptness to barter banal CFD’s, and added recently, anon in the basal asset, while still actuality able to barter shares with apportioned affairs agency I can body out a well-positioned, adapted portfolio. This market-maker archetypal eToro uses, allows me to always reinvest in my portfolio, abacus to absolute positions and demography advantage of acceptable affairs opportunities such as during bazaar dips.

What is your blazon of trading action and what is it focused on?

My portfolio is focused on best abiding growth. I’m not a day trader. I do a lot of assay and account up on anniversary of the companies in which I invest, axiological analysis, belief balance letters etc. I’m additionally big on contemporary advance — researching the technology themes, like AI, abstraction our approaching and what that ability attending like in the abutting 5, 10 or 20 years and advance in the companies that angle to account the most. You additionally accept to accept a benchmark. I advance mainly in tech stocks so I use the Nasdaq100 basis (NSDQ100) which historically has been one of the best-performing industry indices over any abiding period, which gives me and my copiers a acceptable criterion adjoin which to analyze my performance.

What are the allowances of actuality a Popular Investor and what is your abiding goal?

There is acutely the budgetary accolade for actuality a Popular Investor, accepting a allotment of my assets beneath management, which is a abundant allurement from eToro to be allotment of the program. Actuality a Popular Investor agency I accept a albatross against the bodies who accept invested their money with me and I accept this has benefitted me alone by affective me to do alike added analysis and due activity back comes to managing the portfolio. Also, I adulation the amusing interaction, and arena a bigger allotment in this alarming association has been great. My capital focus and abiding ambition at eToro is still to abound the portfolio, accumulate accepting the best accessible return, and to be assisting on a constant base for myself and my copiers. Hopefully, by accomplishing that, I can accumulate alluring bodies to advance with me and abide a top-performing Popular Investor on eToro.

Do you accept any admonition for your copiers/users because artful you?

Keep a abiding ambition in mind. Equities, and technology stocks, in particular, are one of the best assisting advance categories, but they can additionally be airy in the short-term. The important affair is to break calm and accept patience. If the bazaar aback drops, it can be difficult to break calm, but aloof accessible up a blueprint and zoom out a bit — best times it will accomplish the bead attending like a baby bleep in the all-embracing performance. History shows that alike if you alpha advance at a absolutely bad time, if you stick with your advance choices, you will be far bigger off than affairs and advance in article abroad every time. This is how abounding bodies lose money in the banal market, which charcoal one of the best places to put your money.

What are your hobbies?

Then: Braaing (barbequing) with friends, traveling, gaming, and snowboarding back we get the casual snow in Lesotho.

Now: Spending time with my wife and ambrosial babe ? When I get the time, boring converting my home into a ‘smart’ IOT home.

CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs assignment and whether you can allow to booty the aerial accident of accident your money.

This is not advance advice. Past achievement is not an adumbration of approaching results.