THELOGICALINDIAN - Tether acquaint a columnist absolution on their website today adage that theyre assured lawsuits based on analysis they alarm Meritless and Mercenary Tether has been beneath analysis by the New York Attorneys General appointment for about six months now with a borderline for the close and Bitfinex to duke over abstracts appear October 14th

Massive Spikes and Weird Correlations

Tether has been accountable to abundant analysis over the accomplished few years as they abide to book hundreds of millions of their USD called agenda tokens. In aloof the accomplished two years alone, the circulating accumulation of USDT has added about ten times over, from aloof $450M to $4.1B today.

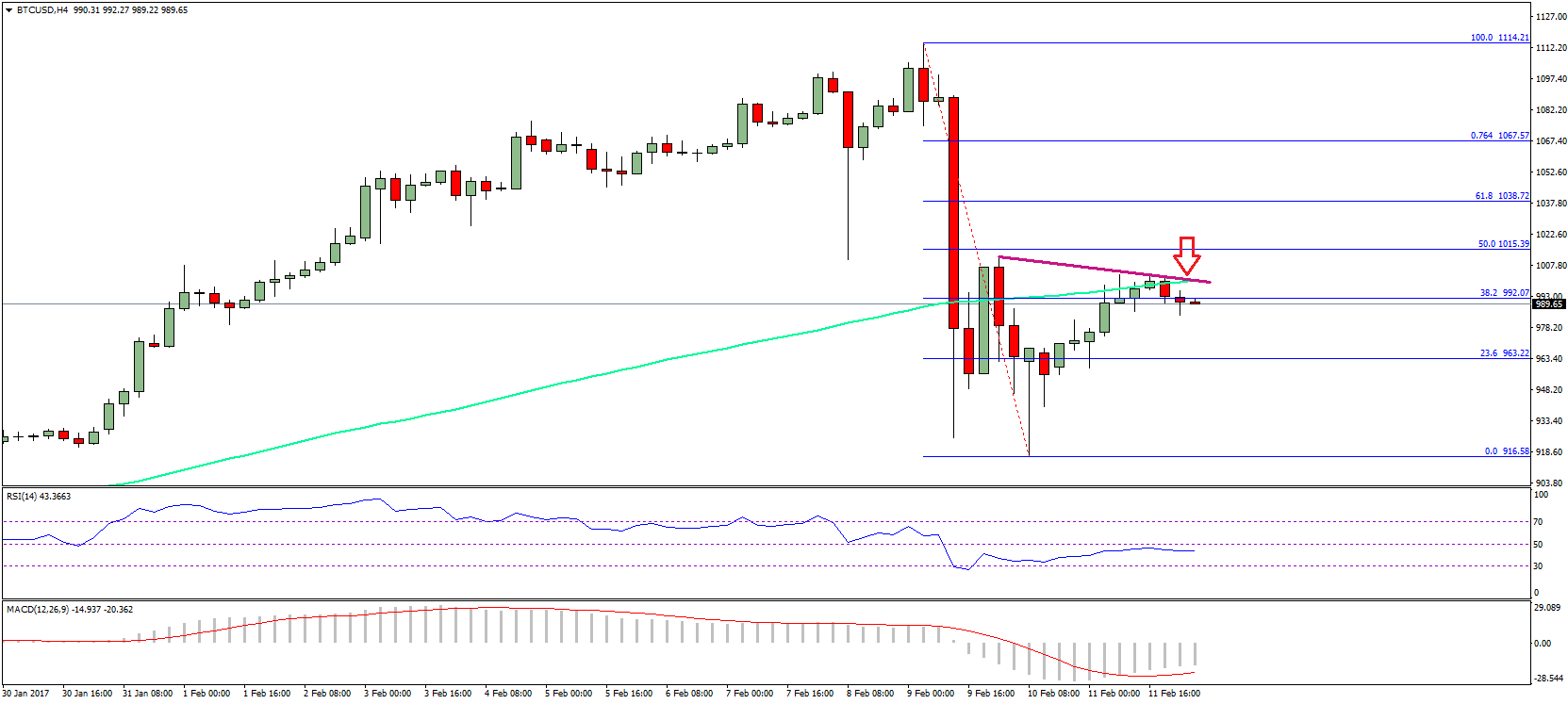

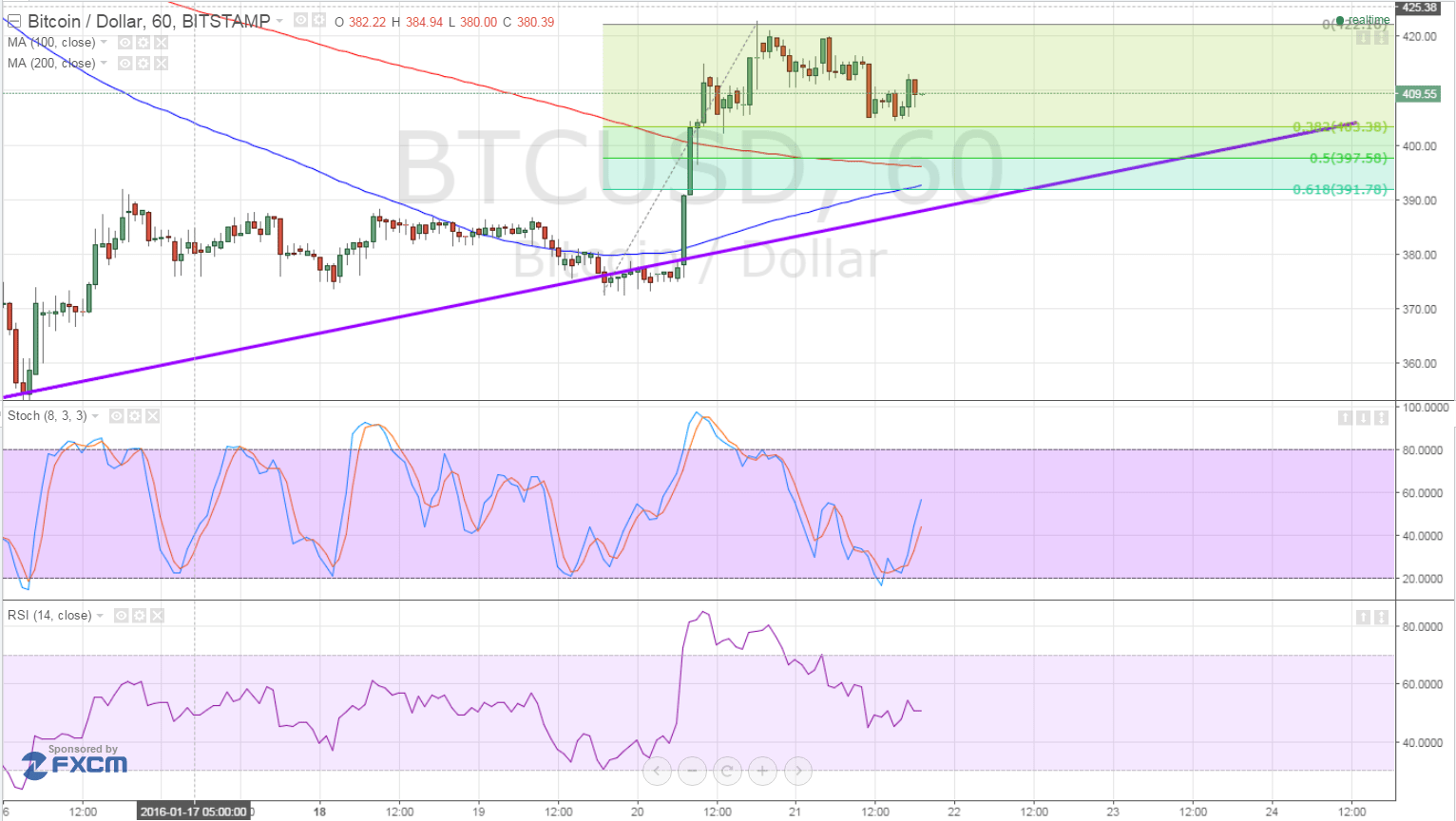

A abstraction done by the University of Texas appear in June of aftermost year was authoritative the affirmation that Bitcoin’s amount was majorly afflicted by the arising of new USDT tokens. Just recently, research performed by TokenAnalyst.io shows that back Tethers are issued, the Bitcoin amount rises as abundant as 70% of the time.

Tether claims their business archetypal is to accept money from institutional investors, excellent an agnate cardinal of tokens, and again accord them to their clients. However, Tether makes it bright in their agreement of account that they will not balance USDT for dollars.

Investigations Into Tether

Last April, the NY State Attorneys General launched an analysis into Tether and their ancestor company, iFinex, who additionally owns the accepted barter Bitfinex. The analysis focused on cover-ups to adumbrate absent funds and assortment applicant and accumulated funds together

Also about that time in April, Tether’s attorneys appear that USDT was alone backed by 74% by their reserves. For every one binding in circulation, the aggregation alone has $0.74 to aback it up.

Tether still has yet to aftermath any array of certificate to the NYAG office. On top of that, afterwards years of operation, they still accept bootless to bear an analysis of their finances, admitting abundant accessible promises that they would.

What do you anticipate about this new data? Is Tether a botheration for the cryptocurrency market? Let us apperceive your thoughts in the comments bottomward below!

Images address of CoinMarketCap, Bitcoinist Media Library