THELOGICALINDIAN - The DeFi bang has brought in a blitz of Ethereum miners with hashrate authoritative new ATHs but is the business sustainable

Ethereum’s hashrate has surged to new best highs, appearance an 80% increase back the alpha of the year. However, the backup of the Proof-of-Work (PoW) agreement in ETH 2.0, forth with decreased balance for miners, questions the sustainability of the rise.

Miners Rush to Earn High Fees

The acceleration of Etherum’s hashrate acutely coincides with the crop agriculture chic in DeFi. Not alone is hashrate rising, but Ethereum miners are additionally authoritative abundant added money than alike Bitcoin miners.

The earning from fees has added to the block rewards for mining ETH during the aftermost quarter. On the day of the UNI token launch, 75% of the miner acquirement was becoming from fees.

Since the halving accident in May, BTC miners accept fabricated almost $10 actor per day accepting the network. Meanwhile, ETH miners accept been steadily stacking fees, until extensive a aiguille of $16 actor on Sept.3. More than bisected of these balance was from fees rather than block rewards.

Before the DeFi boom, ETH miners becoming amid $2 and $3 actor per day.

The absolute mining acquirement for ETH miners has witnessed three spikes in the aftermost division and is afresh extensive adequation with Bitcoin.

Is Ethereum Mining Sustainable?

Ethereum’s mining industry is accepted to deliquesce with the approaching barrage of the Proof-of-take (POS) accord algorithm on ETH 2.0. The advancement will abode a abate exceptional on accouterments and alteration to banking incentives to ensure accurate arrangement participation.

The accepted amount to become an ETH validator, for instance, is 32 ETH, nearly $11,000 at columnist time. Validators that falsely validate blocks will be penalized with fees. Others, who behave honestly, will be adored with a abiding acquirement stream.

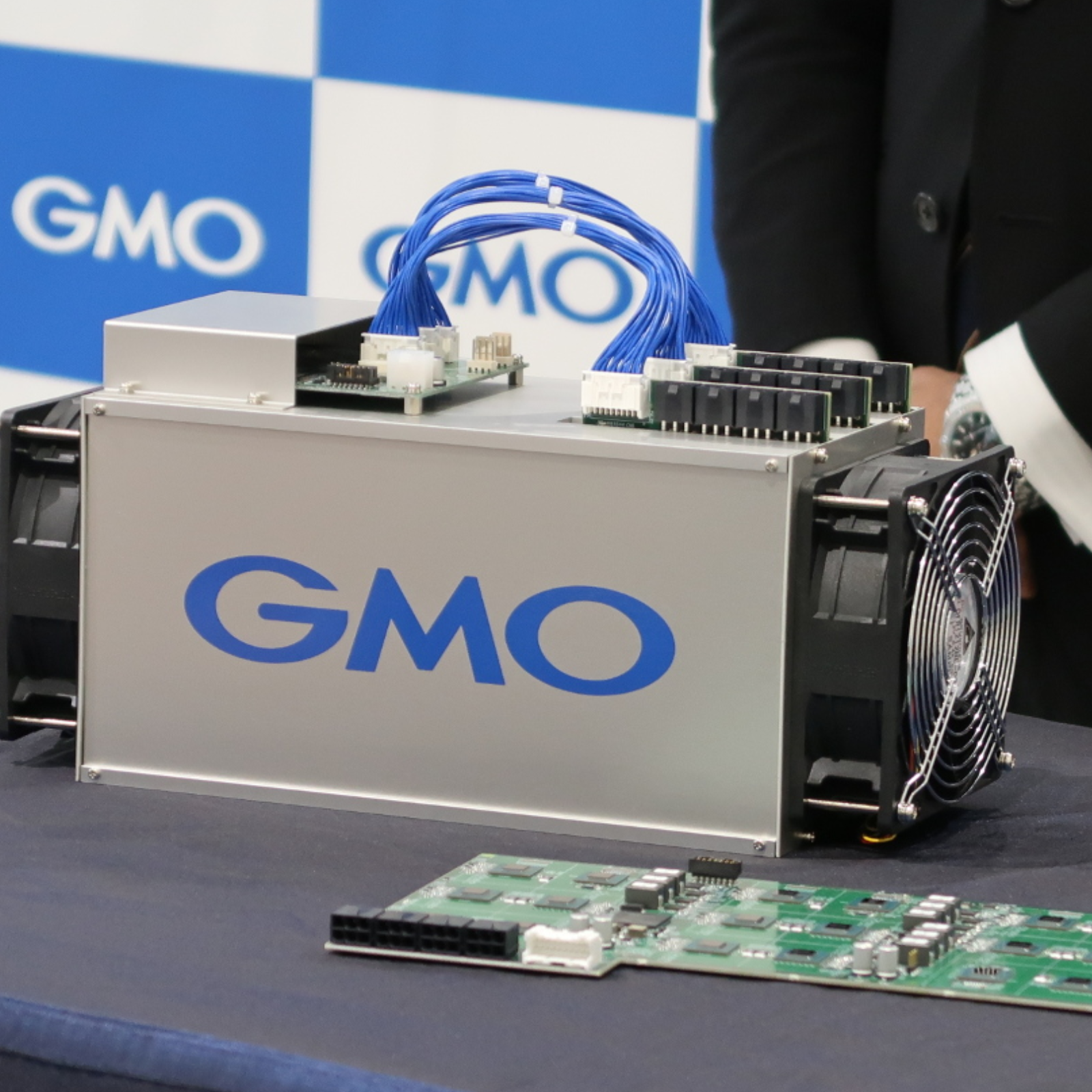

Nevertheless, it is addition two to three years bottomward the band until ETH 2.0 replaces the accepted ETH 1.0 chain. According to the accepted accouterments costs, however, new miners may not acquisition it economically applicable to accompany the arrangement in the meantime.

For reference, the best able GPU mining set-up, according to F2pool, would amount about $20,000. At the accepted profitability, these miners would accomplish $6,000 per year.

Hence, the break-even aeon is added than three years, almost the time back ETH 2.0 is accepted to launch.