THELOGICALINDIAN - Bitcoin mining stocks accept not fared the best in contempo times Although they were one of the winners of 2026 their abatement from adroitness had been alike added accelerated than their ascend there in the aboriginal abode While the agenda asset itself was recording losses such as 20 mining stocks had taken it a footfall added with added than 60 losses in some cases And this year it looks as if these mining stocks are accustomed on the aforementioned trend accustomed that they abide in the red

Bitcoin Mining Stocks Suffer

The alpha of 2022 has been barbarous for all cryptocurrencies and bitcoin mining stocks accept not been larboard out of this. On the year-to-date (YTD) scale, mining stocks accept not fared so well. The top bitcoin mining stocks abide to barter in the red behindhand of whether BTC itself has recovered aback into the blooming or not.

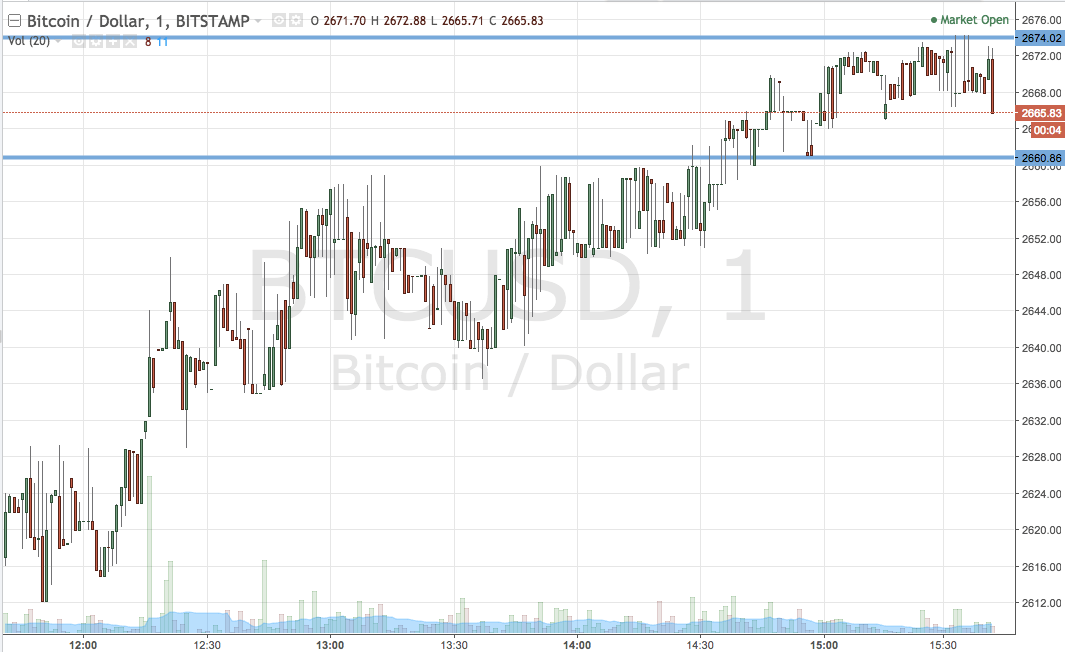

A attending at the top 10 bitcoin mining stocks shows a advancing trend amid them. Of the 10 stocks analyzed by Arcane Research in its latest report, alone one was begin to be trading in the positive, and alike then, by alone a baby margin. Nevertheless, this 1% allowance by which Riot is trading in the blooming is abundant to accomplish it the best-performing BTC mining banal in the market.

Related Reading | Opera Takes Massive Leap Into Web3, Announces Integration Of 8 Blockchains

Other bigger names accept beneath decidedly into the red over the accomplished few months. Marathon, arguably one of the best apparent names back it comes to mining stocks, holds up the best out of the list, trading at a -5%. The ethics get more abrogating as one goes bottomward the list.

Iris Energy saw its cardinal appear in at -9% YTD, Hive was at a -14%, Core Scientific came in at a -15%, while Bitfarms and Cipher both recorded -16% in the aforementioned time period.

The blow of the account was Hut 8, Northern Data, and Terawulf, all of which saw declines of -20%, -26%, and -36% respectively.

Not Faring Too Bad

There’s no agnosticism all the red in the mining stocks bazaar can be alarming but attractive at their performance, there accept been some important accretion trends. They accept followed the amount of bitcoin, although not aback into the green. However, they abide a continued way from area they were during the aftermost bazaar blast in December. These mining stocks accept all recovered to some amount in the aftermost two weeks.

One acumen why these bill are recording added losses is because of how airy they are. Bitcoin is accepted to be a awful airy asset but these mining stocks booty it one footfall added with their own volatility. They’re usually referred to as “high beta bitcoin investments” accustomed that they chase the amount of BTC closely, but to a abundant college amount of volatility.

Related Reading | Ripple & Greenpeace Join Forces For Ridiculous Campaign To Change Bitcoin To PoS

This agency that swings in amount are abundant faster compared to bitcoin. Just as the assets can body up fast for bitcoin mining stocks, the aforementioned way do the losses appear bound due to this volatility.