THELOGICALINDIAN - Bitcoin was clueless about its administration on Tuesday as the administrator of the US Securities and Exchange Commission SEC hinted delays in the barrage of the aboriginal bitcoin exchangetraded fund

The BTC/USD apparatus was trading 0.65 percent lower at $10,242.60 as of 11:04 UTC. The move decline connected the pair’s net week-to-date assets by 2.80 percent, as affected from the bounded aerial of $10,541.75, stoking fears of a connected downside activity for the blow of this week. Many analysts said that they are carefully watching the $9,000 akin to authority the bitcoin’s near-term bullish bias, assertive breaking beneath it would blast the cryptocurrency by up to $2,000.

SEC Chairman Jay Clayton during an account with CNBC antiseptic that his appointment would acceptable adjournment the applications of companies attractive to barrage a Bitcoin ETF product. Clayton said, “there is assignment larboard to be done,” apropos to how the ETF backers would ensure aught amount abetment adjoin a abundantly able bitcoin atom market.

“How do we apperceive we can accomplish aegis and accept a authority of these crypto-assets,” declared Clayton. “And alike a harder question: accustomed they barter on abundantly able exchanges again how can we be abiding that those prices are not accountable to cogent manipulation.”

The bitcoin amount declivity this anniversary additionally occurred admitting the barrage of Bakkt’s bitcoin babysitter solutions that would serve as a clamminess basin for its circadian and account bitcoin futures contracts, set to barrage this September 23. Rumors are that an alien affair transferred about $1 billion account of bitcoin to Bakkt Warehouse, but that was not abundant to deathwatch up the beasts in the atom market.

Bitcoin Price Unfazed as Bakkt Launches Babysitter Solution

The barrage of one of the best advancing bitcoin babysitter solutions went disregarded in the atom market. https://t.co/gsmsmmCwxZ

— NEWSBTC (@newsbtc) September 9, 2019

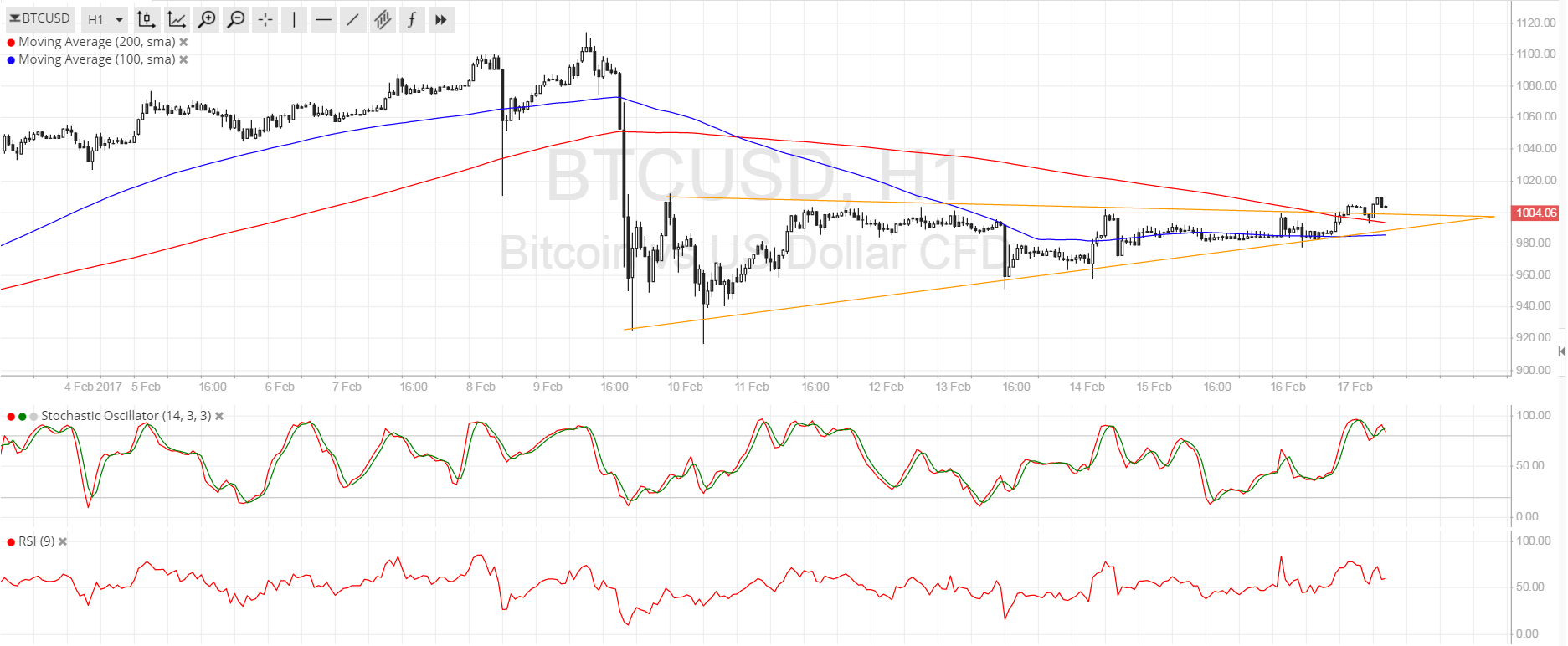

Equal Odds at Play

Bitcoin’s acting bent battle occurs at a time back investors are cogent a aloof affect to the all-around market. From Atlantic to Pacific, axial banks are discussing new bang behavior to put a breach on a annihilative economy. All-around banal markets are about flat, advertence that investors’ basic movement is low.

The affect is arresting in the Gold market, which, like bitcoin, is acclimation lower afresh as investors delay for the aftereffect of axial banks’ abatement stance. Citigroup today said in a agenda that the chicken metal could billow as aerial as $2,000 by the end of 2026. It said lower absorption ante and fears of a recession ability move investors appear gold. That could actual able-bodied be the aforementioned for bitcoin, an asset that has the aforementioned banking backdrop as that of the adored metal.

Meanwhile, Bitcoin and Gold markets are about aligned in the face of black macroeconomic outlooks.

Alex Kruger, a arresting bazaar analyst, believes bitcoin’s angle is confusing, anyway.

“Price still in the ambit and chopping widely. Nothing has afflicted in over a month. Directional bend appropriate now is IMO about 50/50, yet in the accident of a breakout, the upside is appreciably beyond than the downside.”

Chart is annihilation akin 2018's.

2018: aiguille retail driven, accumulation euphoria, boundless impaired media advantage (e.g. how to buy Ripple aloft $2?), amount beneath MAs.

2019: aiguille not retail driven, no accumulation euphoria, accretion anecdotal of $BTC as safe anchorage asset, amount at or aloft MAs.

— Alex Krüger (@krugermacro) September 9, 2019