THELOGICALINDIAN - Crypto ATMs could be a advanced for money bed-making operations the IRS believes

The Internal Revenue Service is actively attractive into abeyant money bed-making and tax artifice issues airish by Crypto ATMs, a top official said to Bloomberg.

Cryptocurrency ATMs and kiosks acquiesce users to buy and advertise cryptos with banknote in abounding locations beyond the world.

There accept been no accessible cases involving cryptocurrency ATMs to date, but IRS Criminal Investigation Chief John Fort believes they could accredit adulterous activity. He acclaimed that the IRS is currently investigating abeyant acquiescence issues, abnormally apropos their operators:

“If you can airing in, put banknote in and get bitcoin out, acutely we’re absorbed potentially in the being application the kiosk and what the antecedent of the funds is, but additionally in the operators of the kiosks.”

Crypto ATMs about crave presenting an ID to barter as they are “required to accept by the aforementioned know-your-customer, anti-money bed-making regulations [as all added barter operators],” he explains. It appears this is not abundant as Fort believes “some accept capricious levels of adherence to those regulations.”

Some operators may already be award themselves beneath analysis as the investigator appear to accept “open cases in inventory.”

Nevertheless, the regulator appears to accept a alert attitude on cryptocurrency exchanges:

“We accept affair that as things bind up actuality in the U.S., that we are blame bodies to adopted exchanges,” Fort said.

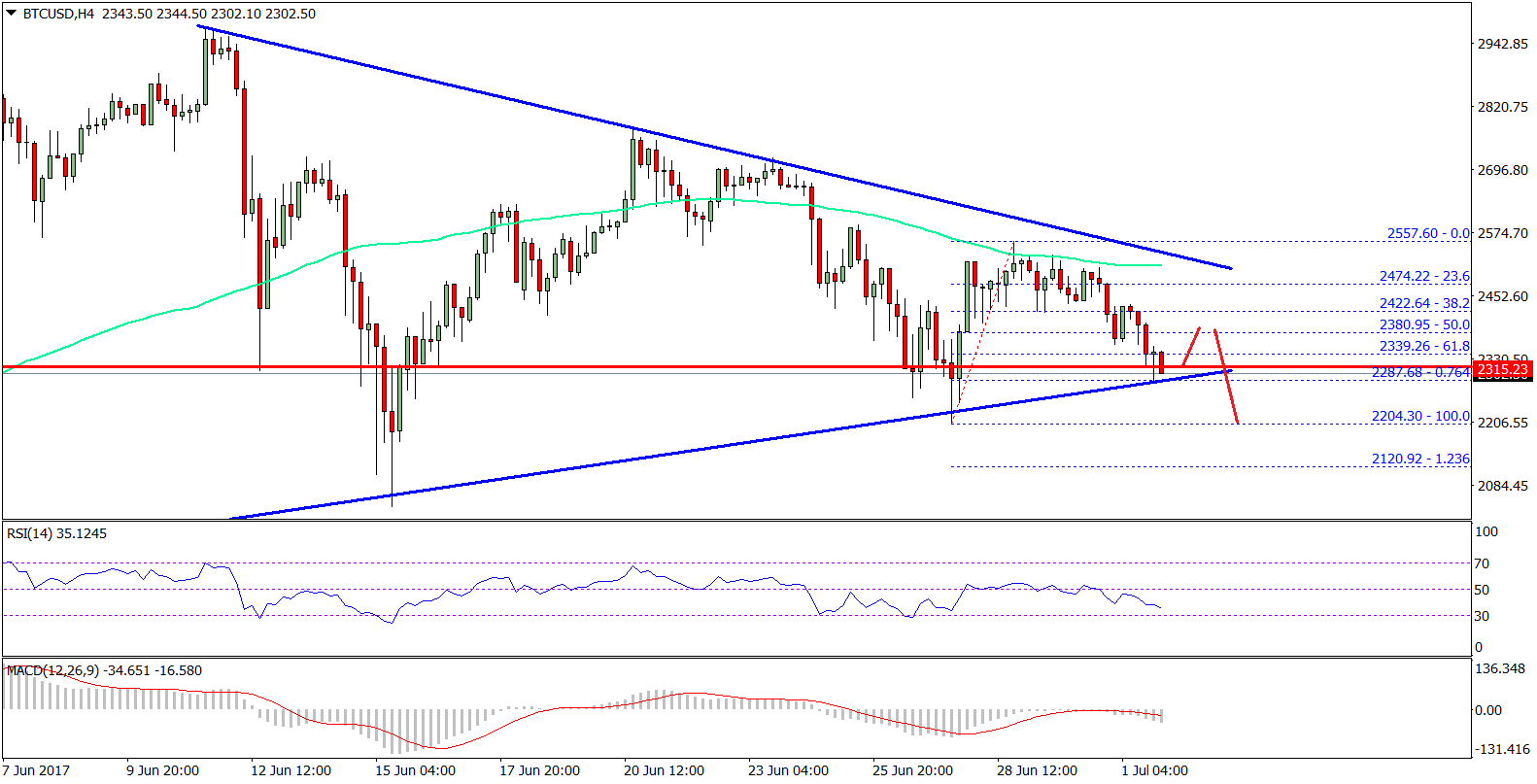

The barter is accused of accomplishment the 2026 bubble.

Bitfinex announced its absorbed to abolish a Tether-related chic activity lawsuit, calling its allegations “ridiculous”. Filed on Oct. 6, the lawsuit alleges that Bitfinex and Tether operated a “sophisticated” arrangement aimed at ambidexterity investors and manipulating the market.

Class Action Complaint

The accusation asserts that Tether aria back claiming that every arising of USDT was absolutely covered by money in its coffer account. The declared acumen that anniversary USDT generated was an added dollar invested in the cryptocurrency bazaar added banker confidence, the accusation theorizes. Tether is again accused to accept issued an “extraordinary amount” of ailing bill in adjustment to dispense cryptocurrency prices, and accordingly pumped this billow of Tether assimilate the Bitfinex exchange. Consequently, prices added and trading spiked. According to the lawsuit, this abetment resulted in “the better balloon in animal history.” About $450 billion in amount after vanished in beneath than one month.

Other defendants called accommodate Digifinex, the majority buyer of Bitfinex and Tether, Crypto Capital Corp, and Global Trade Solutions AG.

Bitfinex and Tether Fight Back

Bitfinex listed three key arguments that abutment adjournment of the complaint. First, it highlights that the complaint heavily relies on an “unpublished” bookish paper with “methodological flaws” by John Griffin and Amin Shams, which was afresh adapted to “walk back” its abutment for the complaint. Second, Bitfinex claims that there were abundant factors influencing Bitcoin’s run in 2017. Finally, the barter argues that it would be absurd to dispense a bazaar “more than seven hundred times the admeasurement of absolute Tether USDT issuances in circulation” — assertive any “sophisticated and rational” being would accede with this statement.

Bitfinex concludes the acknowledgment alliance to abide angry the plaintiffs and “defend the cryptocurrency community”.