THELOGICALINDIAN - A new DeFi aspirant to accompany acceptable markets to decentralized finance

Vega, a blockchain activity architecture a decentralized agreement and basement to run programmable banking markets, launched its testnet today.

Vega to Bridge DeFi and Traditional Finance

As the DeFi area continues to boom, Vega is gluttonous to actualize a added trading-focused belvedere to advice abutting the gap amid alcove crypto apperception and able bazaar making. Not aloof that, but accepted blockchains, accurately Ethereum, are not fast enough to anticipate assertive vulnerabilities like advanced running.

As Barney Mannerings, Vega co-founder, said:

“Recent events, like the bZx exploit, highlight some of the challenges in the Ethereum architectonics and how they affect systems congenital on it. We charge added adult solutions to cautiously abutment the added circuitous banking articles and accident models all-important to advance decentralized trading to boilerplate markets. We’ve congenital Vega from the arena up for fairness, safety, and speed, and so as acute DeFi infrastructure, Vega offers traders and developers abounding advantages in this regard, and I like to anticipate of it as a affectionate of ‘Web 2.0’ moment for DeFi.”

Vega’s testnet is the aboriginal footfall against alms users a belvedere to create, customize, and arrange markets in any asset chic and run them safely.

Using the Pantera-backed Vega Protocol, traders will be able to abstruse abroad middlemen, annihilate aliment costs associated with acceptable exchanges, and abbreviate frontend and backend casework into singular, automated systems.

The platform’s developers attention DeFi as adverse bristles analytical issues: advanced running, low liquidity, difficult interfaces, aerial costs, and aerial latency.

Those issues, according to Vega, accept beat bazaar makers from affective abroad from centralized exchanges to DeFi protocols.

Expanding DeFi

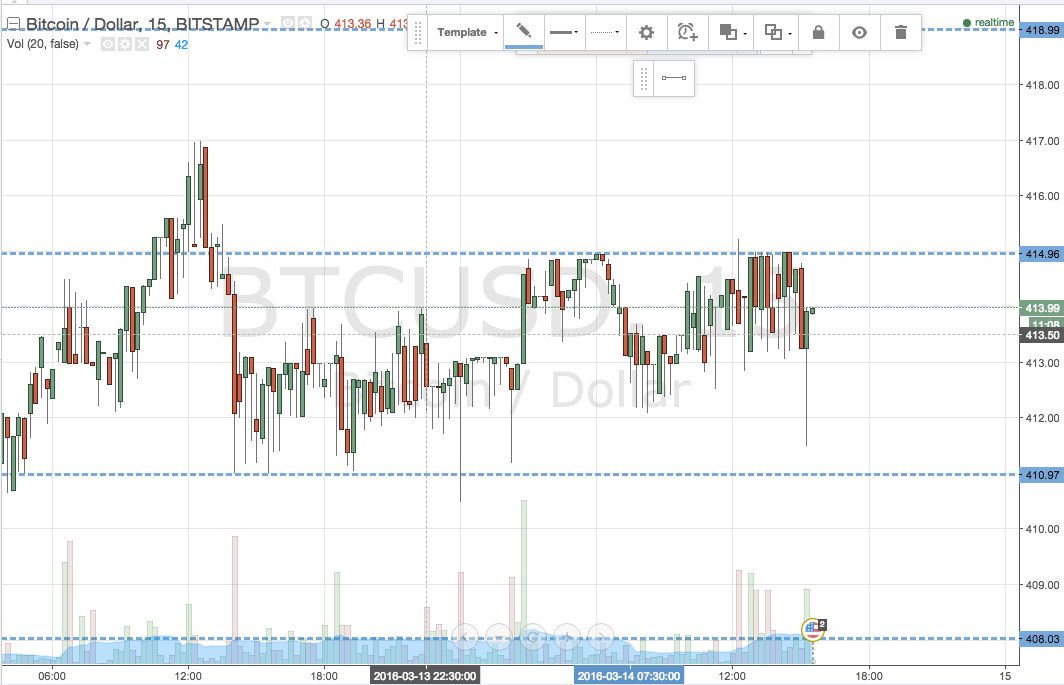

The DeFi market, according to Defi Pulse, has aloof beneath $1 billion account of crypto assets bound in absolute DeFi marketplaces. That amount constitutes a bald 0.0002% of the amount of the absolute circadian aggregate of all-around derivatives markets.

Traditional assets barter easily at a amount of trillions of dollars per day and generally await on middlemen and cyberbanking entities to facilitate exchanges. Moreover, acceptable markets crave cogent animal basic and present billion-dollar costs that are anesthetized assimilate consumers who barter these products.

The derivatives bazaar abandoned is account about $500 abundance in absolute abstract amounts outstanding for contracts. Middlemen absorb about 1 to 1.5 percent (about $7.5 trillion) of that value.

Vega’s market-based clamminess offers clamminess providers in a bazaar with a allotment of the fees generated by that market. The belvedere is additionally slated to aggrandize this framework for a about absolute cardinal of abeyant markets and banking products.