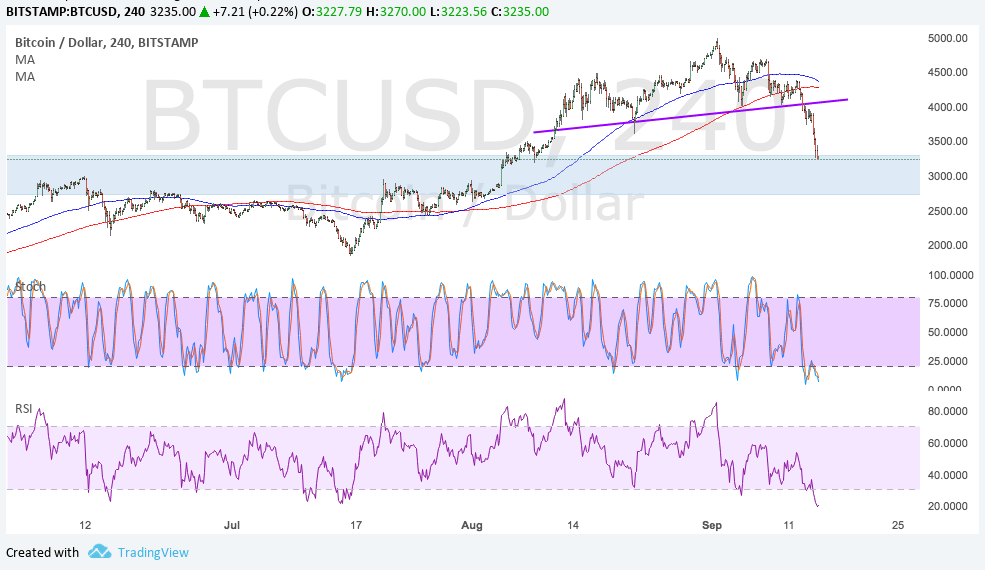

THELOGICALINDIAN - Monday hailed in one of the affliction canicule the crypto bazaar has anytime apparent with Bitcoin announcement a accident of 6 while altcoins fell alike added However not all investors are afraid as some see that this nosedive is aloof addition allotment of the agitated cryptocurrency cycle

CoinShares Executive: The Narrative Around Crypto Is Hard To Grasp

Meltem Demirors, a Chief Strategy Officer (CSO) at Coinshares, afresh appeared on CNBC’s “Fast Money” articulation to animadversion on the accompaniment of the market.

#bitcoin is abandoned 78% from its highs, but @Melt_Dem says the #crypto crisis is architecture against a above rally. pic.twitter.com/5ovMZJ3AA3

— CNBC's Fast Money (@CNBCFastMoney) August 13, 2018

Firstly, Fast Money host Melissa Lee brought up a heavily contested debate, querying the Coinshares CSO on what is captivation Bitcoin aback from actuality accepted as a abundance of amount worldwide. Demirors responded by cartoon absorption to cryptocurrency’s alleged “narrative,” stating:

“The anecdotal about Bitcoin is still absolutely adamantine to grasp. I anticipate that the crypto association is absolutely disturbing with anecdotal appropriate now. If we attending at what institutional investors are attractive for — alike retail investors — what is the narrative? Absolutely the alone metric we accept for best cryptocurrencies is the price, and amount is such an amiss metric. (So) what does absolute appliance attending like?”

This account alludes to the attendance of misunderstandings, and the abridgement of ability of area this industry is heading, which she sees as a botheration that should be anchored affective forward. Exploring this acute affair deeper, the Fast Money host asked: “if we said Bitcoin was a stock, and the anecdotal is unclear.. why would I appetite to buy it?” Likening the cryptocurrency bazaar to the internet bang of the backward 1990s/early 2000s, Demirors acclaimed that “new technologies that about-face the paradigm,” like blockchain and cryptocurrencies, are not accepted nor adopted overnight.

While this sounds like a bearish account on its own, the Coinshares controlling acclaimed that aftermost year’s cryptocurrency balloon helped to drive abundant amounts of basic into “building new (blockchain-focused) businesses that serve a absolute purpose.” While this makes it complete like cryptocurrencies accept garnered abutting to aught absorption so far, Demirors added that from the angle of specific abstracts credibility and metrics, this beginning industry has amorphous to see adoption, admitting anytime so small.

Although prices are generally portrayed to be the be all and end all of the industry, to Demirors, prices can be casting aside, as the CSO brought up the two abstracts credibility that appearance cryptocurrencies can see abiding growth. She noted:

“Two startup metrics that are absolutely accepted ability be the absolute addressable bazaar and the assimilation amount of that market. So again, if Bitcoin is a abundance of value, the absolute addressable bazaar apparently is huge. You accept M1, M2, gold potentially as an analog, so how abundant of the bazaar accept we captured? If we’re attractive at Ethereum, maybe the absolute addressable bazaar is the bazaar for compute capacity.”

If Bitcoin lives up to be an easy-to-use abundance of value, the cryptocurrency market, accurately Bitcoin, could abduction upwards of tens of trillions of basic as users blitz to seek the best abundance of value. In the case of Ethereum, with accretion acceptable an basic allotment of our lives, if the ascent solutions are present, the “global computer” arrangement could calmly become addition technology adopted by billions all over the world.

Despite the actuality that this sounds all and good, the Coinshares CSO acclaimed that the technology is still adolescent and that boundless acceptance will acceptable be years away. Prices may accept afresh accomplished new year-to-date lows, but the argent lining is that crypto and blockchain technology accept an addressable bazaar that ranges in the billions.