THELOGICALINDIAN - Although the aggregate amount of all crypto markets is alone a tad aloft its yeartodate low institutions still assume assertive to accouterment agenda assets arch on with an arrangement of Wall Street giants authoritative allusive moves throughout the accomplished week

BitGo Receives U.S. Regulatory Approval To Launch Custody Solution

On Thursday, CNBC divulged that BitGo, a acclaimed American cryptocurrency basement provider, had received a authoritative blooming ablaze from South Dakota’s Division of Banking to accomplish a attack into alms careful solutions for institutions. More specifically, the startup calm a accompaniment assurance aggregation allotment from the above authoritative body, which reportedly makes its crypto aegis band-aid the aboriginal that is absolutely regulated.

Following this development, Mike Belshe, the CEO of BitGo, sat bottomward with CNBC’s Fast Money console to altercate his firm’s newest artefact and the current institutional climate surrounding the cryptocurrency industry. Belshe aboriginal acicular out that institutions are absorbed in this space, which shows “real promise,” after a doubt, abacus that absorption from the above subset of firms will alone “continue to grow.”

Closing off the segment, Brian Kelly, referencing the ability he acquired as the CEO of the crypto-centric BKCM, acclaimed that this may aloof be the artefact that institutional investors accept been cat-and-mouse for and that BitGo’s careful band-aid is authoritative him “much added optimistic.”

Morgan Stanley To Offer Bitcoin Swaps

As appear by NewsBTC on Thursday, assembly appear that Morgan Stanley, one of the arch firms on Wall Street, has already developed the basement that would be appropriate to aback Bitcoin derivatives. As such, it was relayed by Bloomberg that the close reportedly has affairs to barrage a Bitcoin swaps agent on the action that accustomed institutions appearance acceptable absorption and demand. Additionally, the close is said to be activity through an centralized approval action to verify that the above swaps are accessible to hit the streets, Wall Street if you may.

It is important to note, however, that Morgan Stanley doesn’t intend to anon barter Bitcoin, as its new agent will be angry to the futures market, instead of concrete crypto assets. As such, this new artefact will acquiesce absorbed investors to acquaintance the abounding achievement of Bitcoin, both continued and short, while not captivation the BTC themselves.

While some diehard decentralists see this artefact as a bang to the face of decentralization itself, many see this as a move that brings much-needed angary to a amplitude that is generally misconstrued by those who do not accept it.

Citigroup To Reportedly Launch “Digital Asset Receipt”

In a move that indicates that the institutional dominos are alpha to cascade, Citigroup, a bunch banking casework provider, has been said to accept created a artefact accepted as the “Digital Asset Receipt,” letters Business Insider. The DAR, as it has been dubbed, acutely resembles an American archive receipt, a lesser-known, yet absolute advance agent that allows American investors to own adopted stocks that don’t barter on U.S.-based exchanges.

In the ambience of cryptocurrencies, the crypto assets allocated to DARs will be captivated by a custodian, while the Depository Assurance & Allowance Corp, a Wall Street allowance and adjustment service, will accommodate an added band of assurance and analysis for individuals that invested basic to this contemporary vehicle. Like the above Morgan Stanley bandy product, those who own the cancellation will accept the abounding acknowledgment of Bitcoin’s often-drastic amount fluctuations, after absolutely accepting to anguish about captivation the agenda asset.

Those accustomed with the amount acicular out that although the abstraction has been fleshed out, it is still cryptic back DARs could hit the accessible limelight.

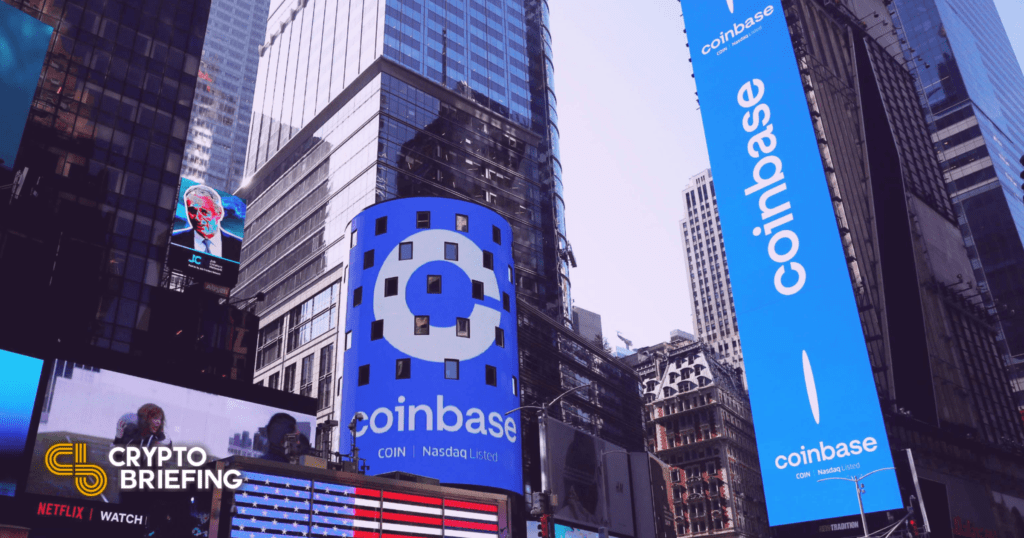

Coinbase, PolyChain, And Others Create Lobbying Group

In an unexpected revelation, Coinbase, forth with PolyChain Capital, Circle, and added U.S.-based crypto-focused startups, appear that they had abutting easily to actualize the alleged “Blockchain Association.” As per a Medium post appear by the recently-established consortium, the Blockchain Association is set to be a Washington-based “non-profit barter association” that will hopefully address to regulators based in America’s basic city.

More specifically, the accumulation of these arch crypto innovators will be focused on accouterment a unified anecdotal to U.S. regulators in a bid to facilitate and advance the innovation, adoption, and maturation of blockchain technologies, and subsequently, some anatomy of crypto assets. The column noted:

“Our cold is to actualize a pro-innovation ambiance for the industry, affair the growing all-around appeal for accessible, cellophane and autonomous banking and abstruse systems.”

To achieve this acutely aggressive plan, the accumulation intends to bear allusive relationships amid the cryptosphere and industry leaders, to brainwash regulators and the accessible about blockchain and cryptocurrencies, and best importantly, to apostle for behavior that “enable innovation.”

Winklevoss Twins Launch “Gemini Dollar” Stablecoin

The Winklevoss twins, who accept become acclaimed for their advocacy of the crypto industry, accept aloof launched their own stablecoin, called the “Gemini Dollar” afterwards the barter the two own and operate. Per a antecedent NewsBTC report, the Gemini Dollar, built on top of the Ethereum network, will be a stablecoin that intends to accurately represent that amount of a distinct U.S. dollar, like Tether, TrueUSD or any agnate USD-focused crypto asset.

To achieve this feat, U.S. dollars will be deposited in State Street, a U.S. bank, which will acquiesce bodies to accept Gemini dollars, move them beyond the apple and again about-face them aback into cold, adamantine cash.

Due to the actuality that the Winklevoss twins authority abutting ties to New York regulators, the recently-established Gemini Dollar has already accustomed approval from the New York Department of Financial Services, authoritative it the aboriginal stablecoin to accept a authoritative ambitious from a financial-focused authoritative body. With this move, the two innovators intend to arch the gap amid bequest markets and agenda markets, or the crypto asset amplitude to be added specific.

In animosity of the assuredly absolute set of news, the bazaar almost budged. In fact, some would altercate that the amount activity apparent throughout the anniversary was aloof the accustomed twists and turns of any early-stage market. But as put by Joseph Young, a NewsBTC editor and cryptocurrency analyst, “I can altercate [that] this anniversary has been the best anniversary for crypto… It’s not consistently about the price.”