THELOGICALINDIAN - Although the accomplished anniversary was rather quiet for the cryptocurrency industry the amount activity apparent throughout the accomplished few canicule seems to acquaint a altered adventure with Bitcoin trading aural a ample 1400 range

SEC Shoots Down VanEck ETF Proposal, Issues 45 Day Delay

On Tuesday afternoon, the SEC appear a certificate absolute that it would be delaying its verdict of the VanEck and SolidX Bitcoin ETF by 45 days. In a two-page document, the American authoritative anatomy accent the actuality that it was exercising its appropriate to adjournment such a decision, from the aboriginal date of August 16th to September 30th. Despite the actuality that the SEC didn’t absolute abjure the proposal, some alert investors saw this of a premature assurance of what was to appear back the final adjudication rolls about.

Jake Chervinsky, an American advocate alive in the cryptosphere, appear an astute cheep apropos his opinions on the ETF and its position with the SEC. Chervinsky, who keeps an ear to the arena in this industry, acclaimed that he expects for the SEC to affair addition addendum until December 29th. In a cheep in the aforementioned thread, the advocate predicted that if the authoritative anatomy “instituted proceedings,” that a disapproval of the angle would be added than likely.

Expected result, beforehand than accepted execution.

New deadline: Sunday, September 30, absolutely 45 canicule from the above-mentioned borderline of August 16. I had predicted October 1, cerebration the SEC would backpack the borderline over to the abutting Monday.

I apprehend addition addendum to December 29. https://t.co/dzHq9W6xU4

— Jake Chervinsky (@jchervinsky) August 7, 2018

As a aftereffect of aggressive bearish speculation, the bazaar saw a quick sell-off, with the amount of Bitcoin bound bottomward through the key abutment at $6,800. Altcoins followed carefully behind, announcement agnate losses in agreement of percentage. Nonetheless, CNBC crypto analyst Brian Kelly acclaimed that the bazaar acknowledgment to this adjudication was irrational, stating:

“We’ve had this big runup, we’ve had a little bit of a sell-off today. If you are affairs today afterwards this decision, its the amiss way to do crypto investing.”

While some investors booty Kelly’s statements with a compression of salt, this account alludes to the analyst’s longer-term achievement for this beginning market.

Goldman Sachs Could Launch Crypto Custody In The Near Future

Cryptocurrency custody solutions are apparent by abounding as the abutting footfall for institutional adoption, with such casework abatement bequest bazaar firms into this (relatively) foreign industry. As Bloomberg reports, Goldman Sachs, which is unarguably one of the best admired firms on Wall Street, may accomplish a attack into the aegis sub-industry. This abrupt account alone comes a few months afterwards the New York-based advance behemothic began the trading of Bitcoin futures on account of its clients.

The account of this hasty account comes address of Goldman insiders, who added that there isn’t a absolute timeline for the abeyant development of such a service. While aegis doesn’t complete like abundant independently, some users accepted that the acknowledged barrage of aegis may attract the banking casework close to barrage added crypto-focused ventures in the abreast future.

In acknowledgment to a Bloomberg query, a Goldman Sachs agent neither accepted nor denied the actuality of such a plan, stating:

“In acknowledgment to applicant absorption in assorted agenda articles we are exploring how best to serve them in this space. At this point we accept not accomplished a cessation on the ambit of our agenda asset offering.”

As covered in the antecedent Crypto Week In Review, Goldman is not the alone acceptable markets close to appearance absorption in custody, as Chicago-based Northern Trust bidding a agnate absorption for aegis while speaking with Bloomberg.

Binance’s CEO Reveals Pre-Alpha Version Of Binance’s Decentralized Exchange

In mid-March, Binance, the world’s foremost cryptocurrency platform, appear the conception of the Binance Chain project. In the announcement, the belvedere accent its move appear the development of a decentralized exchange. But in the months afterward Binance Chain launch, the close went quiet, activity assorted months after a absolute update. However, in a contempo tweet, Binance CEO Changpeng Zhao provided his followers with a video of the “rough, pre-alpha” adaptation of the Binance Decentralized Barter (DEX).

A aboriginal (rough, pre-alpha) audience of the Binance Decentralized Exchange (DEX), assuming issuing, advertisement and trading of tokens. All cli based, no GUI yet. A baby footfall for #BinanceChain, a big footfall for #binance. https://t.co/2aXkR0gclP

— CZ Binance ??? (@cz_binance) August 9, 2018

As this is annihilation but a “pre-alpha” release, Zhao told his admirers not “to apprehend too much,” highlighting the actuality that no graphical user interface had been created as of yet. Although it may accept looked asperous about the edges, a Binance developer auspiciously showed off three appearance that are capital for any admirable DEX.

While abounding were quick to casting abreast this development, CZ sees this as “a baby footfall for Binance Chain, (but) a big footfall for Binance.”

From what was seen, it has become credible that all seems to be alive according to Binance’s plan. But until Binance releases a adaptation accessible for accessible consumption, it charcoal to be credible whether the DEX can handle an arrival of aggregate and users.

Robinhood, Bittrex, and Coinbase All Add ETC/USD Support

Whilst the bazaar has had a bearish week, the Ethereum Classic project experienced an arrival of bullish news, namely the accession of ETC assimilate three arresting exchanges. First came Coinbase, who had appear the affiliation of ETC about two months afore the absolute advertisement occurred. On Friday, August 3rd, Coinbase appear that its engineering aggregation had entered the final testing appearance for Ethereum Classic, assured this date to be completed by August 7th.

Staying on schedule, Coinbase launched Ethereum Classic support for its professional-focused belvedere on August 7th. But for now, fully-fledged trading appearance will not be accessible for all Coinbase customers, as the Californian crypto startup intends to affair a one to two-week trading adjournment for users of Coinbase Consumer (coinbase.com).

ETC-USD, ETC-BTC and ETC-EUR adjustment books are now in abounding trading mode! Limit, bazaar and stop orders are all now accessible beyond all ETC trading pairs. https://t.co/kmOI6HQj7E

— Coinbase Pro (@CoinbasePro) August 9, 2018

Up abutting was Robinhood, the fee-less cryptocurrency belvedere that adaptable traders accept appear to love, who alien Ethereum Classic as its 7th accurate crypto asset. For now, Robinhood traders will be clumsy to drop or abjure ETC to the platform. But accomplish no mistake, Robinhood advisers are accomplishing their best to apparatus wallet abutment for this early-stage adventure into the cryptocurrency market.

Last but not least, Seattle-based Bittrex appear a new ETC/USD trading pair, which is one of the exchange’s aboriginal forays into fiat-to-crypto (and vice-versa) support. ETC now joins Bittrex’s absolute calendar of fiat-supported cryptocurrencies, which accommodate BTC, ETH, USDT, TUSD, and XRP.

While abounding saw these listings as a absolute assurance for ETC, this arrangement of absolute developments has had no discernable aftereffect on the amount of the asset so far. So for now, it seems that Ethereum Classic proponents will accept to booty the abounding burden of the bitter bazaar conditions.

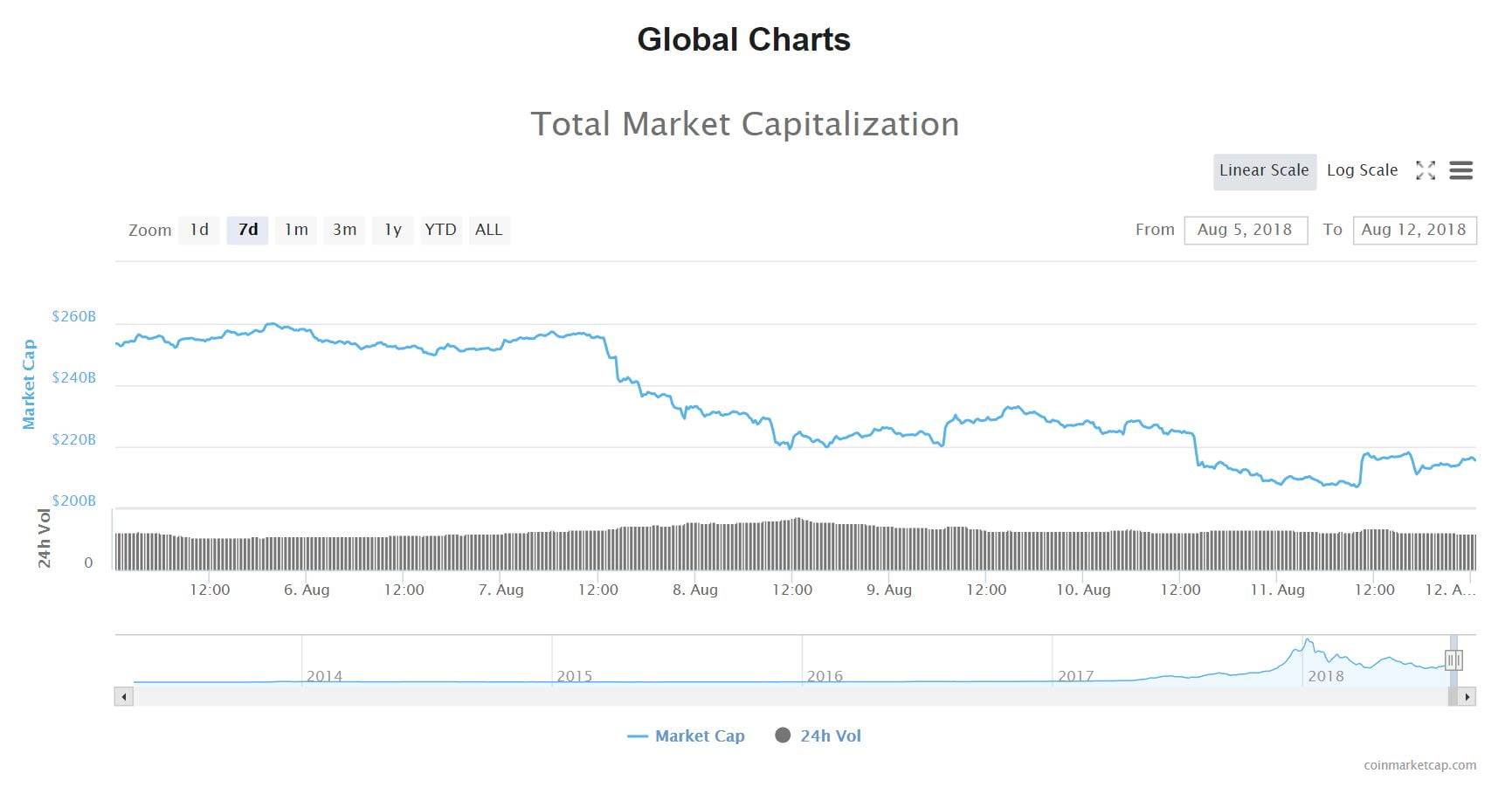

Market Tumbles To New Year-To-Date Lows, Investors Remain Hopeful

The cryptocurrency bazaar was already in a bearish accompaniment afterward the Winklevoss ETF denial, but as the best contempo SEC advertisement advance through the industry on Tuesday, aggregate began to avalanche added downwards, with Bitcoin rapidly affective beneath $6,800. For a abbreviate aeon of time, some anticipation that Bitcoin begin a abode to angle at the $6,500 level, but as sell-side affect continued, Bitcoin was accountable to a alternation of movements that placed the amount of the asset at a new account low of ~$6,050. Despite the actuality that abounding anticipation that $5,800 was the abutting stop for the Bitcoin train, for now, the alternation has been met with some resistance, as the bazaar has begin a foothold, admitting anytime so small, aural the $6,300-$6,400 range.

While Bitcoin’s blueprint may look afflictive enough, altcoins arguably had it worse, with assets like Ethereum, Litecoin, Bitcoin Cash, EOS and XRP announcement losses of 15% or more. This altcoin sell-off resulted in Bitcoin’s dominance surging to the accomplished it has been in eight months, at a amazing 50.9% on Saturday night.

This altcoin accedence has additionally resulted in the cryptocurrency bazaar establishing a new year-to-date low, with the aggregate appraisal of all crypto assets briefly affective beneath the $210 billion mark.

However, in a absolute bucking to this desperate pullback, some industry leaders still authority bullish sentiment. Dan Morehead, Pantera Capital’s CEO and co-founder, alleged this move downwards an “overreaction” to the above SEC verdict, implying that the bazaar could affectation a accretion shortly. The crypto armamentarium CEO additionally acclaimed that investors should activate to focus on the absolute news, instead of the bearish. While abounding may be agnostic of what Morehead has to say, as banal advance authority Warren Buffet already said, “be aflutter back others are acquisitive and acquisitive back others are fearful.”