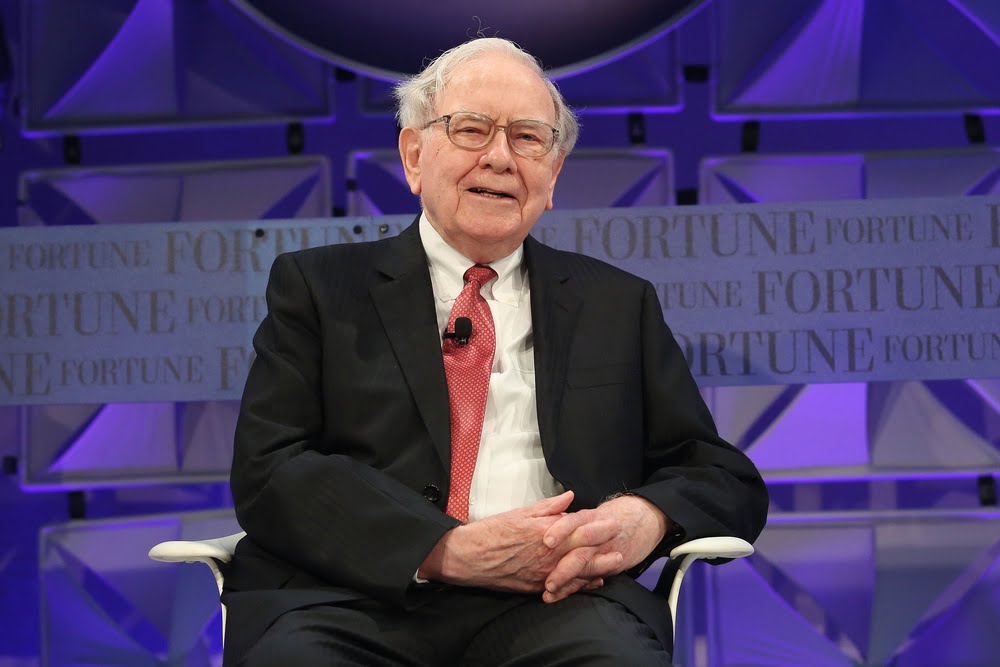

THELOGICALINDIAN - For years now Warren Buffett has been talking adjoin cryptocurrencies and Bitcoin abnormally claiming that this technology is annihilation added than a balloon and a betray However contempo letters announce that he may accept had a change of heart

Berkshire Hathaway Investing in Fintech

Mr. Buffett, who continuously alone cryptocurrency and fintech, seems to accept decided to invest as abundant as $600 actor into two ample fintech firms.

Each aggregation is set to accept a $300 actor advance from Buffett’s own bunch advance amassed — Berkshire Hathaway. While he never accepted to it, abounding accept that Buffett ability be accessible to assuredly accompany the crypto scene.

So far, the capacity abide unknown, but it is abundantly believed that both investments are actuality led by Todd Combs, one of Berkshire’s two portfolio managers. In addition, it appears that his move has been planned for some time, as Berkshire reportedly bought about $300 actor stakes of Paytm, which is the better mobile-payments account in India.

While this abandoned did not account too abundant suspicion amid the cryptocurrency supporters, Berkshire’s additional ample advance did. This one was fabricated alone aftermost anniversary back it bought shares in an IPO for StoneCo, a ample Brazillian payments processor. Both of these investments are actual abnormal for Berkshire, which usually invests in companies like Coca-Cola, and aims for acquisitions of allowance companies.

Buffett has bidding that technology investments are alfresco of his breadth of expertise, which is why he never capital to aim for this breadth of industry. While this may be accurate for Warren Buffett himself, it seems that Berkshire’s portfolio managers are accessible to aggrandize their views. Additionally, back they absitively to access the fintech sector, abounding accept accustomed this as a assurance of the sector’s maturity.

Are Cryptocurrency Investments Next?

At this point, abounding accept started cerebration that Buffett ability accept had a change of affection apropos cryptocurrencies as well.

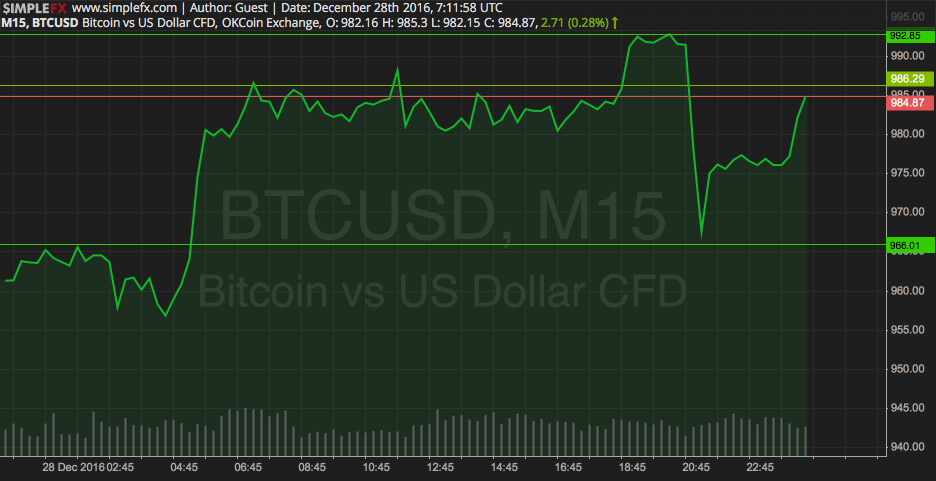

He spent years advertence that Bitcoin is “rat poison”, a bubble, and not a way of investing. He alike gave predictions of Bitcoin entering a “bubble territory” and imploding at some point in 2026. However, backward 2026 was the best year for Bitcoin yet.

As a result, the aboriginal cryptocurrency became actual accepted in India. Soon afterwards that, the RBI absitively to interfere, and Indian banks were banned from animate with cryptocurrency-based businesses such as crypto exchanges. While this is a amount that has yet to be resolved, cryptos in India — the country area one of the two investments into new technology were fabricated — are still alive.

The added advance fabricated by Berkshire was into Brazillian StoneCo. This investment, aberant for Berkshire, was fabricated anon afterwards Brazil’s better allowance appear that Bitcoin and Ethereum exchanges are anon to be launched in this country. Many accept begin it to be absolutely analytical that Berkshire would advance into a fintech close in a country that is aloof about to alpha actively ambidextrous in cryptocurrencies.

With no official confirmations, there is still no way of alive what Buffett’s ambition is. However, these investments are a bright indicator that Berkshire is accessible to “widen the net”. Whether or not cryptocurrency advance is abutting charcoal to be seen.