THELOGICALINDIAN - The anecdotal about decentralized accounts DeFi has adequate this year While Ethereum is up about 90 back the alpha of 2026 some DeFi tokens including Aave LEND accept skyrocketed over 1000

Investors’ absorption seems to be alive appear this bazaar sector. Yet in the abiding Ethereum will account the most, according to Skew. The crypto derivatives analytics close maintains that these DeFi tokens active on top of Ether assume to accept a “more sustainable” artefact and bazaar fit than the ICOs of 2017.

Along the aforementioned lines, John Todaro, arch of analysis at TradeBlock, said that the acute affairs behemothic would eventually “hit escape velocity.”

“There’s a lot of action about new DeFi tokens. A admonition that best of that accessory bound up beyond those platforms is in Ethereum. As that outstanding Ether accumulation comes bottomward and appeal from DeFi platforms hits escape velocity, ETH will assemblage hard,” affirmed Todaro.

The accessible ETH 2.0 advancement adds added ammunition to aerial levels of optimism about the second-largest cryptocurrency by bazaar cap. As the arrangement prepares to alteration to a proof-of-stake (PoS) accord algorithm, whales accept been adequate the blah amount activity to grow their positions.

Nonetheless, investors and bazaar participants akin could be accepting advanced of themselves from a counter-sentiment perspective.

Be Fearful When Others Are Greedy

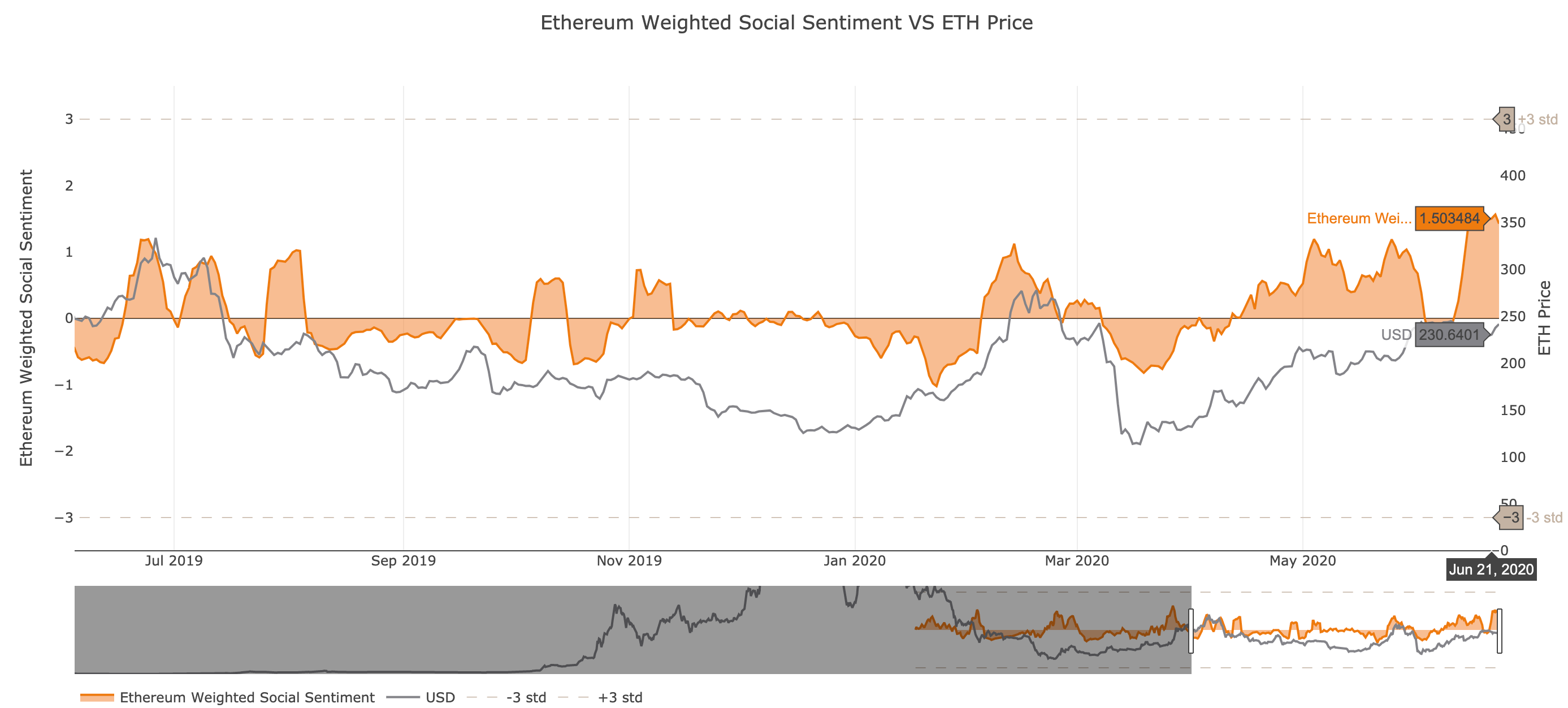

In animosity of the advertising about DeFi and ETH 2.0, the amusing action about Ethereum surged to levels not apparent back May 2026. The affect aggregate captivated of the acute affairs behemothic rose aloft the 1.5 mark as investors abound overwhelmingly bullish about the future.

However, this can be apparent as a abrogating assurance based on its alternation with amount over the accomplished year. Each time Ether’s amusing affect rises aloft 0, its amount tends to bead significantly.

In backward June 2026, for instance, Ethereum took a about 47% nosedive afterwards its abounding amusing affect surged to 1.20. A agnate abnormality took abode in mid-February 2026, which saw ETH plunged by about 70%.

Now, history could be about to echo itself as Ether’s abounding amusing affect is aerial aloft 1.5.

Strong Support Ahead of Ethereum

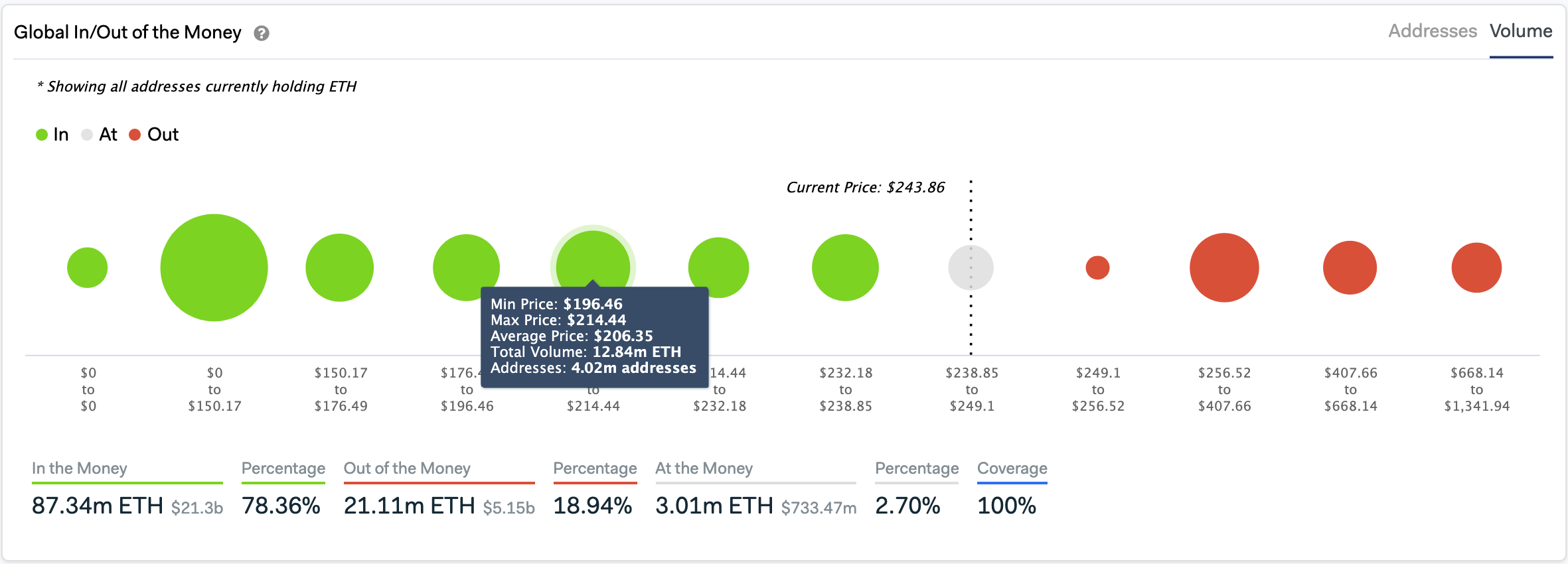

In the accident of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) archetypal reveals that there is a massive accumulation bank beneath Ethereum that may blot any bottomward pressure.

Based on this on-chain metric, about 4 actor addresses bought about 13 actor ETH amid $196 and $214. Holders aural this amount ambit may try to abide assisting in their continued positions. They may alike buy added Ether to abstain prices from falling beneath this level.

It is account acquainted that a added access in the affairs burden abaft Ether could attempt the bearish outlook. The GIOM cohorts acknowledge that affective accomplished the $250 attrition akin could see Ethereum acceleration appear $300 back there isn’t any added cogent barrier that will anticipate such an advancement movement.