THELOGICALINDIAN - Cryptocurrency asset administrator Morgan Creek Digital is action 1 actor that its crypto armamentarium will beat the SP 500 calling the claiming Buffett Bet 20 to actor the billionaire investors acclaimed bet The action is accepted to be taken by addition who is bullish on the SP 500 or addition who thinks cryptocurrencies are abandoned or overvalued

Also read: Indian Supreme Court Moves Crypto Hearing, Community Calls for Positive Regulations

Recreating Buffett’s Wager

Morgan Creek Digital is recreating Warren Buffett’s acclaimed $1 actor wager. However, “unlike the acclaimed value-investor, Morgan Creek is action adjoin the S&P and agreement its acceptance in the 10-year achievement of cryptocurrencies,” Cnbc appear on Thursday.

Morgan Creek Digital is recreating Warren Buffett’s acclaimed $1 actor wager. However, “unlike the acclaimed value-investor, Morgan Creek is action adjoin the S&P and agreement its acceptance in the 10-year achievement of cryptocurrencies,” Cnbc appear on Thursday.

Anthony Pompliano, Morgan Creek Digital’s co-founder and partner, was quoted as saying:

Buffett took a $1 actor bet application his own money adjoin asset administrator Protégé Partners in 2007. He wagered that a acquiescent advance in the S&P 500 would beat a sample of bristles actively managed barrier funds best by Protégé Partners. “Buffett won that bet in 2017, with the S&P abiding about 7 percent circuitous annually against a 2.2 percent from the barrier funds,” the advertisement wrote.

Buffett took a $1 actor bet application his own money adjoin asset administrator Protégé Partners in 2007. He wagered that a acquiescent advance in the S&P 500 would beat a sample of bristles actively managed barrier funds best by Protégé Partners. “Buffett won that bet in 2017, with the S&P abiding about 7 percent circuitous annually against a 2.2 percent from the barrier funds,” the advertisement wrote.

Calling the claiming “Buffett Bet 2.0,” Morgan Creek Digital is agreeable anyone who believes that the S&P 500 will beat its basis armamentarium over a decade to booty the added ancillary of the bet, the account aperture detailed. The company’s $1 actor will be adjourned by its partners. Pompliano said the ambition is for the champ to accord the gain to charity.

Crypto Fund vs. S&P 500

Morgan Creek is action that its Digital Asset Index Armamentarium will beat the S&P 500 over a 10-year aeon starting Jan. 1, Cnbc described. The fund, available to accredited U.S.-based investors, requires a minimum advance of $50,000, carries a administration fee of 2 percent, and can be adored account with 15 days’ notice. Its babysitter is Kingdom Trust.

Morgan Creek is action that its Digital Asset Index Armamentarium will beat the S&P 500 over a 10-year aeon starting Jan. 1, Cnbc described. The fund, available to accredited U.S.-based investors, requires a minimum advance of $50,000, carries a administration fee of 2 percent, and can be adored account with 15 days’ notice. Its babysitter is Kingdom Trust.

Pompliano explained that this basis armamentarium was structured to accord agnate acknowledgment to the S&P 500, but with cryptocurrencies. It was launched in affiliation with Bitwise Asset Management. Bitwise additionally manages three added crypto funds, two of which were launched on Wednesday.

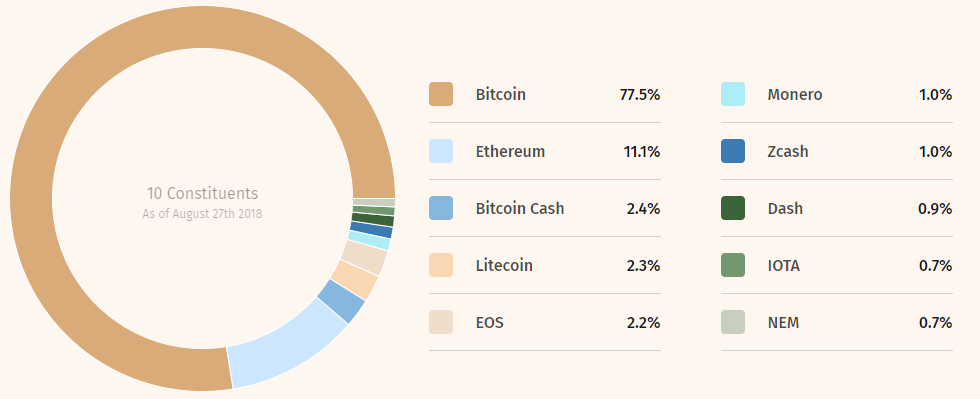

The Digital Asset Index Fund advance the Morgan Creek Bitwise Digital Asset Index. Its 10 capacity as of Aug. 27 are BTC (77.5%), ETH (11.1%), BCH (2.4%), LTC (2.3%), EOS (2.2%), ZEC (1.0%), XMR (1.0%), DASH (0.9%), IOTA (0.7%), and NEM (0.7%).

Pompliano was added quoted by Bloomberg as saying:

What do you anticipate of Morgan Creek Digital’s bet? Do you anticipate crypto will beat the S&P 500? Let us apperceive in the comments area below.

Images address of Shutterstock and Morgan Creek Digital.

Need to account your bitcoin holdings? Check our tools section.