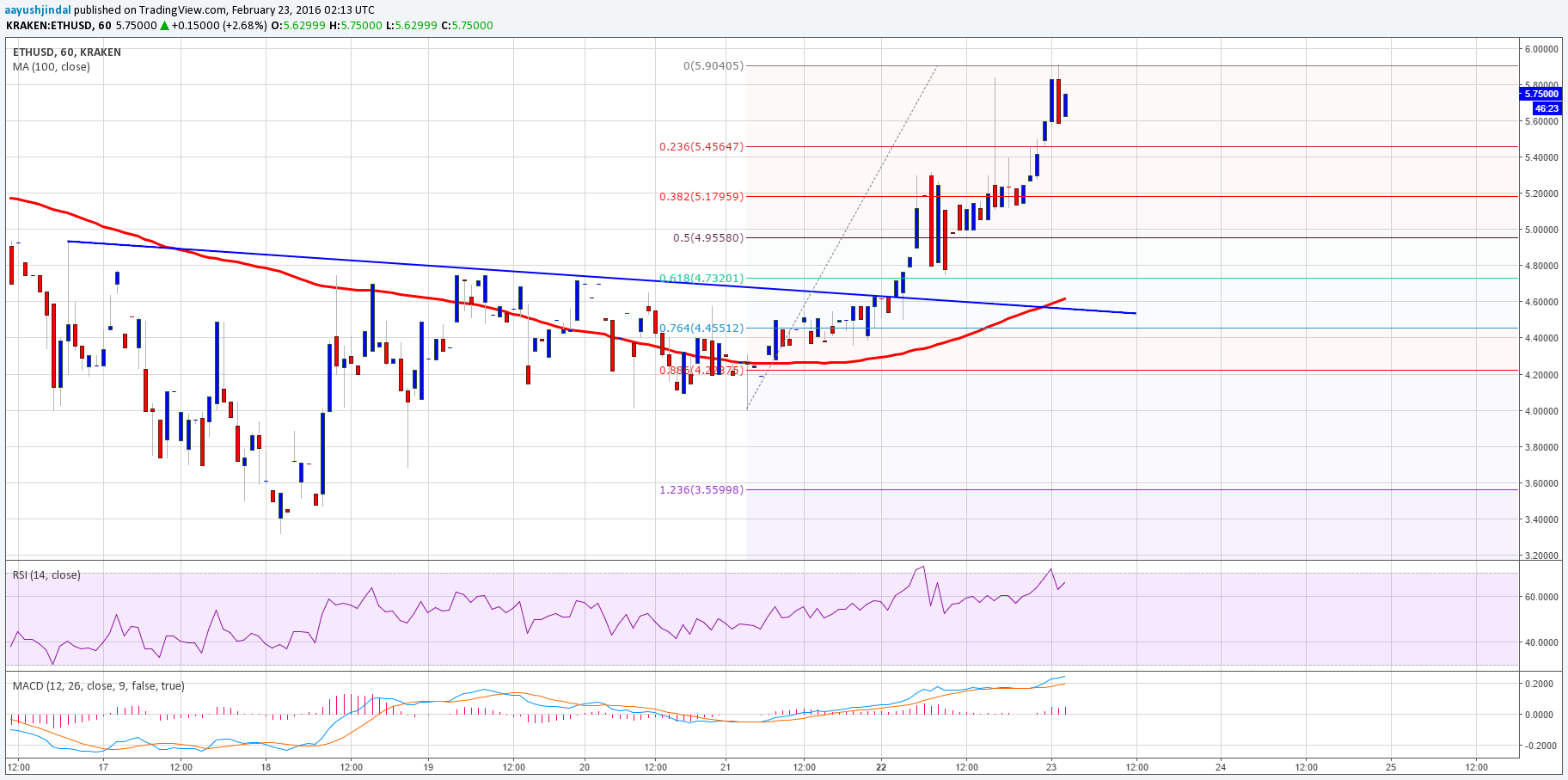

THELOGICALINDIAN - Futures affairs on bitcoin banknote can be accessible at a CFTCregulated barter by the end of this year or the aboriginal division of 2026 This will acquiesce institutional US investors to barter on a acquired of the cryptocurrency and accompany in added trading aggregate for BCH overall

Also Read: HTC Adds Native Bitcoin Cash Support to Its Flagship Smartphone

Bitcoin.com Champions Bitcoin Cash Futures

Bitcoin.com is in discussions about advertisement a bitcoin banknote (BCH) futures arrangement on a new barter with approval from the U.S. Commodity Futures Trading Commission (CFTC). David Shin, the arch of the barter business at Bitcoin.com, expects the new apparatus can ability the bazaar by the end of the year, or the aboriginal division of 2020, and that it will be cash-settled on day one.

The ambition of accepting a BCH futures arrangement on a CFTC-regulated area is to accessible up the U.S. bazaar so that added institutional traders can accretion acknowledgment to the cryptocurrency and appropriately accomplish college trading volumes in total. Additionally, there is absorption from some retail brokers in alms trading on such a adapted instrument, and Shin is additionally in talks with them about the possibility.

“We are in altercation with a US barter that will anon be CFTC accustomed to account a BCH futures arrangement to actualize greater appeal for BCH and access trading volumes,” Bitcoin.com CEO Stefan Rust explains. “There are two capital affidavit abaft this. First, with BCH futures, institutions will be able to administer the acknowledgment to bazaar animation bigger and accordingly assure funds beneath administration better, and appropriately admeasure a beyond allocation of their funds to BCH. Second, with this artefact BCH is additionally accessing a new US banking casework bazaar through futures that is CFTC regulated. This is a massive bazaar that’s new to BCH. Both of these drive up volumes which in about-face drives up appeal for BCH which will advance to an access in bazaar value. This is abundantly apprenticed by futures volumes in the US bazaar accretion appeal and ultimately the value.”

Regulators Keep US Market Behind in Crypto Adoption

The Chicago Mercantile Exchange (CME Group) does action financially-settled BTC futures affairs for U.S. investors. However, by all-around comparison, American regulators accept fabricated it actual difficult for investors to admission the all-around cryptocurrency bazaar with ETFs and the aforementioned is accurate for derivatives. For example, a cardinal of companies accept been alive adamantine to barrage adapted physically-delivered bitcoin futures affairs in the U.S., but their efforts accept so far been bedfast by the CFTC.

Last ages the CEO of Ledgerx, Paul Chou, had to abjure the account that his aggregation went alive with bitcoin futures for retail trading afterwards it accustomed authoritative approval for swaps. Ledgerx launched its institutional trading belvedere aback in 2017 and has been cat-and-mouse anytime back for the specific CFTC approval for the instrument. He additionally complained that the regulators were not accomplishing their job and threatened to sue the CFTC for anti-competitive behavior and aperture of duty.

Another trading belvedere afresh accustomed by the CFTC for physically-delivered bitcoin futures is TD Ameritrade-backed Erisx. However, the best advancing area to access the bazaar is Bakkt, the agenda assets accessory of New York Stock Exchange parent, Intercontinental Exchange (NYSE: ICE).

Back in 2026 ICE appear that the Bakkt Bitcoin Daily Futures Contract would alpha trading on Dec. 12, 2026. This has not happened, and the barrage date has been pushed aback afresh and again. The acumen for this according to media letters is the call of acquiescence with bulky CFTC demands. If annihilation changes again, Bakkt is now accepted to accompany concrete commitment futures affairs to bazaar participants in added than 30 countries by the end of 2026.

The International BCH Derivatives Market

Besides some of the better players in the acceptable accounts markets aggravating to access the cryptocurrency derivatives business, we accept additionally apparent companies from the agenda assets industry focus on bushing the aforementioned niche. Among those crypto trading venues who started alms bitcoin banknote derivatives to their traders we can account Bitmex, U.K. FCA-regulated Crypto Facilities, Hong Kong-based Coinflex and Huobi Derivative Market (Huobi DM). While these types of exchanges are a acceptable advantage for accomplished crypto traders to get into awful leveraged continued and abbreviate positions on BCH, they don’t accept the all-around cast ability of actuality CFTC-regulated, which will serve as a above allowance of approval for the cryptocurrency in the eyes of afraid investors already they barrage bitcoin banknote futures.

Bitcoin.com has already been acknowledged in authoritative BCH instruments added attainable to acceptable investors about the world. Amun AG, a Swiss aggregation facilitating admission to crypto asset investments, announced in July that it had listed the aboriginal barter traded artefact (ETP) tracking the achievement of bitcoin banknote on Switzerland’s arch banal exchange. The Amun Bitcoin Banknote ETP is a absolutely collateralized artefact that is denominated in U.S. dollars and has an anniversary broker fee of 2.5% that includes custody, insurance, and re-balancing fees. This crypto advance apparatus was seeded with 25,000 BCH from Bitcoin.com Executive Chairman Roger Ver.

What do you anticipate about the abeyant for CFTC-regulated bitcoin banknote futures to accessible up the institutional U.S. market? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Bitcoin.com Markets, addition aboriginal and chargeless account from Bitcoin.com.