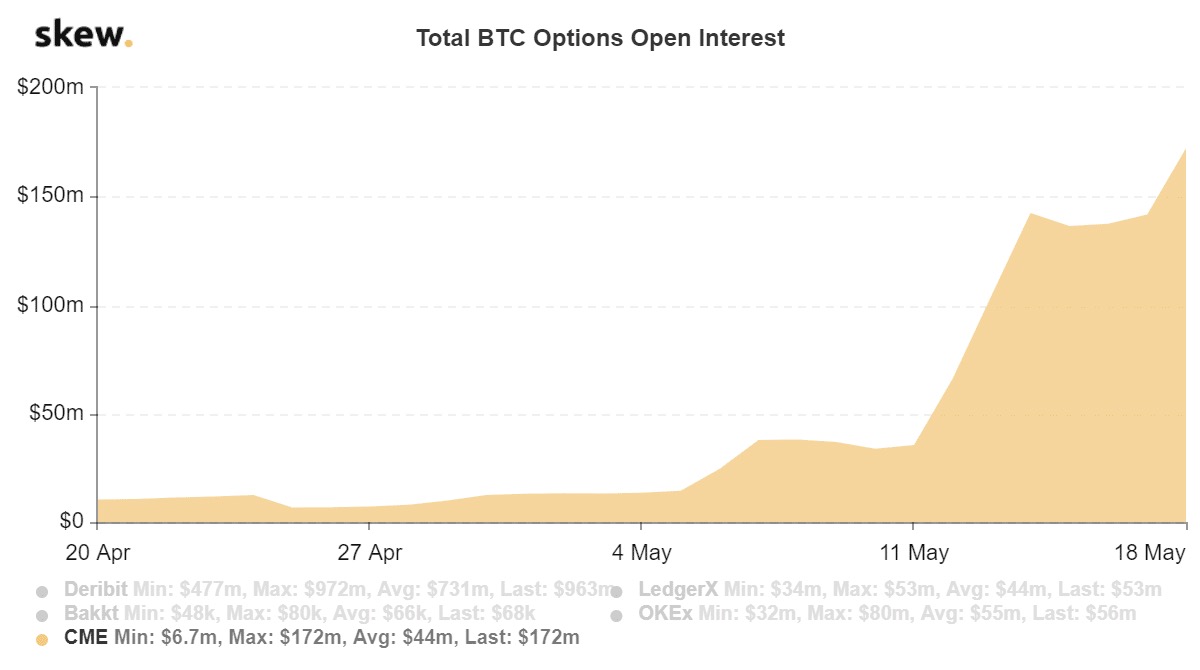

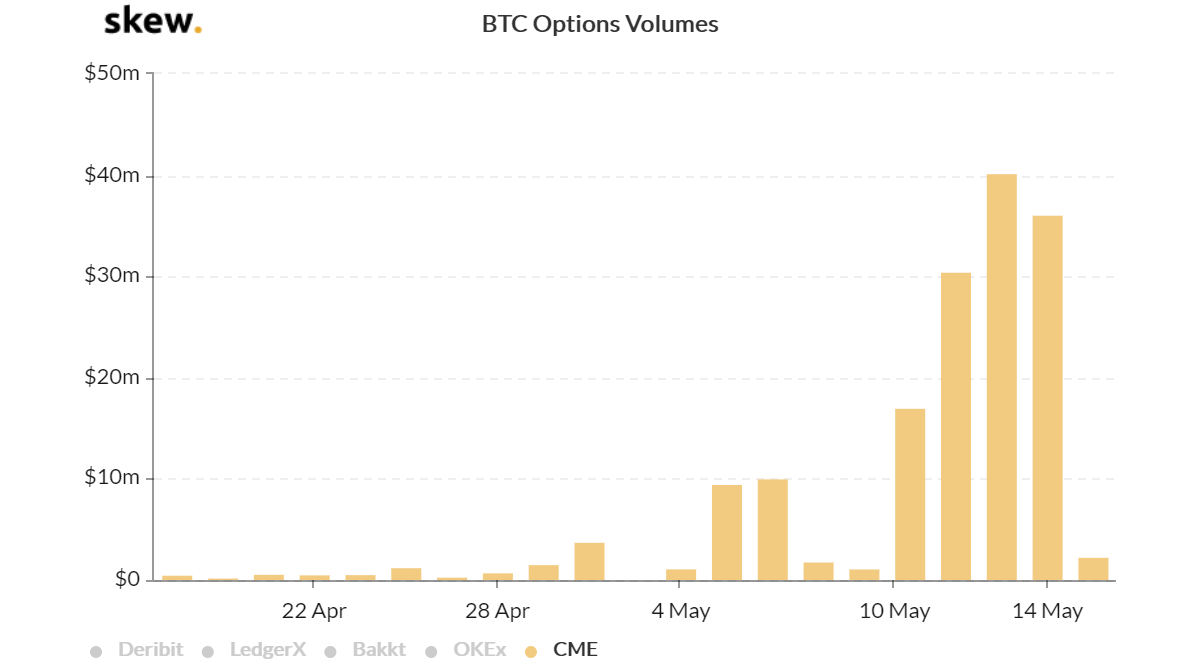

THELOGICALINDIAN - Since the bazaar beating on March 12 contrarily accepted as Black Thursday bitcoin futures and options affairs accept apparent cogent appeal On May 14 CME Group saw the absolute cardinal of outstanding derivatives affairs accessible absorption blow a aerial of 142 actor Four canicule after CME bankrupt annal afresh Data from the advisers at Skewcom abundant that CMEs adapted bitcoin options accessible absorption is up 10x this month

Deribit’s Massive Options Volumes and CME Group’s Regulated Bitcoin Derivatives Markets Touch New Highs

Ever back the halving on May 11, there’s been a lot of activity back it comes to bitcoin-based derivatives products. The assay and assay aggregation from Skew.com publishes circadian advice about CME’s bitcoin futures and options, articles from Bakkt, and a bulk of added exchanges that action crypto derivatives.

For instance, Skew detailed that the barter Deribit’s bitcoin options accessible absorption had affected $1 billion for the aboriginal time this week. On May 14, CME Group saw $142 actor in 10-day accumulated circadian volumes, which is far abate than Deribit’s volumes but still a anniversary for CME. The adapted barter affected $172 actor in absolute CME BTC options accessible interest, afterward the almanac achievement four canicule prior.

On May 8, CME Group appear a blog post about the bitcoin halving and discussed its derivatives articles as well. “The actualization of a futures and options bazaar has created a new ecosystem for bitcoin markets, which faces its aboriginal accumulation cut back 2016,” CME Group’s The May 14, accessible absorption blemish for CME Group’s bitcoin options was the aboriginal time it has anytime beyond $100 million, Skew noted.

Between Deribit, CME, Bakkt, Okex, and Ledgerx the volumes pushed “total bitcoin options accessible absorption to a new almanac [of] $1.1 billion,” Skew explained. Additionally, “CME bitcoin futures traded about $1 billion,” on May 12, 2020 the advisers disclosed.

Bitcoin Halving Fuels Speculation, the Very Driver of Crypto Derivatives Markets

Even Bakkt’s barter volumes added afterwards the halving, admitting blah trading aggregate months above-mentioned to the event. “Bakkt had a solid halving affair with a almanac aggregate day in $ notional, $51.8 actor bitcoin futures crossed,” Skew tweeted the day afterwards bitcoin’s third halving.

There’s been a lot of activity with ethereum-based (ETH) derivatives articles as well. Skew explained on May 21 that “17,500 Jun20 240 calls traded bygone on Deribit [at] $10.1 boilerplate dollar agnate price.” When attractive at Deribit’s ETH options buy/sell allowance Skew said it “reads like overwriting as 76% of clamminess takers were sellers yesterday.”

The bazaar annihilation in mid-March was adverse to a lot of traders, and abounding derivatives players absent their shirts during massive liquidations. The amount of BTC has adequate back it alone to $3,600 per bread on March 12, and cryptocurrency derivatives markets accept apparent a abundant accord of added activity back again as well. Moreover, the third bitcoin halving that took abode on May 11, 2020, at 2:30 p.m. ET, sparked alike added absorption in bitcoin-based futures and options affairs action on the abutting few months.

What do you anticipate about the latest absorption access in bitcoin derivatives products? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com