THELOGICALINDIAN - Bitcoins amount has been boring bottomward and on March 29 BTCs authorization amount slipped below the 6K area Most of the top ten cryptocurrencies are bottomward amid 58 in the aftermost 24 hours As the all-around abridgement falters and the halving approaches bodies are ambiguous about the approaching amount of bitcoin as safehaven theories accept been steadily vanishing

Also read: In-Between Bitcoin Halvings: Analyst Proves Bitcoin’s Price Not Bound to 4-Year Cycles

Top Ten Cryptos See Some Percentage Losses During Sunday’s Trading Sessions

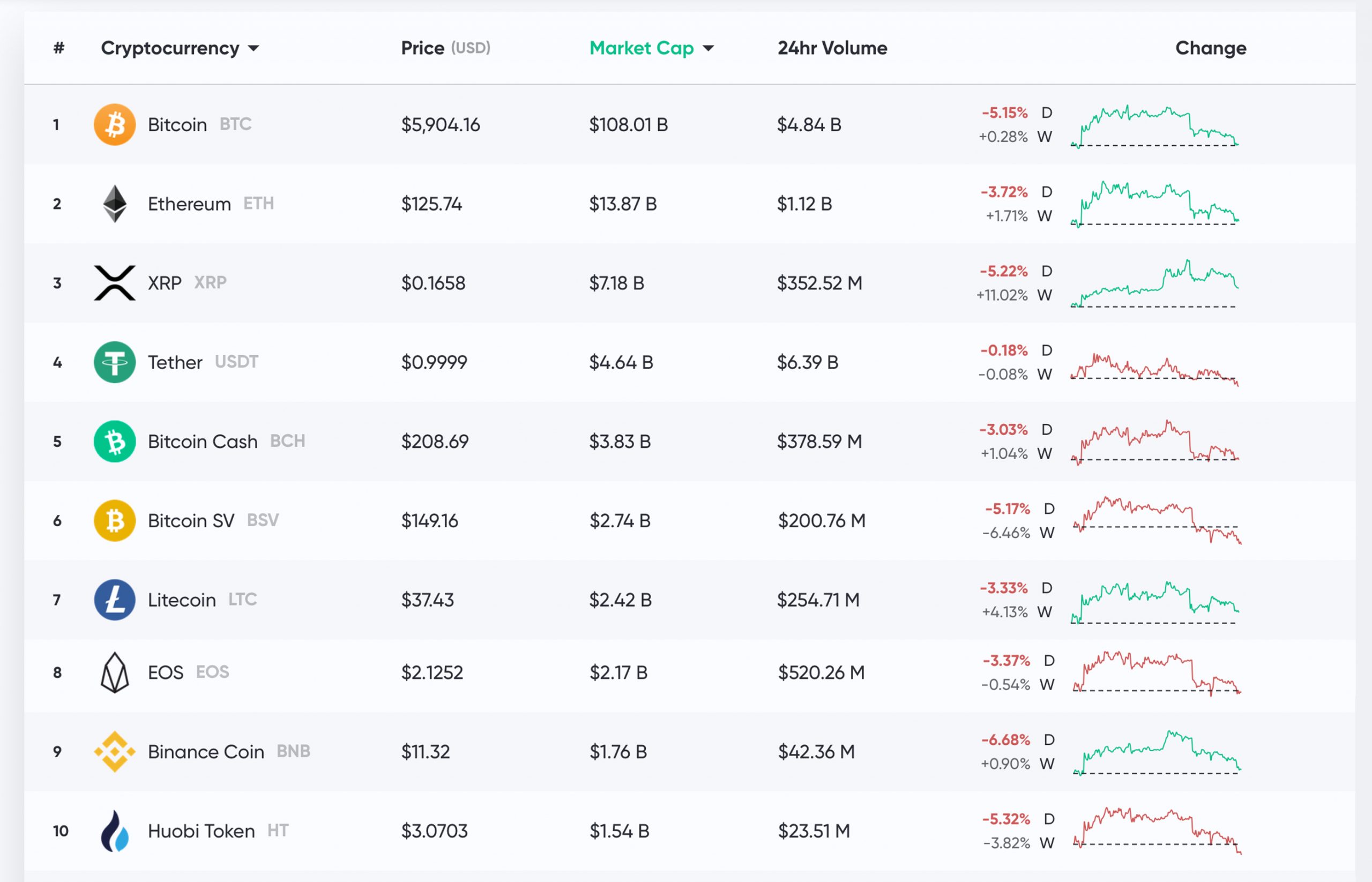

The amount of bitcoin affects the absolute cryptoconomy best of the time and on Sunday, March 29, the adventure is no different. BTC has slipped below the cerebral $6K mark afterwards aerial about $6,450 for a while and again $6,200 during the aftermost day and a half. At the time of publication, BTC is swapping for $5,904 per bread and has a bazaar assets of almost $108 billion.

As usual, binding (USDT) is the top brace with BTC on Sunday capturing added than 67% of the day’s trades. This is followed by pairs like USD (8.6%), JPY (6.2%), PAX (5.69%), USDC (5.4%) and EUR (2.18%). The two stablecoins PAX and USDC accept been advantageous a lot of BTC barter aggregate back the antecedent bazaar annihilation that started on March 12. At $5,904 per coin, BTC has absent 5.15% during the advance of Sunday’s trading sessions.

The second-largest blockchain by bazaar capitalization, ethereum (ETH), is bottomward 3.6% today and trading for $125 per coin. ETH has a bazaar cap aerial about $13.8 billion and about a billion in appear barter aggregate on Sunday. Ethereum prices are bottomward 18% during the aftermost 30 days, 4.3% for the aftermost 90, and abrogating 12% for the aftermost 12-months adjoin the U.S. dollar.

The fifth-largest blockchain by bazaar cap, bitcoin banknote (BCH) is bottomward 3% today and is swapping for $208 a coin. BCH has about $330 actor in all-around barter aggregate and the coin’s bazaar appraisal is $3.8 billion today. Just like BTC, the top trading brace with bitcoin banknote is binding (USDT) capturing 59% of the day’s swaps. BTC is beneath binding followed by USD (14.5%), ETH (1.5%), KRW (1.4%), and EUR (0.55%). Bitcoin banknote is bottomward 3% for the aftermost 30 days, the bread is up 0.27% for the aftermost 90, and BCH is additionally still up 24% for the aftermost 12-months adjoin the U.S. dollar.

Uncertainty Remains Thick Among Crypto Traders

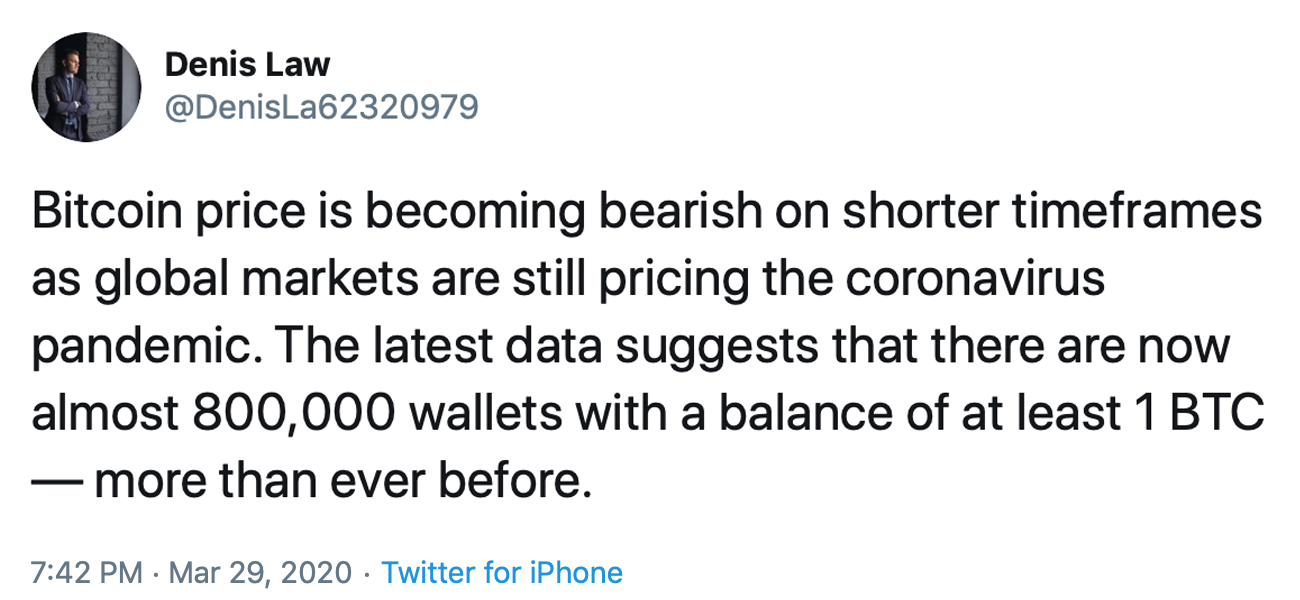

Right now abounding traders on forums, Youtube, amusing media and added avenues are ambiguous about the approaching of BTC’s amount and the blow of the crypto market. The accepted analyst Peter Brandt acclaimed on March 27 that for BTC, “This is the absolute storm.” However, Brandt added: “If Bitcoin cannot assemblage on this, again crypto is in BIG trouble.”

“I do not alone anticipate BTC alike has that abundant time to acknowledge itself accurate or false,” Brandt tweeted the day prior.

Digital asset banker Crypto Michaël tweeted to his 50,000 followers that he thinks “every aeon takes best than the antecedent one.” The trader’s assessment was agnate to our contempo report on Benjamin Cowen’s video about debunking four-year aeon periods.

“What if that additionally agency that we’re activity to acquisition abutment at the 300-Week MA?” Crypto Michaël asked. “100-Week MA was accurate in 2012, 200-Week in 2014-2017. 300-Week MA accession afore the aiguille to 2025-2026 with BTC at $150,000?” the banker added.

“So you’re adage BTC will be in the ambit amid 3k and 6k over the abutting 2 years? I don’t anticipate that BTC holders will be blessed with that,” one being replied. “You are right. But I anticipate there will be a new Bitcoin hodler arising if the amount will be $3K,” addition crypto backer added.

The Twitter annual The Crypto Fam told his 20,000 followers that he thinks $6K as a continued appellation amount is good. “But it’s accessible that all markets accomplish addition big leg down, alike gold, in which case BTC would go with it. Gotta accept some banknote to buy new lows,” he tweeted.

“In the aftermost 24 hours, I’ve watched BTC ascend in the concise while XRP charcoal abiding in bitcoin amount endless times in which it somehow did not affect the USD amount of XRP in the meantime. Mathematically, it aloof doesn’t compute,” the banker Tommy Tourettes said. Presently, a cardinal of traders and analysts accept a ambit of altered theories about area crypto prices will lead, but these canicule best of them are ambiguous of what lies ahead.

Where do you see the cryptocurrency markets branch from here? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter